Why Rebuild Estimates Are Often Wrong: How reasonable assumptions turn into costly surprises

Rebuild estimates sit quietly at the center of most homeowners policies.

They inform the dwelling limit, influence premiums, and shape expectations about what recovery will look like after a loss. Because they are presented as precise numbers, they tend to inspire confidence. Yet in practice, rebuild estimates are one of the most common sources of underinsurance.

The issue is not that estimates are careless or arbitrary. It is that they are built on assumptions that are difficult to keep current as homes, markets, and regulations change.

How rebuild estimates are typically created

Most rebuild estimates are generated using standardized software models. These models rely on basic inputs such as square footage, year built, general construction type, and location. From there, average material costs, labor rates, and construction practices are applied to produce an Estimate.

This approach is efficient and necessary at scale. However, it also means that estimates are only as accurate as the information they start with and the assumptions baked into the model. Details that significantly affect rebuild cost are often simplified or excluded entirely.

Custom finishes, complex layouts, unusual structural features, and site specific challenges rarely fit neatly into standardized templates.

Why estimates drift out of sync over time

Even a well built estimate can become outdated surprisingly quickly.

Construction costs do not rise evenly or predictably. Labor shortages, material price swings, supply chain disruptions, and regional growth all affect rebuild costs in ways that broad indexes struggle to capture. After large scale events, these pressures can intensify almost overnight.

At the same time, homes evolve. Renovations improve quality and complexity. Additions increase square footage. Systems are upgraded. These changes meaningfully increase rebuild cost, yet they are often not reflected unless the Policy is actively revisited.

When policies renew automatically, estimates tend to be adjusted incrementally rather than re evaluated from the ground up. Over time, small gaps compound.

The problem with averages and shortcuts

Rebuild models rely heavily on averages. Average labor costs. Average material pricing. Average construction timelines. While averages work well in stable conditions, they struggle in moments of disruption.

They also struggle with homes that fall outside the norm.

Older homes with unique construction, custom architectural details, or non standard materials can be particularly difficult to estimate accurately. Likewise, high quality finishes or specialized systems can push rebuild costs well beyond what a generalized model assumes.

Because these nuances are not obvious on a Declarations Page, homeowners rarely realize that the estimate may not reflect their specific situation.

When timing changes everything

Rebuild estimates are usually calculated under normal conditions. Losses rarely occur under normal conditions.

After regional disasters, rebuild timelines lengthen and costs rise. Contractors become scarce. Permits take longer. Materials are harder to source. Temporary measures turn into extended projects. All of these factors increase cost, even if the original estimate was reasonable when the policy was written.

This timing mismatch is one of the reasons underinsurance often appears during widespread events, even among homeowners who believed their coverage was strong.

Example

A homeowner’s rebuild estimate accurately reflects local costs at the time the policy is issued. Two years later, a major storm affects the region. Labor shortages and material delays push bids far above the original estimate. The dwelling limit, still tied to that earlier number, is no longer sufficient.

Why estimates feel more reliable than they are

Rebuild estimates are presented as precise numbers, often down to the dollar. This precision creates a sense of certainty that is not always justified.

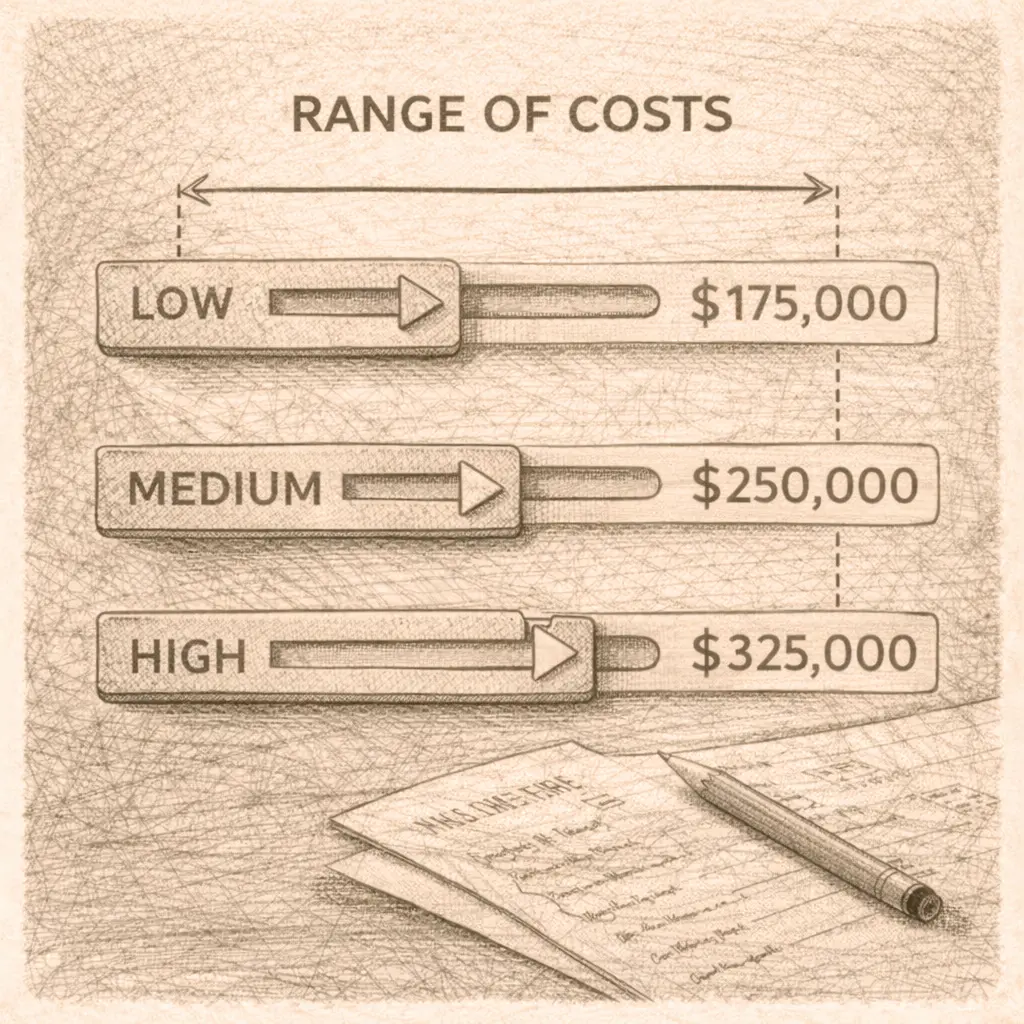

In reality, rebuild cost is a range, not a single figure. Small changes in scope, materials, or timing can move that range significantly. When policies are built around a single point estimate, they leave little room for those variations unless additional coverage features are in place.

Because the estimate looks official, it is rarely questioned.

What matters more than the exact number

The goal is not to find a perfectly accurate rebuild estimate. That is rarely possible.

What matters more is understanding the margin for error built into the policy. Extended replacement coverage, ordinance or law coverage, and regular reviews all help absorb the uncertainty inherent in rebuilding.

Recognizing that estimates are approximations, not guarantees, leads to better decisions about how much flexibility a policy should include.

Wrap-Up

Rebuild estimates are a necessary starting point, but they are not a promise.

They are built on assumptions that can become outdated as homes change and markets shift. When those assumptions are treated as fixed truths, underinsurance becomes more likely. When they are understood as approximations, it becomes easier to evaluate whether a policy has enough flexibility to handle real world conditions.

In the next article, we will look at Demand Surge and post loss construction costs, and why rebuilding after major events is often far more expensive than homeowners expect.