Remodels and Additions and Their Impact on Homeowners Insurance

Home remodels and additions can significantly increase the value, functionality, and appeal of your home. However, they also bring new risks that can impact your homeowners insurance. Whether you’re adding a room, remodeling a kitchen, or building a new deck, it’s important to review and adjust your insurance coverage to ensure your home and investment are protected throughout the renovation process.

This article explores how to update your homeowners insurance for remodels and additions.

Why Remodels & Additions Impact Homeowners Insurance

Home improvements affect homeowners insurance for several reasons:

Increased Property Value: Remodeling projects or new additions can increase the replacement cost of your home, requiring updates to dwelling coverage.

Higher Liability Risks: Construction projects increase the risk of accidents or injuries, both to workers and visitors.

Potential Gaps in Coverage: Certain remodels or additions may not be covered by existing policies, necessitating temporary coverage or Policy endorsements.

How to Adjust Homeowners Insurance for Remodels & Additions

Follow these steps to ensure that your home, Personal Property, and liability Exposure are properly covered during and after home improvement projects:

1. Increasing Dwelling Coverage

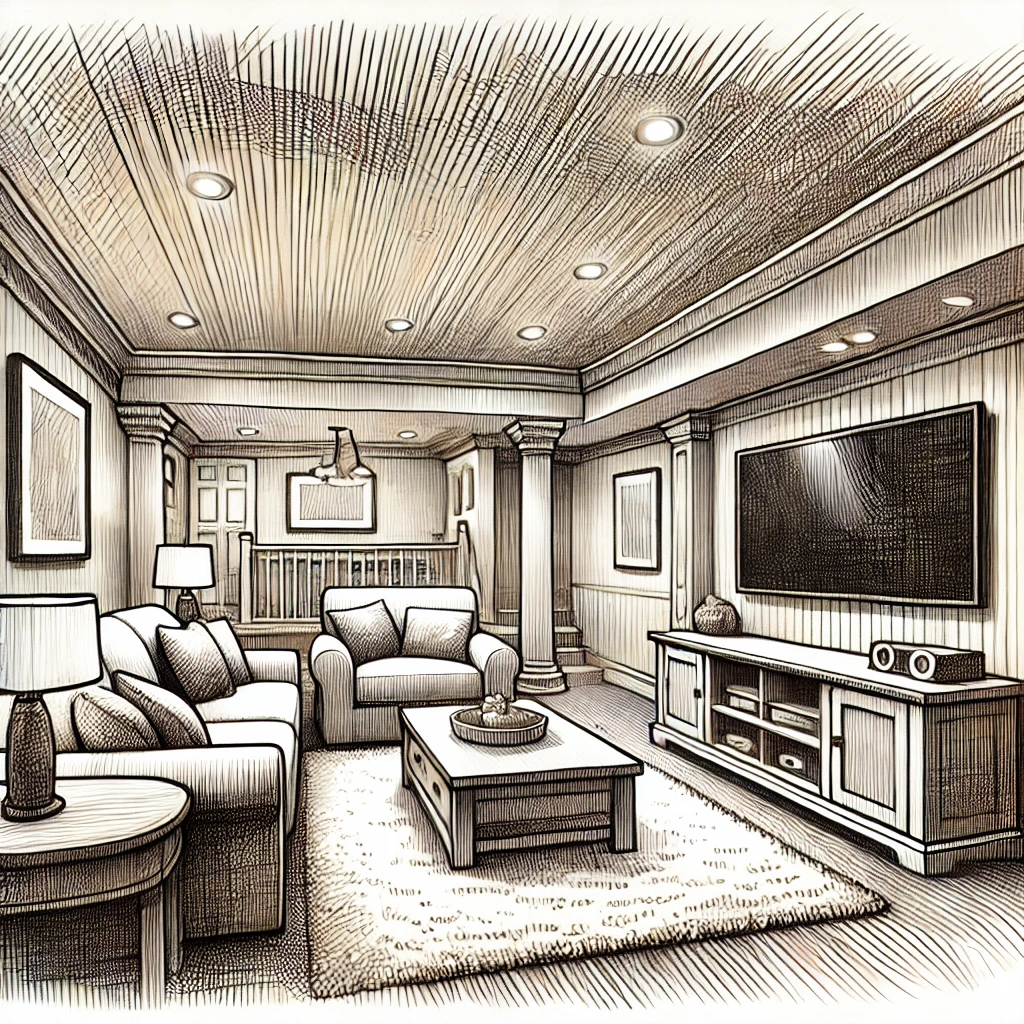

Major renovations or additions, such as a new bedroom, expanded kitchen, or finished basement, increase the replacement cost of your home:

Update Dwelling Coverage Limits: Contact your insurance agent to update the dwelling coverage limit on your homeowners policy to reflect the increased value from the remodel or addition.

Example: If you add a new bedroom, upgrade a kitchen, or finish a basement, update your coverage to match the increased replacement cost of the home.

Ensure Sufficient Replacement Cost Coverage: Confirm that your policy includes replacement cost coverage, which pays the full cost to rebuild or repair your home with similar materials and quality.

Example: If a fire destroys the remodeled kitchen, replacement cost coverage helps rebuild it to the same Specifications, without accounting for Depreciation.

2. Managing Liability Coverage During Construction

Construction projects introduce new liability risks, whether from accidents on-site or damage to neighboring properties:

Increase Liability Limits: Consider increasing your liability coverage temporarily during renovations to cover potential injuries to workers or visitors.

Example: If a Contractor slips on wet flooring and is injured, increased liability coverage can help cover medical costs and legal fees.

Verify Contractor Insurance: Ensure that contractors working on your home carry their own liability and workers’ compensation insurance. Request proof of coverage before work begins to protect yourself from potential claims.

Example: If a contractor’s tools cause damage to your home or a neighbor’s property, their insurance should cover the costs.

3. Adding Temporary Coverage During Renovations

Depending on the scope and duration of the renovation, you may need temporary or additional coverage:

Builders Risk Insurance: For major renovations, consider purchasing builders risk insurance, which covers the structure, materials, and equipment on-site during construction. (see our complete article on Builders Risk Insurance)

Example: If a windstorm damages construction materials or partially completed structures, builders risk insurance covers the cost of repairs or replacements.

Vacancy Clauses: If you temporarily move out of your home during the renovation, notify your insurer. Many homeowners policies have vacancy clauses that limit coverage if the home is unoccupied for more than 30-60 days.

Example: You may need to add vacancy coverage if the renovation makes the home temporarily uninhabitable.

4. Reviewing Personal Property Coverage

Remodeling often involves purchasing new furniture, appliances, or fixtures:

Update Personal Property Coverage: If you purchase new high-value items like appliances, electronics, or custom furniture, update your personal property coverage to reflect the new value.

Example: If you add a new entertainment system to a finished basement, consider a scheduled personal property Endorsement to ensure full protection.

Consider Special Endorsements: For valuable items like custom cabinetry, high-end appliances, or specialty fixtures, consider adding endorsements that provide broader protection.

5. Renovation-Specific Considerations

Certain types of remodels or additions require special insurance considerations:

Adding a Pool or Deck: If you add a swimming pool, Hot Tub, or deck, notify your insurer to ensure adequate liability coverage. Pools and decks increase liability risks, such as slips, falls, or drowning incidents.

Example: Your insurer may recommend adding or increasing liability limits and implementing safety measures, like pool fences or self-closing gates.

Converting Attics or Basements: Converting unfinished spaces into living areas increases the home’s value and requires updated dwelling coverage to reflect the change in replacement cost.

Upgrading Electrical or Plumbing Systems: If you upgrade electrical wiring, plumbing, or HVAC systems during the remodel, you may qualify for discounts on your homeowners insurance due to reduced risks of fire or water damage.

Additional Steps for Maintaining Coverage

As you complete remodels and additions, consider these actions to ensure ongoing protection:

Re-Evaluate Coverage After Completion

Once renovations are complete, review your policy to ensure it accurately reflects the increased value, potential risks, and new features of the home.

Perform Regular Maintenance

New additions and systems require maintenance to avoid unexpected damage or failures. Regular upkeep can prevent claims and help maintain lower premiums.

Keep Documentation

Maintain records of renovation costs, permits, receipts, and photos of improvements to simplify future claims or coverage updates.

Examples of Claims Involving Remodels & Additions

Understanding real-life scenarios can help illustrate how homeowners insurance can protect against risks during and after renovations:

Fire Damage During a Kitchen Remodel

A fire breaks out during a kitchen renovation, damaging new cabinets and appliances. Builders risk insurance covers the repair costs and replacement of damaged items.

Injury to a Contractor

A contractor falls from a Ladder while working on a roof extension, sustaining injuries. The contractor’s liability insurance should cover the medical costs, provided the homeowner verified coverage before the project began.

Storm Damage to a New Addition

A windstorm damages the frame of a new addition under construction. Builders risk insurance covers the cost to repair the damage, preventing delays and extra expenses.

How to Maximize Homeowners Insurance Protection

Here are steps to ensure comprehensive protection for remodels and additions:

Increase Dwelling & Liability Coverage

Update coverage limits to match the increased home value and extend liability limits to handle construction-related risks.

Add Temporary Builders Risk Insurance

For major renovations, consider builders risk insurance to cover the structure, materials, and equipment on-site.

Verify Contractor Insurance

Require proof of liability and workers’ compensation insurance from contractors to protect against construction-related claims.

Additional Resources

Insurance Information Institute (III): Offers guidance on updating homeowners insurance for remodels and additions, covering replacement costs, liability, and construction-specific risks. Visit III for more information.

National Association of Home Builders (NAHB): Provides resources for homeowners considering renovations, including best practices for insurance and risk management. Visit NAHB for details.

Consumer Reports: Offers tips on home renovation planning, including how to manage insurance updates during and after remodeling. Visit Consumer Reports for insights.

Wrap-Up

Remodels and additions can enhance your home’s value and functionality, but they also require careful adjustments to your homeowners insurance. By increasing dwelling and liability limits, adding temporary coverage during construction, and verifying contractor insurance, you can protect your home and investment throughout the renovation process.

Regular reviews, proactive adjustments, and consultations with your insurance agent help maintain comprehensive coverage that matches your evolving home.