Understanding Mold and Fungus Endorsements in Your Homeowners Insurance Policy: A Detailed Guide

Mold and fungus growth can cause significant damage to your home and pose serious health risks. Unfortunately, standard homeowners insurance policies often limit or exclude coverage for mold and fungus damage, especially if it results from long-term conditions or poor maintenance. To ensure you are adequately protected, you may need to add a Mold and Fungus Endorsement to your homeowners insurance policy.

This detailed guide will explain what Mold and Fungus endorsements are, how they work, and provide specific examples to help homeowners understand their importance and application.

What is a Mold and Fungus Endorsement?

A Mold and Fungus endorsement is an add-on to your homeowners insurance policy that provides coverage for damage caused by mold, fungus, and microbial growth. This endorsement typically covers the cost of removing the mold, repairing or replacing damaged property, and addressing the underlying cause of the mold problem, such as fixing a leaky pipe or addressing water damage. It may also cover additional living expenses if you need to temporarily relocate while your home is being treated for mold.

Why You Might Need Mold and Fungus Coverage

Mold can grow quickly in areas of your home that are damp or have experienced water damage, such as basements, bathrooms, or around Plumbing fixtures. Without proper coverage, you could be responsible for the significant costs of mold Remediation, repairs, and related health issues. Standard homeowners insurance policies typically cover mold damage only if it results from a covered Peril, such as a burst pipe, and even then, the coverage is often limited.

A Mold and Fungus endorsement ensures that you have broader protection against these risks, helping you manage the potentially high costs of dealing with mold.

Key Components of Mold and Fungus Coverage

1. Coverage for Mold Remediation

What It Is: This coverage helps pay for the costs associated with removing mold and fungus from your home, including professional remediation services. It covers the expenses related to cleaning, treating, and removing mold-infested materials.

Example:

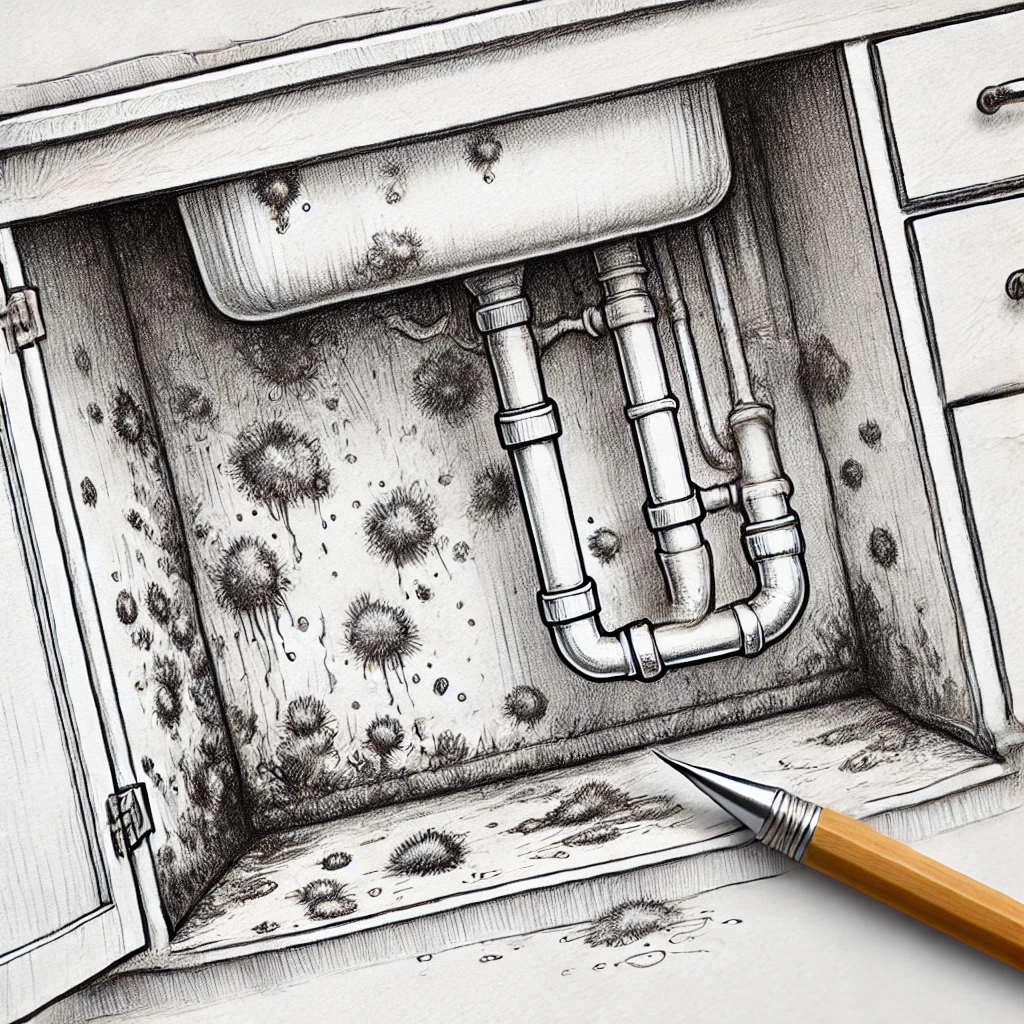

If a slow leak under your kitchen Sink goes unnoticed, causing mold to grow behind the cabinets and on the walls, a Mold and Fungus endorsement would help cover the cost of hiring a mold remediation company to remove the mold, clean the area, and replace any damaged materials.

Action Step: Evaluate the areas of your home most prone to moisture and consider adding this coverage if you are concerned about potential mold growth.

2. Coverage for Repairing or Replacing Damaged Property

What It Is: This coverage reimburses you for the cost of repairing or replacing Personal Property and structural components of your home that have been damaged by mold or fungus.

Example:

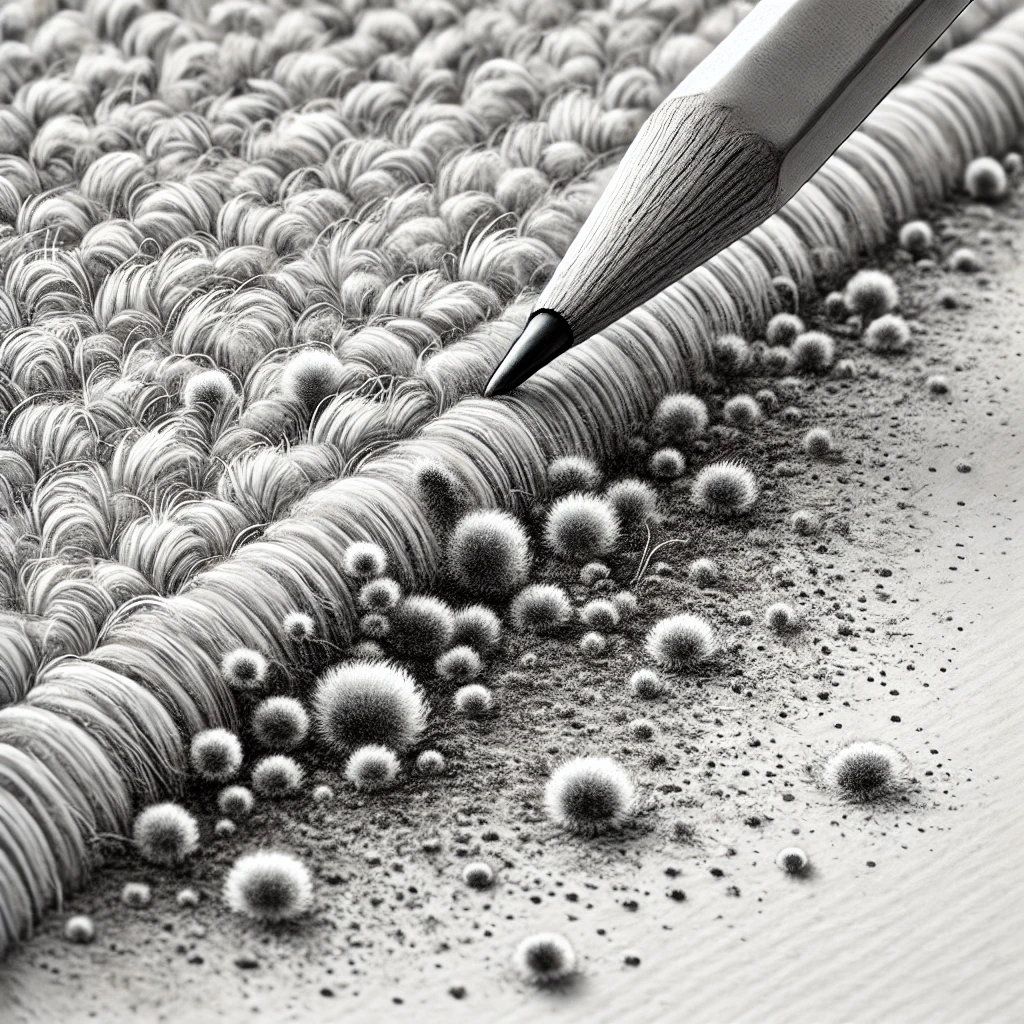

If mold spreads from a damp basement to your carpeting and furniture, resulting in $10,000 worth of damage, the Mold and Fungus endorsement would help cover the cost of replacing the damaged Carpet and furniture, as well as repairing any affected parts of the home.

Action Step: Create an inventory of personal property and assess the structural components of your home that could be at risk for mold damage, ensuring your coverage limits are sufficient.

3. Coverage for Underlying Causes

What It Is: Mold and Fungus endorsements often include coverage for repairing the underlying cause of the mold growth, such as fixing a leaky pipe, roof, or other sources of water intrusion that led to the mold problem.

Example:

If a faulty roof allows water to seep into your attic, leading to mold growth, the endorsement would help cover the cost of repairing the roof to prevent future mold issues, in addition to covering the mold remediation.

Action Step: Regularly inspect your home for potential water damage or leaks and address any issues promptly to prevent mold growth.

4. Additional Living Expenses (ALE) Coverage

What It Is: If your home becomes uninhabitable due to mold contamination, ALE coverage helps pay for temporary housing and other living expenses while your home is being treated and repaired.

Example:

If mold spreads throughout your home, making it unsafe to live in, ALE coverage would help cover the cost of a rental property or hotel stay while mold remediation and repairs are completed.

Action Step: Consider the potential costs of temporary housing if your home becomes uninhabitable due to mold and ensure your policy includes sufficient ALE coverage.

5. Coverage Limits

What It Is: Mold and Fungus endorsements typically come with specific coverage limits, which is the maximum amount the insurer will pay for a Claim related to mold damage. These limits can vary depending on the insurer and the specific endorsement, often ranging from $5,000 to $50,000 or more.

Example:

If your policy includes a $20,000 limit for mold damage and the total cost of remediation and repairs is $25,000, your insurance should cover up to $20,000, leaving you responsible for the remaining $5,000.

Action Step: Review the coverage limits of your endorsement to ensure they meet your needs. Consider the potential costs of mold remediation and repairs and choose limits that provide adequate protection.

6. Exclusions and Limitations

What It Is: Mold and Fungus endorsements may come with exclusions and limitations. Common exclusions might include mold damage resulting from long-term neglect, maintenance issues, or pre-existing conditions.

Example:

If mold develops because of a leak that was not repaired in a timely manner, your policy may exclude coverage for the damage, considering it a maintenance issue.

Action Step: Carefully review the exclusions and limitations of your endorsement to understand what is and isn’t covered. Ensure your policy aligns with your needs and potential risks.

Specific Examples of How Mold and Fungus Coverage Works

Scenario 1: Mold from a Leaking Roof

A storm damages your roof, leading to a slow leak that eventually causes mold to grow in your attic and spread to nearby walls. The total cost of remediation and repairs is $15,000.

Outcome with Standard Coverage: Without a Mold and Fungus endorsement, your standard homeowners insurance policy may not cover the mold damage, leaving you responsible for the full $15,000 out of pocket.

Outcome with Mold and Fungus Coverage: With the endorsement, your insurance should cover the cost of roof repairs to stop the leak, as well as the $15,000 for mold remediation and repairs.

Scenario 2: Mold from a Plumbing Leak

A hidden plumbing leak behind a bathroom wall causes water to seep into the Drywall, leading to mold growth. By the time the mold is discovered, it has spread to nearby rooms, causing $20,000 in damage.

Outcome with Standard Coverage: Without Mold and Fungus coverage, you would likely have to pay for the mold removal and repairs yourself, as standard policies often exclude slow leaks and resulting mold damage.

Outcome with Mold and Fungus Coverage: With the endorsement, your insurance should cover the $20,000 cost of repairing the plumbing, removing the mold, and repairing the affected areas of your home.

Scenario 3: Mold in a Finished Basement

High humidity levels in your finished basement lead to mold growth on the walls and carpeting. The total cost to remove the mold and replace the damaged materials is $12,000.

Outcome with Standard Coverage: Without Mold and Fungus coverage, your standard homeowners policy might not cover the cost of repairs, especially if the mold was caused by high humidity rather than a sudden event.

Outcome with Mold and Fungus Coverage: With the endorsement, your insurance should cover the $12,000 cost of mold remediation, replacing the carpeting, and repairing the damaged walls.

How to Add Mold and Fungus Coverage to Your Policy

Assess Your Mold Risk: Start by evaluating the areas of your home that are most susceptible to mold growth, such as basements, bathrooms, and areas around plumbing fixtures. If you live in a humid climate or have experienced water damage in the past, you may be at higher risk.

Contact Your Insurance Agent: Discuss your needs with your insurance agent and ask about adding a Mold and Fungus endorsement to your homeowners policy. They can guide you through the process and help you choose the best coverage options.

Review the Endorsement Terms: Once added, carefully review the terms of the endorsement, including coverage limits, deductibles, exclusions, and any special conditions. Make sure the policy aligns with your needs and potential risks.

Consider Additional Coverage Options: Depending on your situation, you may also want to consider other endorsements, such as water or steam seepage coverage, to complement your Mold and Fungus Coverage.

Update Your Coverage as Needed: As you make improvements to your home or as your situation changes, make sure to update your coverage to reflect these changes. Regular reviews of your policy will help ensure you are adequately protected.

Wrap-Up

Mold and Fungus Coverage is an essential endorsement for homeowners who want to protect themselves from the potentially significant costs of mold remediation and related repairs. This coverage fills a critical gap in standard homeowners insurance policies, providing financial protection against damage that can occur gradually and lead to serious health and structural issues. By understanding the different aspects of Mold and Fungus Coverage and carefully considering your specific needs, you can make informed decisions to protect your home from these risks. Regularly reviewing your policy and adjusting your coverage as needed are key steps in maintaining comprehensive protection.

If you have any questions or need to add this endorsement to your policy, contact your insurance agent for guidance. Properly managing your homeowners insurance with Mold and Fungus Coverage provides peace of mind and financial security for your home.