A Homeowner’s Guide to Public Insurance Adjusters

When disaster strikes—fire, flood, storm, or another covered loss—filing a homeowners insurance claim can quickly become complex and overwhelming. One of the most effective ways to protect yourself is by hiring a licensed public insurance adjuster to advocate on your behalf.

Unlike insurance company adjusters (who work for the carrier), public adjusters work for you, the policyholder, to document damages, estimate losses, and negotiate a fair settlement. This guide explains how public adjusters help, what they do, and what to expect during the process.

Loti provides public adjusting services in many states across the U.S. Be sure to check our current licensing and availability if you're considering hiring a public adjuster.

What Is a Public Insurance Adjuster?

A public insurance adjuster (PA) is a licensed professional who represents homeowners or business owners—not insurance companies—during the property insurance claims process. They manage the technical aspects of a claim and work to ensure the policyholder receives the full benefits of their policy.

They are especially useful for large, complex, or disputed claims, such as:

House fires or wildfires

Water or mold damage

Hurricanes, hail, or wind damage

Total losses or large personal property claims

Disputes over scope of loss or depreciation

Extended displacement or additional living expenses

What Services Do Public Adjusters Provide?

Damage Documentation

They assess the full extent of property damage and create detailed documentation using photos, reports, and industry-standard software. This often includes rebuilding estimates, contents inventories, and valuation of hard-to-spot damage.

Policy Interpretation

They review your policy to determine which coverages, endorsements, exclusions, and deductibles apply. This includes analyzing additional living expense coverage, code upgrades, personal property limits, and more.

Estimating and Scoping

They create a professional scope of loss using tools like Xactimate and Loti. This includes estimating labor and material costs, structural repairs, debris removal, and damage to finishes and furnishings.

Contents Inventory

They assist in identifying and valuing personal property—everything from furniture and electronics to clothing, tools, and collectibles. They also help apply depreciation and replacement cost calculations correctly.

Negotiation

They communicate directly with the insurance company’s adjuster and negotiate a settlement based on the evidence collected. They challenge denials, lowball offers, and improper depreciation.

Final Settlement and Ongoing Support

They ensure that all payments—including supplements, code upgrades, and recoverable depreciation—are properly accounted for, even after initial settlement.

What to Expect When Working With a Public Adjuster

Initial Review: You’ll review your loss and policy with the adjuster. They may inspect the property and recommend next steps.

Engagement Agreement: Public adjusters typically work on a contingency basis (a percentage of the claim payout), and you'll sign a written agreement to authorize representation.

Claim Development: They’ll prepare all necessary documentation, reports, inventories, and estimates. This can take days or weeks depending on the size and scope of the loss.

Carrier Negotiation: The adjuster submits the package and negotiates directly with the insurance company to resolve any disputes and maximize your claim.

Ongoing Support: After settlement, they may continue to assist with documentation needed for recoverable depreciation or supplemental claims if new damage is uncovered.

Examples

Example 1: Fire Damage in a Single-Family Home

A family with severe smoke and fire damage used a public adjuster to develop a detailed reconstruction estimate and a 1,200-item personal property inventory. The insurer’s initial offer was less than half of the final amount they settled for.

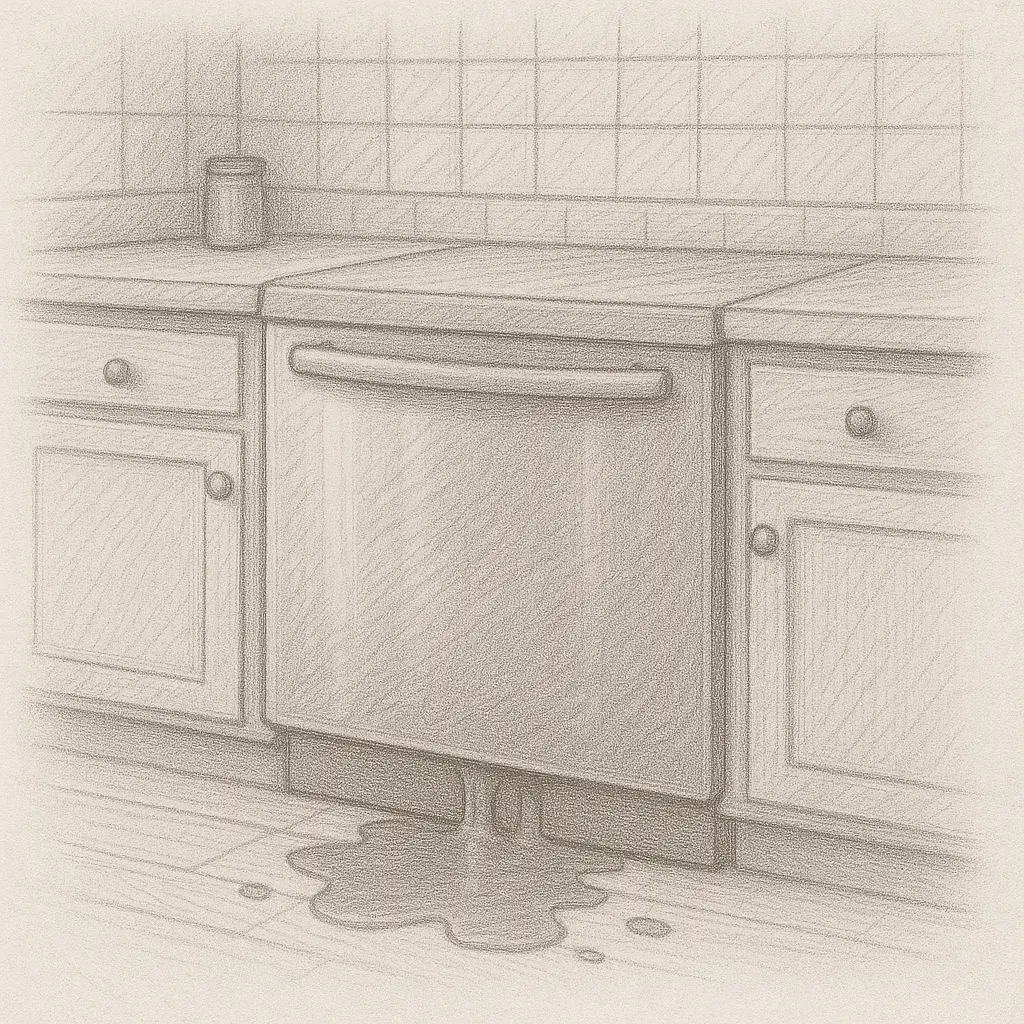

Example 2: Water Leak in a Kitchen

After a dishwasher leak caused cabinetry and flooring damage, the homeowner was offered partial repair costs. The public adjuster helped prove mold behind the walls and secured a full replacement of cabinetry and sub-flooring.

Example 3: ALE and Displacement Support

Following a windstorm that rendered a home uninhabitable, the adjuster helped the homeowners document additional living expenses, secure temporary housing coverage, and negotiate a final settlement that included code upgrades and permit costs.

Terms You Might Hear

Scope of Loss: A line-by-line repair estimate that defines what’s damaged and how much it costs to fix or replace.

RCV vs. ACV: Replacement Cost Value is the full cost to replace; Actual Cash Value deducts depreciation.

ALE: Additional Living Expenses—reimbursement for costs incurred while you’re displaced.

Depreciation Holdback: The withheld amount that is recoverable once repairs are completed.

Contents Inventory: A list of personal property damaged or lost, often with supporting photos, prices, and age.

Resources for Homeowners

Wrap-Up

Hiring a public adjuster can dramatically improve the outcome of your claim—especially when damages are extensive, policy language is unclear, or the process becomes contentious. They work to ensure you're not underpaid or overlooked.

If you're managing a complex or large claim, it's worth speaking with a licensed professional. Loti offers public adjusting services in many states, so check our availability to see how we can help support your recovery.