Replacement Cost Versus Depreciation for Belongings: Why how items are valued matters as much as how much coverage you have

Once homeowners begin to understand how much Personal Property they actually own, the next surprise often comes from how insurance decides what that property is worth.

Many people assume that insurance will simply replace what was lost. In reality, personal property coverage can operate under very different valuation methods, and those differences can significantly affect how much the policy ultimately pays.

The distinction between replacement cost and depreciated value is one of the most important and least understood aspects of personal property coverage.

What replacement cost coverage means in practice

Replacement cost coverage is designed to pay what it would cost to replace an item with a similar new item at today’s prices.

This does not mean the policy will replace an item with the exact same model or brand, but it does mean the payout is based on current market cost rather than age or condition. When replacement cost applies, depreciation is not deducted from the final amount paid.

For homeowners, this approach aligns most closely with expectations. It reflects the reality that replacing everyday items usually requires buying new ones, not used equivalents.

However, replacement cost coverage must be specifically included. It is not always the default.

How depreciated coverage works

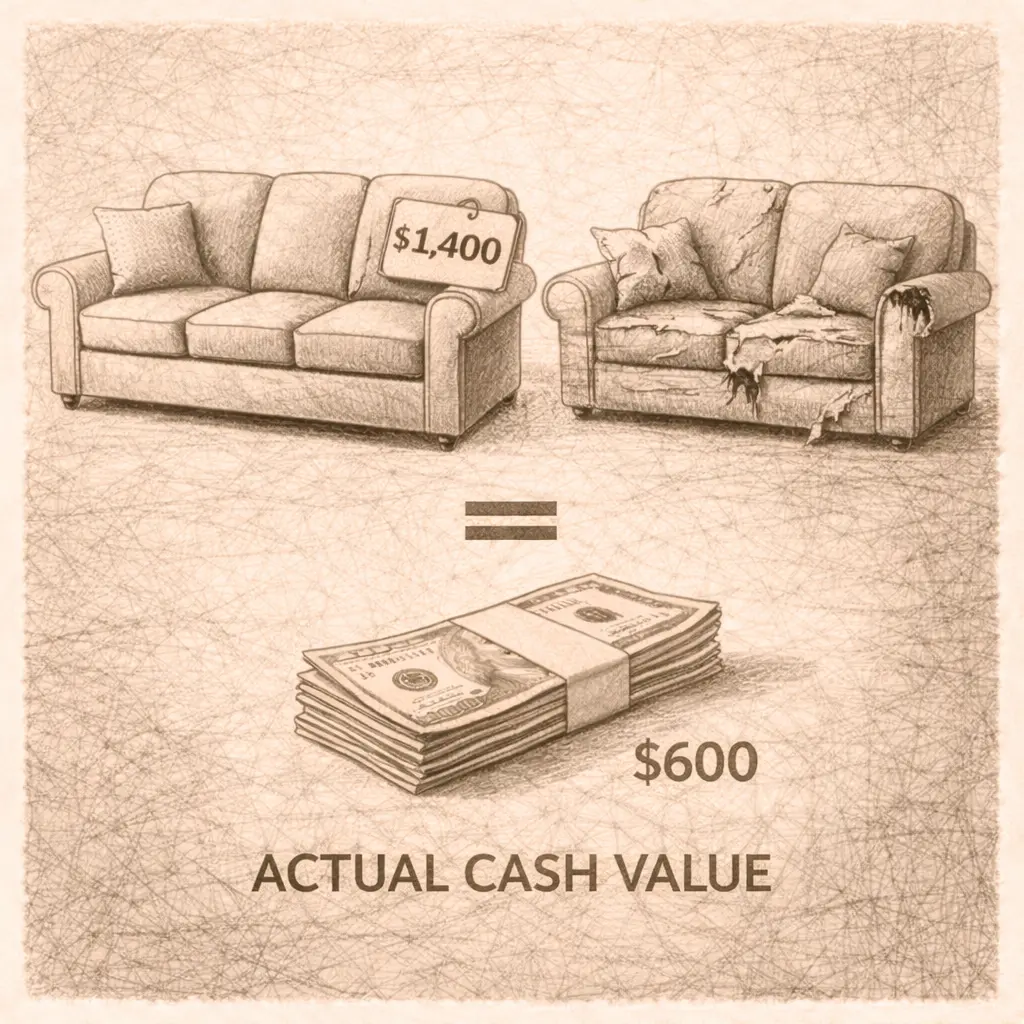

Depreciated coverage, often referred to as actual cash value, takes a different approach.

Under this method, insurance pays the value of an item based on its age and condition at the time of loss. Items are assumed to lose value over time, even if they remain functional or well cared for. The older the item, the greater the depreciation.

In practice, this can lead to payouts that feel disconnected from replacement needs. A functional sofa, television, or set of clothing may have little remaining value on paper, even though replacing it requires significant expense.

Example

A homeowner loses a ten year old couch in a fire. Under depreciated coverage, the policy may assign it a minimal value, resulting in a small payout. Replacing that couch with a comparable new one costs far more, leaving the homeowner to cover the difference.

Why depreciation surprises homeowners

Depreciation often surprises homeowners because it is applied item by item across an entire household.

While a single depreciated payout may feel manageable, the cumulative effect across hundreds or thousands of items can dramatically reduce the total amount paid. Clothing, furniture, electronics, and household goods all lose value on paper, even if they are still useful.

When a large loss occurs, depreciation can quietly erode a significant portion of personal property coverage, especially when limits are already tight.

This is one of the main reasons personal property claims feel more constrained than expected.

The role of replacement cost endorsements

Many policies allow homeowners to add replacement cost coverage for personal property through an Endorsement.

This endorsement changes how items are valued and can significantly improve claim outcomes. It does not increase the personal property limit itself, but it ensures that depreciation is not deducted from payouts, allowing the full limit to be used toward actual replacement.

Because this endorsement affects valuation rather than limits, it is often overlooked during policy reviews. Yet its impact during a loss can be substantial.

Why replacement cost still has boundaries

Even with replacement cost coverage, personal Property Insurance has limits.

Coverage still applies up to the total personal property limit and remains subject to category sublimits and exclusions. Replacement cost determines how items are valued, not how much total coverage is available.

This means that replacement cost coverage works best when paired with limits that realistically reflect total replacement needs.

Choosing the right valuation approach

There is no universal right choice for every household.

Replacement cost coverage typically results in higher premiums, but it provides more predictable recovery. Depreciated coverage costs less, but it shifts more risk to the homeowner, particularly in large losses.

Understanding which approach your policy uses and how it affects payouts is essential for evaluating whether coverage aligns with your expectations.

Wrap-Up

The way personal property is valued can dramatically change what insurance pays after a loss.

Replacement cost coverage reflects the reality of replacing items today, while depreciated coverage reflects how items lose value over time. Knowing which method your policy uses helps explain why personal property claims often feel constrained and why limits that seem adequate on paper may fall short in practice.

In the next article, we will examine sublimits and category caps, and how they further shape what personal property coverage actually pays.