Why Market Value Is the Wrong Reference Point: And how confusing price with rebuild cost quietly leads to underinsurance

One of the most common assumptions homeowners make about insurance is that coverage should roughly match the value of their home.

That assumption feels logical. Homes are bought and sold based on market value, property taxes reference assessed value, and online estimates make home prices feel constantly visible and precise. It is natural to assume that insurance should track those same numbers.

In reality, market value and rebuild cost measure entirely different things. Confusing the two is one of the most reliable ways underinsurance quietly takes hold.

Market value reflects what someone would pay

Market value represents what a buyer is willing to pay for a home in its current condition, at a particular moment, in a particular market. It is influenced by location, land value, demand, interest rates, and broader economic trends.

Two identical homes on similar lots can have very different market values depending on neighborhood popularity, school districts, or timing. In many cases, a significant portion of a home’s market value has nothing to do with the structure itself.

Insurance does not protect land. It protects the cost to rebuild the structure that sits on it.

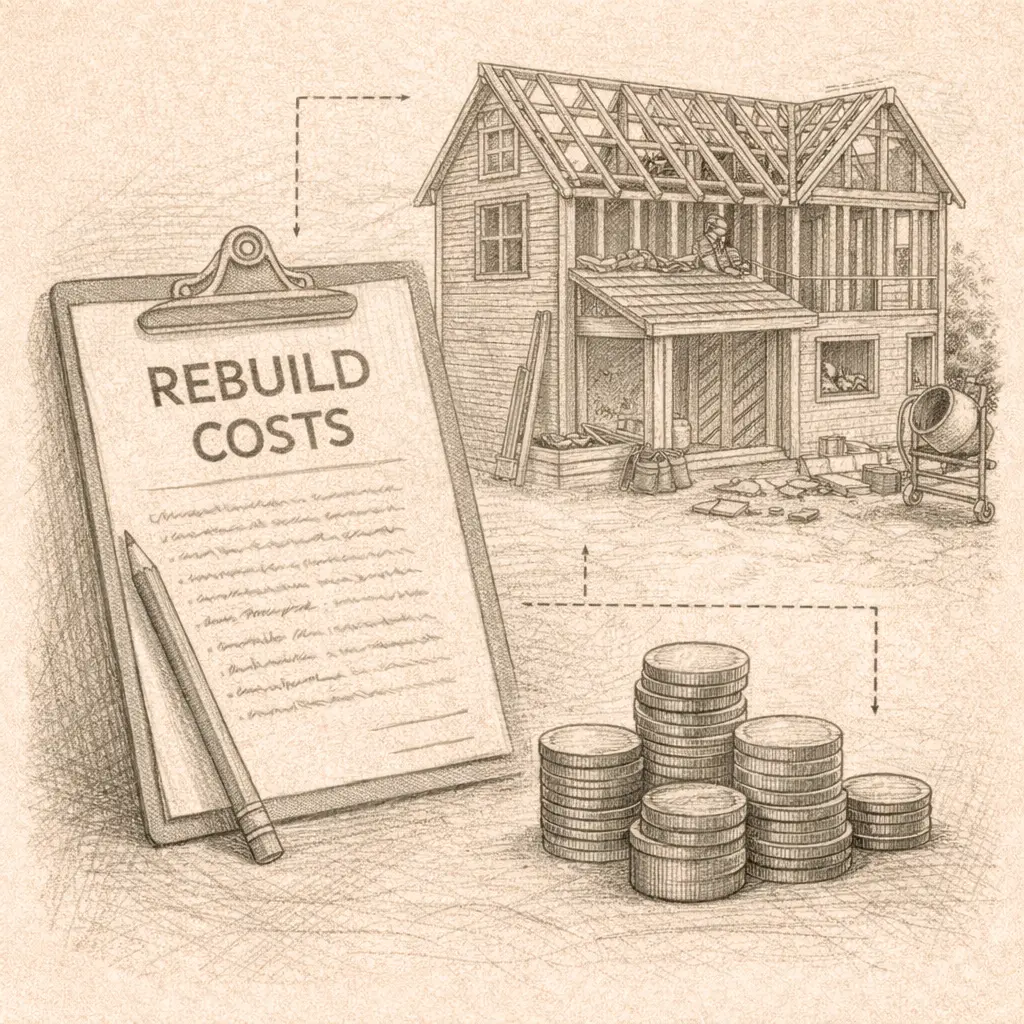

Rebuild cost reflects what it takes to start over

Rebuild cost is the amount required to reconstruct your home after a loss using similar materials and methods, while meeting current building codes. It includes labor, materials, design complexity, and the realities of the local construction market.

Unlike market value, rebuild cost is heavily influenced by factors that homeowners rarely see day to day. Labor availability, permitting timelines, code requirements, and regional demand all play a role. After large disasters, these factors can change quickly and dramatically.

Because rebuild cost is not visible in the same way as market value, it is often underestimated.

When high market value hides underinsurance

In some areas, especially where land values are high, market value can greatly exceed rebuild cost. This can create a false sense of security.

A homeowner may assume that because their home is worth a large amount on paper, their insurance coverage must be sufficient. In reality, the dwelling limit may still be based on outdated rebuild assumptions or generic estimates that have not kept pace with actual construction costs.

In these cases, the gap does not show up until rebuilding begins and estimates exceed coverage.

Example

A homeowner lives in a desirable neighborhood where land value drives most of the home’s price. Their property value is high, but the dwelling limit is based on an older rebuild estimate. After a fire, construction bids come in well above the policy limit due to labor shortages and updated code requirements. The market value of the home never mattered to the rebuild.

When rising prices create the opposite problem

In other cases, rapidly rising home prices can push homeowners to assume they are underinsured when they may not be.

During periods of fast appreciation, market value can rise much faster than rebuild cost. This can lead to unnecessary anxiety or overcorrection if market value is used as the primary reference.

The key is not to match insurance limits to market price, but to understand what actually drives rebuild cost and whether coverage reflects those realities.

Why rebuild estimates fall behind

Rebuild estimates are often generated quickly when a policy is first written and then adjusted incrementally over time. These adjustments may rely on general indexes rather than local construction conditions or changes to the home itself.

Major renovations, changes in material quality, and evolving building codes are rarely captured automatically. Over time, the estimate becomes less representative of what rebuilding would truly require.

Because the number still looks official, it is rarely questioned.

What to focus on instead

Rather than anchoring on market value, it is more useful to think about rebuild cost as its own moving target.

Questions worth asking include how complex the home is to rebuild, whether major upgrades have been made, how local construction markets behave after disruptions, and whether the policy includes features like extended replacement or ordinance coverage that help absorb uncertainty.

These factors are far more predictive of how a policy will perform during a loss than a single market value number.

Wrap-Up

Market value is useful for buying, selling, and financing a home. It is not a reliable guide for setting insurance limits.

Understanding the difference between price and rebuild cost helps explain why many homeowners feel surprised by coverage gaps, even when their home appears valuable on paper. Insurance works best when it is tied to what recovery actually requires, not what the market happens to say at any given moment.

In the next article, we will look at how everyday life changes, renovations, and normal accumulation quietly push coverage out of alignment over time, often without any clear warning signs.