Understanding the Land Stabilization Endorsement in Homeowners Insurance Policies

When it comes to protecting your home from the unexpected, many homeowners focus on visible damage—like fires, floods, or windstorms. But what happens when the ground beneath your home shifts? That's where the Land Stabilization endorsement can play a vital role in your homeowners insurance coverage.

What Is Land Stabilization Coverage?

A Land Stabilization endorsement is an add-on to a standard homeowners insurance Policy that helps cover the cost of stabilizing land that has shifted, collapsed, or eroded as a result of a covered Peril—usually when that instability threatens the structural integrity of your home.

This coverage is not for damage to the land itself, but rather for making the land stable enough to support repairs to your insured structures, such as the dwelling or other buildings like garages or guest houses.

Why It Matters

Most standard homeowners policies exclude coverage for earth movement, landslides, and other ground-related issues—even if they result from a covered event like a fire or pipe burst. If your home is damaged by one of those covered perils, but the ground underneath is unstable, your policy might pay to repair the house but not to stabilize the land it sits on. That can leave you on the hook for significant out-of-pocket costs.

Adding the Land Stabilization endorsement helps close this coverage gap, allowing you to properly rebuild or repair your home with the necessary land work included.

What’s Typically Covered

The Land Stabilization endorsement may help pay for:

Engineering assessments of the soil and slope

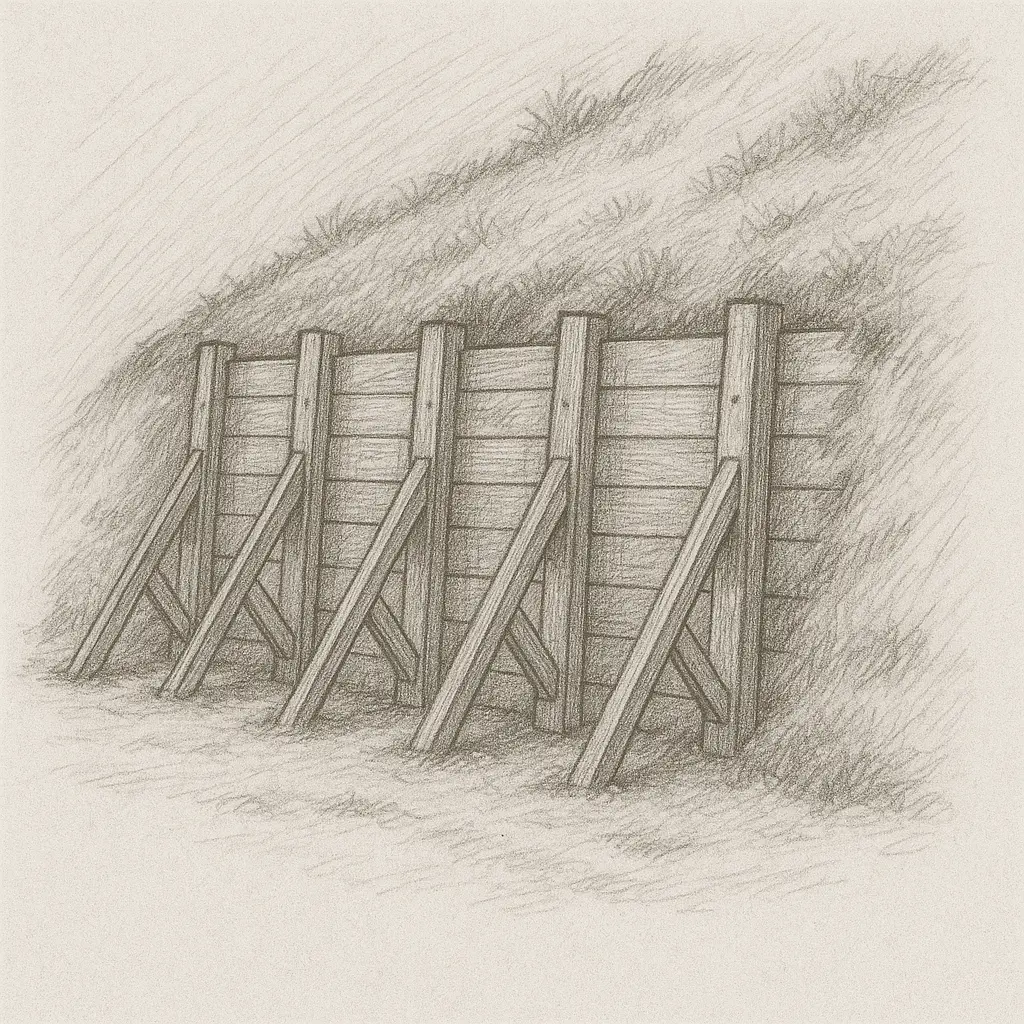

Excavation, fill, or Retaining Wall installation

Grading or contouring to prevent further movement

Specialty contractors or equipment required for slope repair

Coverage typically applies only when land destabilization is directly related to a covered loss (e.g., a water main break that causes Soil Erosion).

What’s Not Covered

It's important to note the limitations:

Natural settling or gradual earth movement is usually excluded.

Earthquakes and landslides are only covered if you have a separate policy or endorsement.

Preventive land work not tied to a covered Claim is not included.

Common Scenarios

A wildfire damages your home and burns off vegetation, leading to slope instability. You’ll need land stabilization to rebuild safely.

A Plumbing failure causes significant ground erosion under the Foundation.

Heavy rain following a covered peril leads to minor land shifting that threatens your structure.

In each case, having land stabilization coverage may help ensure the home can be safely repaired or rebuilt.

Key Takeaways

Standard homeowners insurance does not include land stabilization.

This endorsement helps fund essential groundwork after a covered loss to allow proper repairs.

Coverage is conditional, meaning it must relate directly to another insured event.

Costs for land work can be substantial, making this endorsement valuable in hilly or erosion-prone areas.

Should You Add It?

Homeowners in areas with sloped lots, Clay-heavy soil, or frequent rainfall should strongly consider it. It’s especially important for homes built on hillsides, near canyons, or in post-wildfire zones, where soil can easily shift after vegetation loss.

Ask your insurance provider whether this endorsement is available, how much it costs, and what perils trigger coverage.

Final Tip

If you’re rebuilding after a claim, be sure to ask whether your Estimate includes land work and whether the insurer considers it covered. Without this endorsement, you might find that your home can’t be rebuilt until you handle expensive stabilization work yourself.