Replacement Cost, Extended Replacement, and Guaranteed Coverage: Why the type of dwelling coverage matters as much as the amount

Once homeowners understand what dwelling coverage is designed to pay for, the next question is usually how much coverage is enough.

That is an important question, but it is only part of the story. Just as important is how the Policy responds when rebuilding costs exceed expectations. This is where the type of dwelling coverage becomes critical, and where many homeowners discover too late that not all coverage behaves the same way.

Replacement cost, extended replacement, and guaranteed replacement coverage may sound similar, but they operate very differently when costs rise or rebuilding becomes more complicated.

Replacement cost coverage sets a firm ceiling

Standard replacement cost coverage pays to rebuild your home up to the dwelling limit shown on your policy. As long as rebuilding costs stay within that limit, the coverage performs as expected.

The challenge arises when costs exceed the Estimate that limit was based on. Construction pricing can change quickly due to labor shortages, material price spikes, permitting delays, or regional disasters. When that happens, replacement cost coverage does not adjust automatically.

Once the dwelling limit is reached, the policy stops paying, even if the home is not fully rebuilt. The homeowner becomes responsible for the difference.

Replacement cost coverage is common and can work well when estimates are accurate and conditions are stable. Its limitation is that it assumes the original estimate will remain valid when it matters most.

Extended replacement coverage provides a buffer

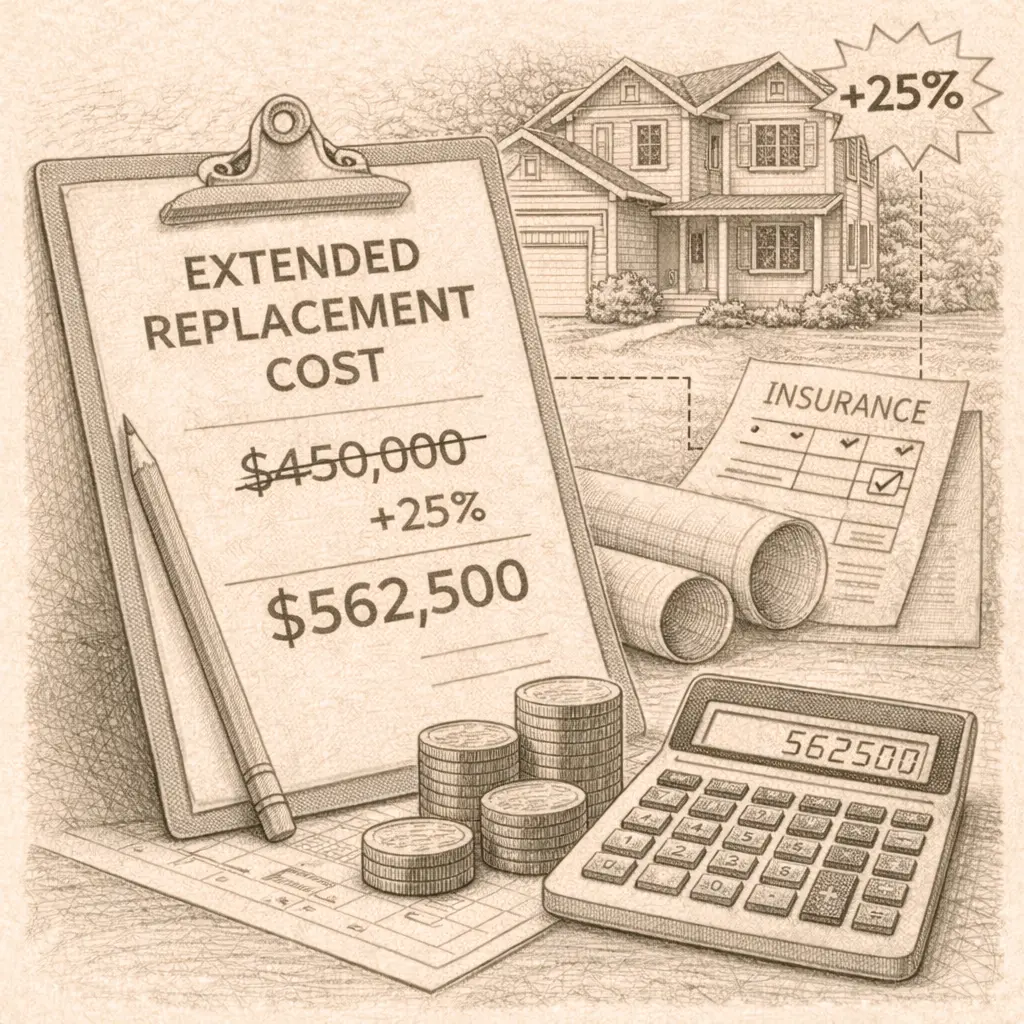

Extended replacement coverage is designed to help absorb cost increases that occur after a loss. It typically allows the insurer to pay a certain percentage above the stated dwelling limit, such as twenty five or fifty percent, if rebuilding costs exceed expectations.

This additional cushion can make a significant difference during periods of disruption, when construction costs rise and timelines stretch. It does not eliminate the need for an accurate base limit, but it reduces the risk that moderate overruns will leave homeowners exposed.

However, extended replacement coverage is not unlimited. The extra amount is capped, and in extreme cost environments it may still fall short. Understanding both the base limit and the extension is essential.

Example

A home has a dwelling limit based on a reasonable estimate at the time the policy was written. After a wildfire affects the region, labor and material costs surge. Rebuilding bids come in above the original limit, but within the extended replacement allowance. The extension bridges the gap and allows reconstruction to continue without major out of pocket expense.

Guaranteed replacement coverage removes the cap but adds conditions

Guaranteed replacement coverage is the most robust form of dwelling coverage. In theory, it allows the insurer to pay whatever it costs to rebuild the home, even if that amount exceeds the dwelling limit.

In practice, guaranteed replacement coverage comes with important conditions. Insurers typically require that the home be insured to a certain standard, that rebuild estimates are updated regularly, and that homeowners notify the insurer of significant changes or renovations. Some policies exclude certain types of losses or set boundaries around what qualifies as a comparable rebuild.

Guaranteed replacement coverage is also becoming less common, particularly in higher risk areas. Where it is available, it can provide substantial peace of mind, but only if its conditions are clearly understood.

Why the differences matter during real claims

The distinctions between these coverage types often feel abstract until a loss occurs.

During rebuilding, homeowners rarely face a single, predictable cost. Instead, expenses accumulate over time as plans evolve, materials change, and timelines extend. The type of coverage determines how much flexibility exists when reality diverges from the original estimate.

With standard replacement cost coverage, even modest overruns can become the homeowner’s responsibility. With extended replacement coverage, there is room for adjustment, but only within defined limits. With guaranteed replacement coverage, the policy is designed to follow actual costs more closely, though compliance requirements still matter.

Understanding these differences ahead of time helps set realistic expectations and avoids surprises when decisions are hardest to make.

Choosing the right structure for your situation

There is no single correct choice for every homeowner.

The right structure depends on how complex the home is to rebuild, how volatile local construction markets tend to be, and how much risk a homeowner is comfortable carrying. In areas prone to large scale events, the buffer provided by extended or guaranteed replacement coverage can be particularly valuable.

What matters most is knowing which structure your policy uses and how it behaves when costs exceed assumptions.

Wrap-Up

The amount of dwelling coverage on your policy is important, but the way that coverage responds when costs rise is just as critical.

Replacement cost, extended replacement, and guaranteed replacement coverage are not interchangeable. Each one sets different expectations for how rebuilding will be handled when estimates fall short. Understanding which type you have, and what its limits are, provides a more complete picture of how your policy would perform during a real recovery.

In the next article, we will look at why rebuild estimates themselves are often wrong, even when coverage appears strong, and how those inaccuracies contribute to underinsurance.

Additional Reading and Sources

For more detail on replacement coverage types, these resources may be helpful:

• Insurance Information Institute, advice for new home buyers

https://www.iii.org/article/what-should-new-homebuyers-know-about-homeowners-insurance

• United Policyholders on extended and guaranteed replacement

https://uphelp.org/claim-guidance/extended-replacement-cost

• Policy Genius on what is extended replacement cost

https://www.policygenius.com/homeowners-insurance/what-is-extended-replacement-cost/