Signs You May Be Underinsured in These Areas: How to recognize gaps in other structures and liability coverage

Coverage gaps outside the main home rarely announce themselves.

Detached structures and liability exposure tend to sit quietly in the background of a homeowners Policy. Premiums are paid, nothing appears wrong, and daily life continues as usual. Because these areas are not tested often, it is easy to assume they are fine. This article is meant to highlight a few common indicators that coverage may deserve a closer look, before circumstances force the issue.

These signs are prompts, not conclusions.

You have detached structures that are more than basic

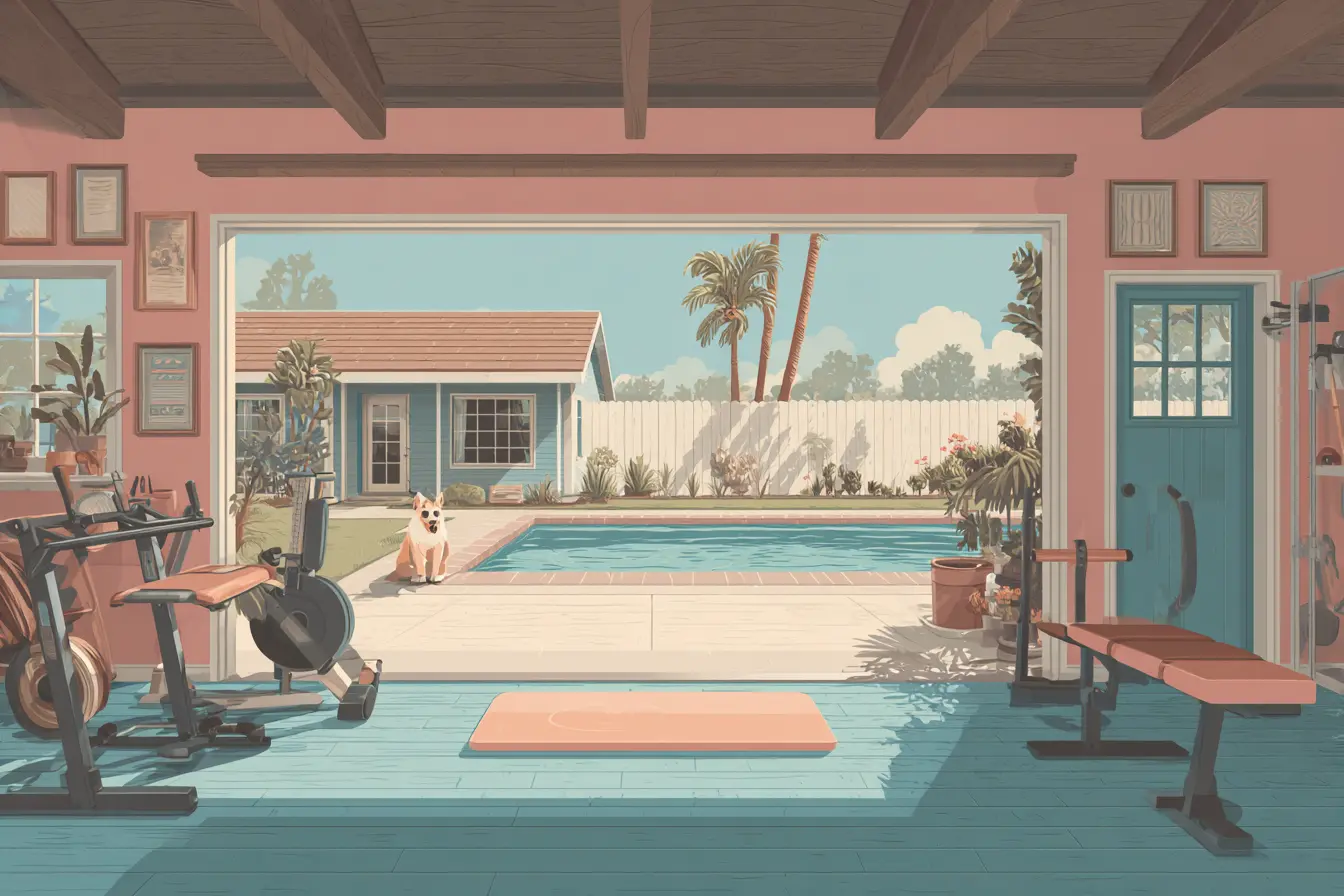

One of the clearest signals is the presence of detached structures that go beyond simple storage.

Garages that double as workshops, finished studios, accessory units, pool houses, or substantial fencing and retaining walls all increase rebuild cost. If other structures coverage is still set at a default percentage without reflecting how those buildings are actually used, limits may be tight.

When detached structures play an active role in daily life, their rebuild needs are often underestimated.

Improvements were made without revisiting coverage

Detached structures often evolve independently of the main home.

Upgrades such as Insulation, electrical work, Plumbing, or interior finishes can significantly change rebuild cost. Because these improvements are often incremental, they rarely trigger an insurance review.

If coverage has not been revisited since those changes were made, assumptions may no longer align with reality.

You assume dwelling coverage would absorb a shortfall

A common misconception is that strong dwelling coverage will provide flexibility elsewhere.

In reality, other structures coverage is a separate bucket. If its limit is exhausted, dwelling coverage generally cannot be used to make up the difference. If reassurance comes primarily from the size of the dwelling limit rather than the specific other structures limit, that separation may not be fully understood.

This misunderstanding is a frequent source of surprise during claims.

Your liability limit has not changed as life has

Liability exposure tends to change as households evolve.

More guests, pets, amenities, rental activity, or home based work all increase exposure, even when nothing feels risky day to day. If liability limits were set years ago and have not been revisited since life changed, they may reflect an earlier version of your household.

Liability coverage does not adjust automatically to lifestyle.

You rely on minimum limits without much thought

Many homeowners carry standard liability limits because they were suggested at purchase.

Those limits may still be appropriate, but if they have never been reconsidered, it is difficult to know. Liability losses are driven by severity rather than frequency, and even a single event can exceed basic limits.

If limits feel more like defaults than deliberate choices, it may be worth understanding the exposure they are meant to address.

You have Assets you would want protected

Liability coverage exists to shield personal assets from unexpected claims.

If you have accumulated savings, investments, or future income you would want protected, liability limits become more consequential. Coverage that felt sufficient earlier in life may not align with current financial reality.

Understanding how liability coverage relates to asset protection helps put limits into perspective.

You are unsure how these coverages were set

As with other areas of the policy, uncertainty is informative.

If you do not know how other structures or liability limits were chosen, when they were last reviewed, or what assumptions they reflect, those numbers are largely untested. That does not mean they are wrong. It means their fit is unknown.

Knowing the origin of a number often matters as much as the number itself.

Wrap-Up

Other structures and liability coverage often become underinsured not because they are ignored, but because they change quietly as properties and lives evolve.

Detached buildings grow more complex. Lifestyles introduce new exposure. Coverage defaults remain in place. Recognizing the signs that these areas may be tight gives you the opportunity to revisit assumptions on your own terms, rather than during a stressful event.

With this chapter complete, the next chapter will shift toward the final pieces of the policy puzzle: pulling everything together, prioritizing what matters most, and deciding what to do next without pressure or urgency.