Pets and Their Impact on Homeowners Insurance

Bringing a new pet into your home is a joyful experience, but it also comes with added responsibilities and potential risks that may affect your homeowners insurance. Pets can influence your coverage needs in several ways, from property damage and liability to specific breed restrictions.

This article explores how to update your homeowners insurance to ensure comprehensive protection for both your new furry friend and your home.

Why Pets Impact Homeowners Insurance

Pets can affect homeowners insurance for several reasons:

Property Damage: Pets can accidentally cause damage to your home, personal belongings, or a neighbor's property.

Increased Liability Risks: Pets, particularly dogs, can lead to liability claims if they injure someone or cause damage to property.

Breed Restrictions: Some insurance companies have restrictions based on pet breed or type, which can impact coverage availability or cost.

How to Adjust Homeowners Insurance When Adding a Pet

To ensure your home and personal Assets are adequately protected, consider these steps when updating homeowners insurance after getting a pet:

1. Assessing Liability Coverage for Pets

Pets, especially dogs, can increase liability risks, primarily if they bite or injure someone:

Increase Liability Limits: Review your homeowners insurance liability limits to ensure they are sufficient to cover potential claims related to pet-related injuries.

Example: If your dog bites a guest or neighbor, liability coverage helps cover medical expenses, legal fees, and any settlements.

Consider Adding an Umbrella Policy: For additional protection, consider adding Umbrella Insurance, which extends liability limits beyond the standard homeowners policy, providing more comprehensive coverage in case of a large Claim.

Example: If your pet causes significant injury or damage that exceeds your homeowners liability limits, umbrella insurance can cover the remaining costs.

Check for Breed Restrictions: Some insurers may restrict coverage or charge higher premiums for certain breeds of dogs. Check with your insurer to confirm if your pet’s breed affects your policy.

Example: Breeds perceived as higher risk (e.g., pit bulls, rottweilers, or German shepherds) may require additional coverage or may be excluded from standard liability coverage.

2. Managing Property Damage from Pets

Pets can unintentionally damage your home or personal belongings:

Understand What’s Covered: Standard homeowners insurance typically does not cover damage caused by pets to your own property, such as chewed furniture, scratched floors, or torn-up carpets.

Example: If your dog chews through the Drywall, the cost of repairs is generally not covered.

Protect Against Neighbor Damage: While damage to your own property by pets is not covered, damage your pet causes to a neighbor’s property may be covered under liability insurance.

Example: If your dog digs under a Fence and damages a neighbor’s garden, liability coverage can help with repairs.

3. Home Modifications for Pets

Adding a pet to your household often involves making changes to your home to accommodate the new family member:

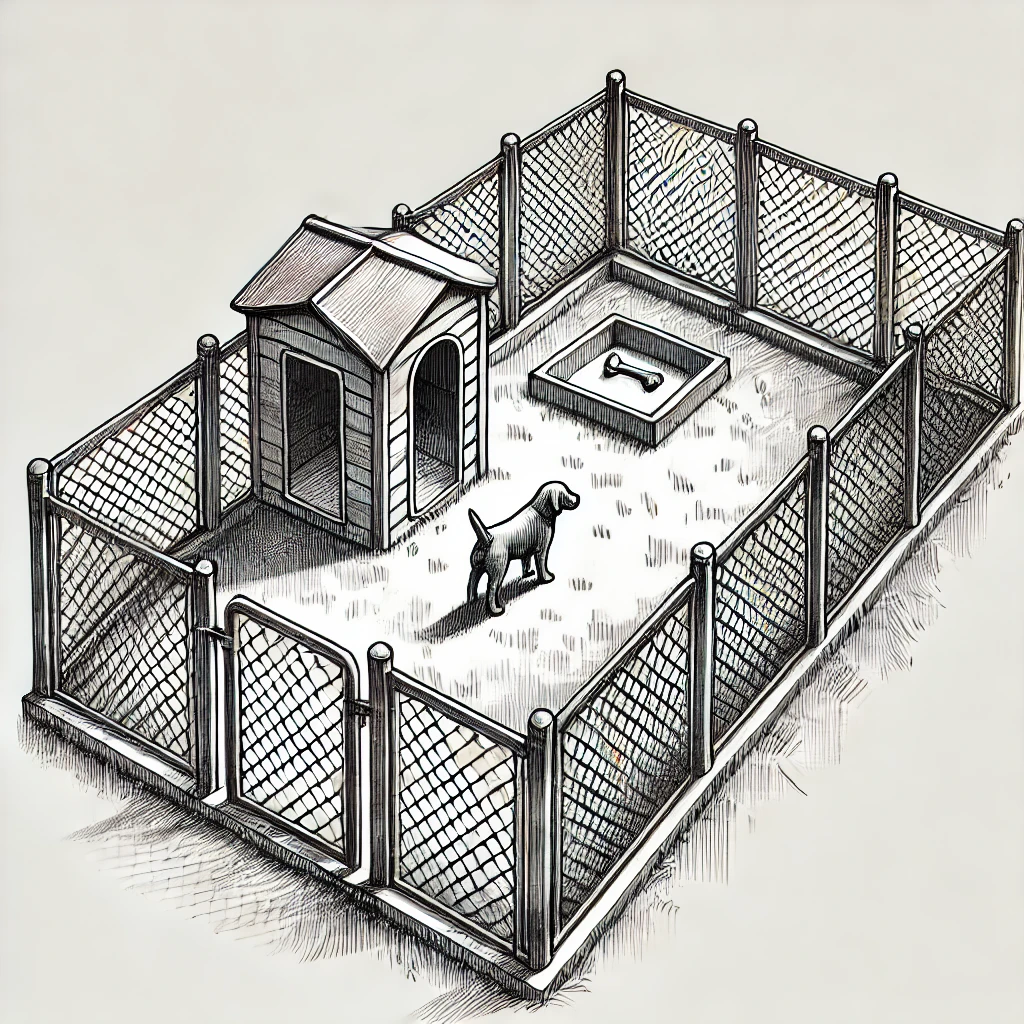

Inform Your Insurer About Major Changes: If you add a fenced area, dog run, or pet shelter, notify your insurer, as these changes may affect your coverage needs or qualify for discounts.

Example: Adding a secure fence can reduce liability risks and may help lower your Premium.

Pet-Proofing Safety Upgrades: Install pet gates, childproof latches, and secure storage for pet supplies. Some of these safety upgrades can enhance home security and potentially qualify you for insurance discounts.

4. Evaluating Personal Property for Pet Risks

Pets can impact personal property coverage, especially if they cause damage to items belonging to guests or third parties:

Check Guest Property Coverage: If your pet damages a guest’s personal belongings (e.g., chews a guest’s laptop or bag), verify whether your Personal Liability Coverage can help pay for repairs or replacement.

Example: If your cat knocks over a guest’s phone, your liability coverage can help replace the damaged device.

Consider Additional Riders for Special Items: If your pet’s presence increases the risk of damage to valuable items (e.g., art, antiques, or electronics), consider scheduling these items for added protection.

Pets and Other Insurance Types

In addition to homeowners insurance, consider these related coverages when adding a pet to your home:

Pet Insurance: Pet insurance helps cover veterinary expenses, ranging from routine checkups to major medical treatments. It can also cover injuries from accidents, illnesses, and some chronic conditions, depending on the policy.

Example: If your dog requires surgery after an accident, pet insurance can help cover the medical expenses.

Umbrella Insurance: For higher liability protection beyond the limits of homeowners insurance, consider umbrella insurance, especially if your pet interacts with neighbors, visitors, or the public frequently.

Additional Steps for Maintaining Coverage

To ensure ongoing protection for your home and your new pet, consider these actions:

Review Your Policy Annually

Conduct an annual review of your homeowners insurance, especially if you add more pets or make significant home modifications.

Train Your Pet

Invest in proper training to reduce behavioral risks, such as biting, jumping, or damaging property, minimizing liability claims and injury risks.

Keep Your Insurer Informed

Always notify your insurance company if you add a new pet, make significant home changes, or if an incident involving your pet occurs, even if no claim is filed.

Examples of Claims Involving Pets

Understanding real-life scenarios can help illustrate how insurance protects against pet-related risks:

Dog Bite Incident

Your dog bites a neighbor’s child while playing in the yard. Liability coverage helps cover the child’s medical expenses, legal fees, and any Settlement costs.

Damage to a Neighbor’s Property

Your dog escapes the yard and damages a neighbor’s garden. Liability coverage can help pay for the cost of replacing damaged plants and repairing any structural damage.

Guest Injury Caused by a Pet

A guest trips over your cat, sustaining a sprained ankle. Your liability coverage helps cover medical costs and potential legal fees if a claim is filed.

How to Maximize Homeowners Insurance Protection

Here are steps to ensure comprehensive protection for your home and pets:

Increase Liability Limits

Consider extending liability coverage or adding umbrella insurance to handle large claims related to pet injuries or damages.

Invest in Pet Training

Training can reduce aggressive behaviors or other risky actions, lowering the likelihood of liability claims.

Install Pet Safety Features

Secure fences, gates, and pet-proof latches can minimize risks and qualify for potential discounts on homeowners insurance.

Additional Resources

Insurance Information Institute (III): Offers guidance on managing homeowners insurance coverage for pet owners, including liability and breed-specific considerations. Visit III for more information.

American Kennel Club (AKC): Provides tips on pet training, safety, and breed information that can help minimize risks associated with dog ownership. Visit AKC for insights.

ASPCA: Offers resources on pet safety, pet-proofing homes, and pet insurance options. Visit ASPCA for more details.

Wrap-Up

Adding a pet to your family brings joy, but it also requires careful consideration of your homeowners insurance coverage. By updating liability limits, considering pet insurance, and investing in safety measures, you can protect both your home and your new furry friend.

Regular reviews, proactive adjustments, and consultations with your insurance agent help maintain comprehensive coverage that matches your evolving needs as a pet owner.