Understanding Sinkhole and Mudslide Endorsements in Your Homeowners Insurance Policy: A Detailed Guide

Natural ground movement, such as sinkholes and mudslides, can cause catastrophic damage to homes and property. However, these types of events are typically not covered by standard homeowners insurance policies. To protect your home from these risks, you may need to add Sinkhole and Mudslide endorsements to your policy.

This detailed guide will explain what Sinkhole and Mudslide endorsements are, how they work, and provide specific examples to help homeowners understand their importance and application.

What are Sinkhole and Mudslide Endorsements?

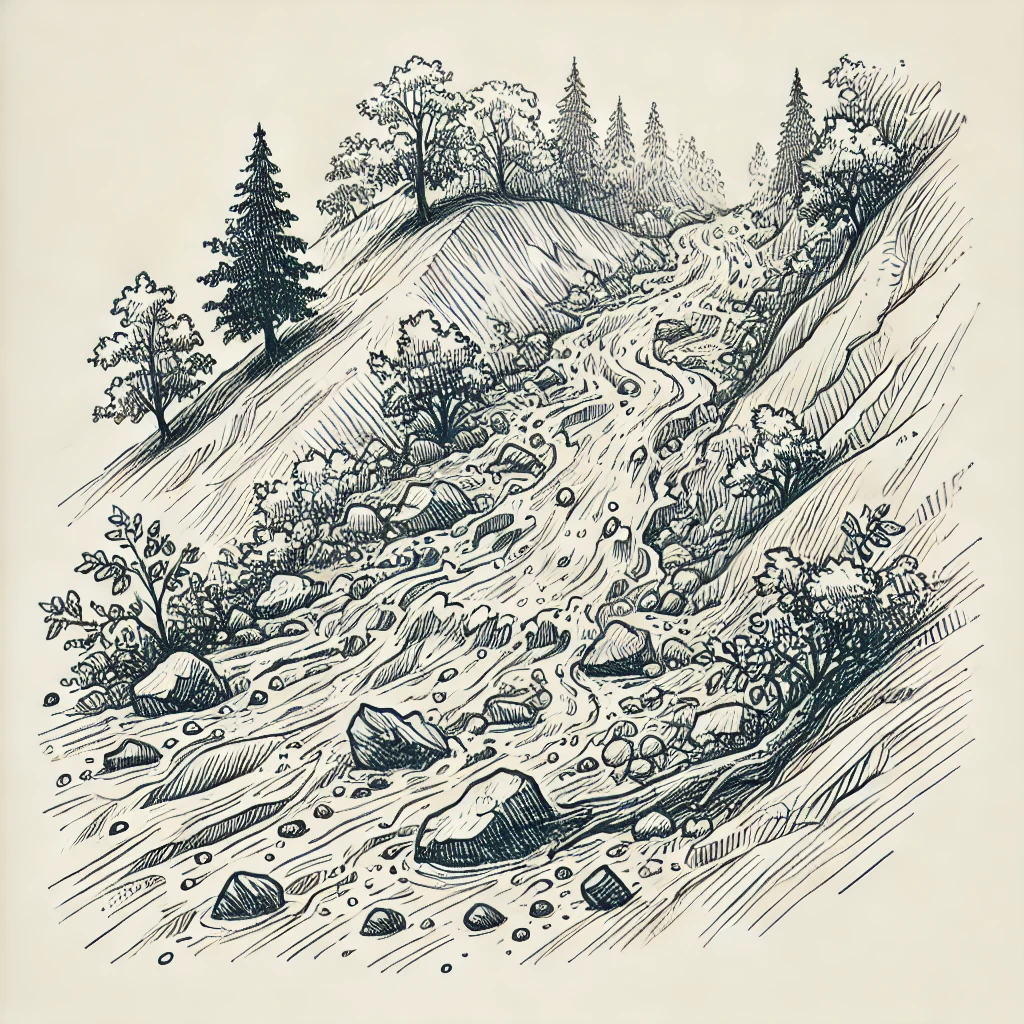

Sinkhole and Mudslide endorsements are add-ons to your homeowners insurance policy that provide coverage for damage caused by these specific types of ground movement. Sinkholes occur when the ground collapses due to the erosion of underlying rock layers, often resulting in sudden and severe damage to homes. Mudslides (or mudflows) occur when heavy rains or rapid snowmelt cause a mass of mud and debris to flow down a slope, potentially destroying structures in its path.

Why You Might Need Sinkhole and Mudslide Coverage

Homeowners living in areas prone to sinkholes, such as parts of Florida, Texas, Alabama, Missouri, Kentucky, and Pennsylvania, or regions with steep terrain that may experience mudslides, should strongly consider these endorsements. Without adequate coverage, the financial burden of repairing or rebuilding a home after such an event can be overwhelming.

Standard homeowners policies often exclude damage from earth movement, making these endorsements critical for those at risk.

Key Components of Sinkhole and Mudslide Coverage

1. Coverage for Structural Damage

What It Is: This coverage protects the structure of your home, including the Foundation, walls, roof, and any attached structures, from damage caused by sinkholes or mudslides. It covers the cost of repairing or rebuilding your home after such an event.

Example:

If a sinkhole opens beneath your home, causing part of your foundation to collapse and significant structural damage, the Sinkhole Endorsement would help cover the cost of repairing the foundation and any other affected parts of your home.

Action Step: Evaluate the risks in your area and consider adding this coverage if you live in a region where sinkholes or mudslides are a known hazard.

2. Coverage for Personal Property

What It Is: This aspect of Sinkhole and Mudslide coverage protects your personal belongings, such as furniture, electronics, appliances, and clothing, from damage caused by these events. It reimburses you for the cost of replacing or repairing these items.

Example:

If a mudslide flows into your home, destroying $20,000 worth of personal property, the Mudslide endorsement would help cover the cost of replacing or repairing the damaged items.

Action Step: Create an inventory of your personal property and ensure that your coverage limits are adequate to protect these items from sinkhole or mudslide damage.

3. Additional Living Expenses (ALE) Coverage / Loss of Use

What It Is: Also known as Loss of Use coverage, ALE coverage helps pay for temporary housing and other living expenses if your home is rendered uninhabitable due to sinkhole or mudslide damage. This coverage includes costs such as hotel stays, rental properties, and additional food expenses.

Example:

If a sinkhole causes severe damage to your home, making it unsafe to live in, ALE coverage would help cover the cost of renting a temporary home or staying in a hotel while repairs are completed.

Action Step: Consider the potential costs of temporary housing if your home becomes uninhabitable due to a sinkhole or mudslide, and ensure your policy includes sufficient ALE coverage.

4. Coverage Limits and Deductibles

What It Is: Sinkhole and Mudslide endorsements typically come with specified coverage limits, which is the maximum amount the insurer will pay for a Claim related to these events. These limits can vary depending on the insurer and the specific endorsement. Additionally, these endorsements may have higher deductibles than standard homeowners insurance, reflecting the significant risk associated with earth movement.

Example:

If your policy includes a $300,000 limit for sinkhole damage and the total cost of repairs is $250,000, your insurance should cover the full amount, minus your Deductible.

Action Step: Review the coverage limits and deductibles of your endorsement to ensure they meet your needs. Choose limits that provide adequate protection against the potentially high costs of repairing sinkhole or mudslide damage.

5. Exclusions and Limitations

What It Is: Like all insurance endorsements, Sinkhole and Mudslide coverage may come with exclusions and limitations. For example, coverage might exclude damage caused by gradual earth movement that is not classified as a sinkhole or mudslide, or it might not cover damage to certain types of structures, such as fences or detached garages.

Example:

If a gradual settling of the ground causes minor cracks in your foundation over several years, this may not be covered if your policy only covers sudden and catastrophic earth movement like sinkholes or mudslides.

Action Step: Carefully review the exclusions and limitations of your endorsement to understand what is and isn’t covered. Consider purchasing additional endorsements or separate policies if necessary.

Specific Examples of How Sinkhole and Mudslide Coverage Works

Scenario 1: Sinkhole Damage to a Home

A sinkhole forms under your property, causing part of your house to collapse into the ground. The total cost of repairs, including stabilizing the ground and rebuilding the collapsed portion of the house, is $350,000.

Outcome with Standard Coverage: Without a Sinkhole endorsement, your standard homeowners insurance policy would likely exclude coverage for earth movement, leaving you responsible for the entire $350,000 cost of repairs.

Outcome with Sinkhole Coverage: With the endorsement, your insurance should cover the $350,000 cost of stabilizing the ground and rebuilding your home, minus your deductible.

Scenario 2: Mudslide Damage to a Home

A heavy rainstorm triggers a mudslide that flows down a nearby hill and into your home, damaging the foundation, walls, and personal property. The total cost of repairs and replacements is $200,000.

Outcome with Standard Coverage: Without a Mudslide endorsement, your standard homeowners insurance policy may exclude coverage for mudslide damage, requiring you to pay for repairs and replacements yourself.

Outcome with Mudslide Coverage: With the endorsement, your insurance should cover the $200,000 cost of repairing the foundation, walls, and replacing the damaged personal property.

Scenario 3: Temporary Relocation Due to Sinkhole Damage

A sinkhole severely damages your home, making it unsafe to live in. You need to relocate to a rental property for six months while your home is repaired. The total cost of the rental and additional living expenses amounts to $25,000.

Outcome with Standard Coverage: Without Sinkhole coverage that includes ALE, you would be responsible for all temporary living expenses out of pocket.

Outcome with Sinkhole Coverage: With ALE coverage included in your Sinkhole endorsement, your insurance should cover the $25,000 in rental and living expenses, providing financial relief during the repair process.

How to Add Sinkhole and Mudslide Coverage to Your Policy

Evaluate Your Risk: Start by assessing the likelihood of sinkholes or mudslides in your area. Consider factors such as local geology, recent events, and proximity to areas known for these types of ground movement. If you live in a high-risk area, adding this coverage is crucial.

Contact Your Insurance Agent: Discuss your needs with your insurance agent and ask about adding Sinkhole and Mudslide endorsements to your homeowners policy. They can guide you through the process and help you choose the best coverage options.

Review the Endorsement Terms: Once added, carefully review the terms of the endorsement, including coverage limits, deductibles, exclusions, and any special conditions. Make sure the policy aligns with your needs and potential risks.

Consider Additional Coverage Options: Depending on your location and specific risks, you may need additional endorsements, such as Flood Insurance or coverage for other types of earth movement, to fully protect your property.

Update Your Coverage as Needed: As the risks in your area change or as you make improvements to your home, make sure to update your coverage to reflect these changes. Regular reviews of your policy will help ensure you are adequately protected.

Wrap-Up

Sinkhole and Mudslide endorsements are essential additions to your homeowners insurance policy if you live in an area prone to these types of ground movement. This coverage provides financial protection against the significant costs associated with repairing or rebuilding your home and replacing personal property after a sinkhole or mudslide. By understanding the different aspects of these endorsements and carefully considering your specific needs, you can make informed decisions to protect your home and belongings from these risks. Regularly reviewing your policy and adjusting your coverage as needed are key steps in maintaining comprehensive protection.

If you have any questions or need to add these endorsements to your policy, contact your insurance agent for guidance. Properly managing your homeowners insurance with Sinkhole and Mudslide coverage provides peace of mind and financial security in the face of natural disasters.