Why Most People Underestimate What They Own: How everyday accumulation quietly outpaces insurance limits

Very few people think of themselves as owning a lot of stuff.

Belongings tend to accumulate slowly and organically. Items are added one at a time, replaced as needed, or received over years of living in a space. Because nothing arrives all at once, it is difficult to notice how much replacement value has quietly built up.

Insurance limits, on the other hand, are usually set at a single moment in time.

That mismatch between gradual accumulation and static assumptions is one of the main reasons Personal Property coverage falls behind.

Incremental purchases do not feel expensive

Most household items are purchased individually. A couch here, a television there, new cookware, new shoes, new linens. Each purchase feels manageable and rarely triggers a mental tally of total value.

Over time, however, those individual decisions add up to an entire household’s worth of belongings. When everything must be replaced at once, the cumulative cost often surprises even the most organized homeowners.

What felt modest in pieces becomes substantial in aggregate.

Replacement happens at current prices, not past ones

Another reason people underestimate what they own is that replacement cost reflects today’s prices, not what was originally paid.

Furniture, electronics, and household goods often cost more to replace than expected, especially when quality, availability, and shipping are factored in. Items purchased years ago at lower prices must now be replaced at current market rates, often under time pressure.

This disconnect becomes most visible after large losses, when homeowners discover that replacing familiar items requires far more than anticipated.

Example

A homeowner replaces a lost sofa with what seems like a comparable model, only to discover that prices have risen significantly. Multiply that experience across every room in the home, and personal property limits can be reached quickly.

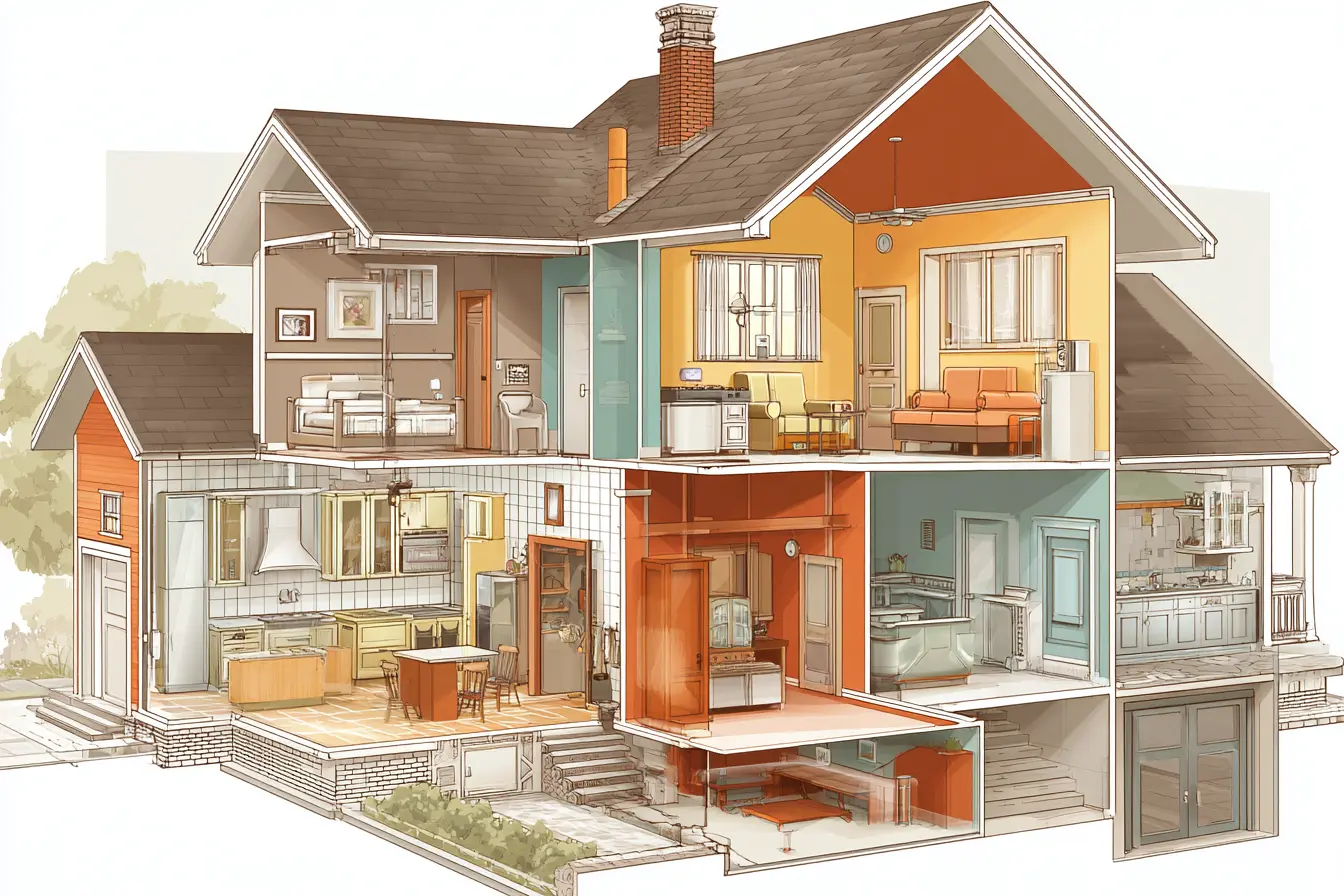

Storage hides value in plain sight

Closets, garages, attics, and storage spaces are particularly effective at concealing replacement value.

Seasonal clothing, tools, sporting equipment, Holiday items, and long forgotten purchases all live outside daily view. Because these items are not used regularly, they are easy to discount mentally.

Yet when a loss affects the entire home, these hidden items must also be replaced. Storage areas often represent a significant portion of personal property value, even though they rarely come to mind during Policy reviews.

Categories blur together in memory

Personal property coverage treats belongings as a single pool, but homeowners tend to think in categories.

Furniture is considered separately from clothing. Electronics feel distinct from kitchenware. Books, decor, and household supplies fade into the background. This mental separation makes it difficult to visualize total replacement cost.

Insurance does not replace items category by category. It pays up to a total limit, regardless of how those items are grouped in your mind.

This is one of the reasons broad losses feel so overwhelming financially.

Life stages accelerate accumulation

Certain phases of life cause personal property to grow faster than expected.

Growing families accumulate clothing, toys, and furniture quickly. Working from home adds equipment and technology. Hobbies introduce specialized gear. Long term residences naturally gather more belongings than homes that are frequently turned over.

Because these changes often feel temporary or gradual, insurance limits are rarely adjusted to reflect them.

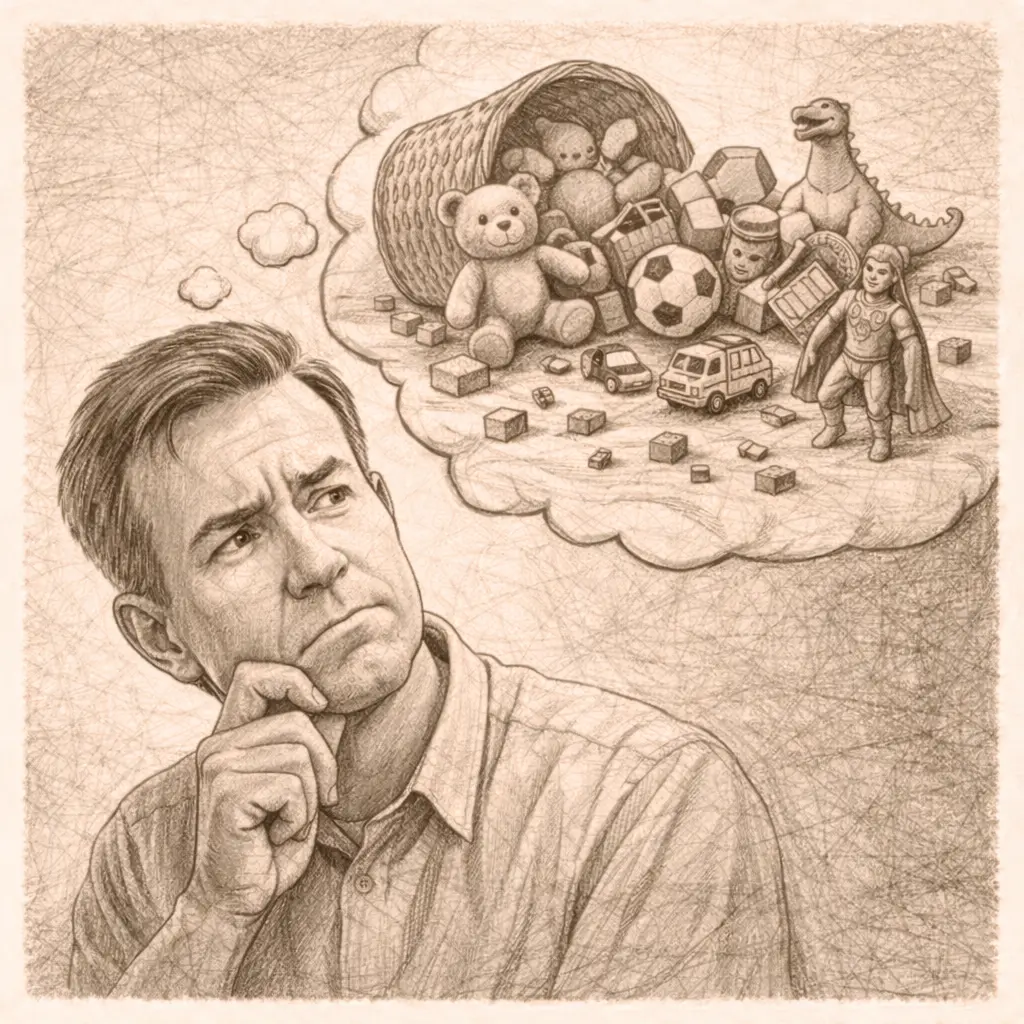

Why underestimation persists

Underestimating personal property is not about carelessness. It is about human perception.

People are good at tracking large, visible assets like homes and vehicles. They are far less accurate when estimating the value of many small items accumulated over time. Insurance policies rely on a number that must represent all of those items combined, even though the owner rarely thinks about them that way.

Without a deliberate effort to step back and consider total replacement, underestimation tends to persist.

Wrap-Up

Most homeowners underestimate what they own because accumulation is gradual, replacement prices change, and storage hides value in plain sight.

Understanding this pattern helps explain why personal property coverage is so often strained during large losses. It also reinforces the importance of evaluating coverage based on total replacement needs, not individual purchases or rough guesses.

In the next article, we will look at how replacement cost and depreciation affect personal property claims, and why that distinction can dramatically change what insurance actually pays.