Understanding the Earth Movement Peril in Homeowners Insurance: What You Need to Know

The earth beneath our homes is constantly shifting, but sometimes these movements can become extreme and cause significant damage. Events such as earthquakes, landslides, sinkholes, and mudslides can lead to severe structural damage, resulting in costly repairs. The earth movement peril refers to these types of natural phenomena that can affect your home. However, coverage for earth movement is generally not included in standard homeowners insurance policies without additional endorsements or separate policies.

This detailed guide will explain what the earth movement peril is, what it typically includes, why it’s often excluded from standard policies, and provide specific examples to help homeowners understand when and how this coverage might apply.

What Is the Earth Movement Peril?

The earth movement peril refers to damage caused by various types of ground movement, including:

Earthquakes: Seismic activities that cause the ground to shake and can result in the shifting or cracking of foundations, walls, and other structural elements.

Landslides: The sliding down of a mass of earth or rock from a mountain or cliff, which can push homes off their foundations or bury structures.

Sinkholes: A depression or hole in the ground caused by the collapse of a surface layer, which can swallow parts of or entire homes.

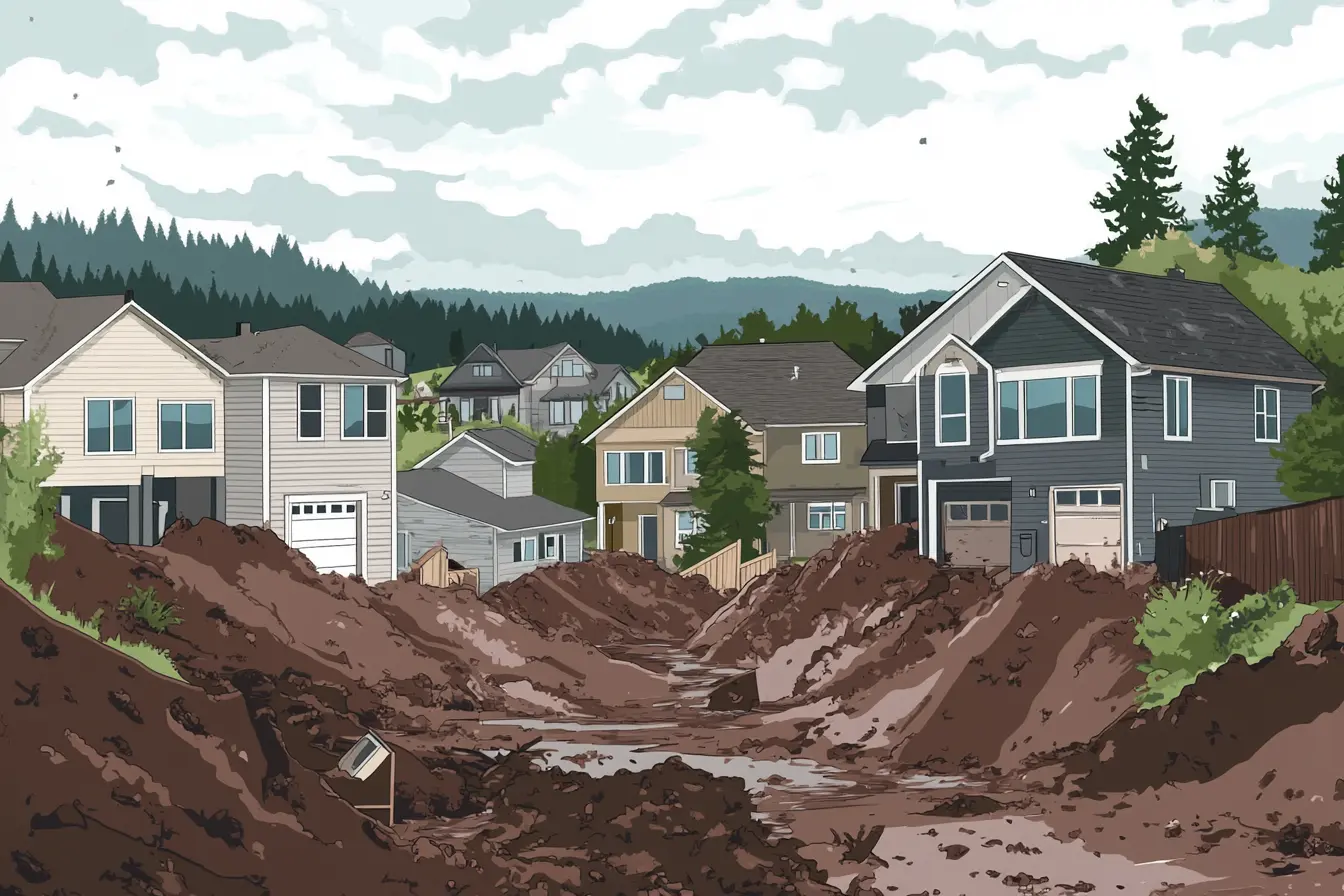

Mudslides: A flow of mud down a hillside or mountain, typically caused by heavy rain, which can destroy structures in its path.

What Does Earth Movement Coverage Include?

When homeowners purchase earth movement coverage, typically through an Endorsement or separate Policy, it may include the following:

Structural Damage to the Home: Coverage typically includes damage to the home’s structure, such as the Foundation, walls, roof, and any attached structures like garages or decks. This is essential for repairing or rebuilding a home that has been damaged or destroyed by earth movement.

Damage to Other Structures: Coverage may also extend to other structures on the property, such as detached garages, sheds, fences, or retaining walls that are damaged by earth movement.

Personal Property: Some policies or endorsements include protection for personal belongings inside the home that are damaged or destroyed by earth movement, such as furniture, electronics, appliances, and clothing.

Additional Living Expenses (ALE): If earth movement renders your home uninhabitable, some policies may cover the cost of temporary living expenses while your home is being repaired or rebuilt.

Debris Removal: Coverage may include the cost of removing debris from your property, such as the remains of damaged structures or items destroyed by earth movement.

Why Earth Movement Coverage Is Not Included in Standard Homeowners Policies

There are several reasons why earth movement coverage is generally excluded from standard homeowners insurance policies:

High Risk of Catastrophic Loss: Earth movement events like earthquakes, landslides, and sinkholes can cause extensive damage that affects entire neighborhoods or regions. The potential for large-scale destruction and financial loss makes it difficult for insurers to include this coverage in standard policies without significantly increasing premiums.

Geographical Variability: The risk of earth movement varies significantly depending on location. While some regions, like California, are highly prone to seismic activity, others are at risk of landslides or sinkholes. Excluding earth movement coverage from standard policies allows insurers to offer more tailored coverage options based on regional risk factors.

Specialized Coverage Requirements: Earth movement events often require specific and costly repairs, such as foundation stabilization, soil testing, or complete rebuilding. By offering earth movement coverage as an endorsement or separate policy, insurers can ensure that the coverage is appropriately designed to address these unique needs.

Separate Government-Backed Programs: In some cases, government programs may offer specialized insurance for certain types of earth movement, such as the California Earthquake Authority (CEA) for earthquake coverage in California. These programs are designed to provide coverage specifically for these high-risk areas.

Loti can help:

In addition to helping you organize information for your homeowners policies, Loti also supports specialized insurance types such as those from the CEA to make filing claims easier and faster for everyone involved.

Specific Examples of Earth Movement Peril Coverage

1. Structural Damage from an Earthquake

Scenario: A homeowner experiences a significant earthquake that causes the foundation of their home to crack, leading to structural instability and damage to the walls and roof.

Coverage: If the homeowner has purchased earthquake insurance, the policy would cover the cost of stabilizing and repairing the foundation, as well as any necessary structural repairs to restore the home’s safety and integrity.

Outcome: The homeowner files a Claim under their earthquake insurance policy and should receive compensation for the repairs needed to restore their home.

2. Home Destroyed by a Landslide

Scenario: Heavy rains trigger a landslide on a hillside, causing a large portion of earth to slide down and destroy the homeowner’s property, including the house and detached garage.

Coverage: If the homeowner has a landslide endorsement or a separate earth movement policy, the coverage would include the cost of removing debris, rebuilding the home, and repairing or replacing the detached garage.

Outcome: The homeowner files a claim and should receive compensation for the rebuilding and debris removal needed to restore their property.

3. Sinkhole Swallows Part of a Home

Scenario: A sinkhole opens up beneath a homeowner’s property, swallowing a portion of the house, including the kitchen and dining room.

Coverage: If the homeowner has purchased sinkhole coverage, the policy would cover the cost of stabilizing the remaining structure, filling the sinkhole, and rebuilding the damaged parts of the home.

Outcome: The homeowner files a claim under their sinkhole insurance policy and should be reimbursed for the cost of the necessary stabilization and reconstruction.

4. Mudslide Damage After Heavy Rain

Scenario: A homeowner’s property is hit by a mudslide following a period of intense rainfall. The mudslide causes significant damage to the home’s foundation and lower level.

Coverage: If the homeowner has mudslide coverage, their policy would cover the cost of repairing the foundation, removing the mud, and addressing any structural damage caused by the mudslide.

Outcome: The homeowner files a claim and should receive compensation for the necessary repairs and cleanup.

How to Obtain Earth Movement Coverage

If you live in an area prone to earth movement events, it’s important to consider purchasing earth movement coverage to protect your home and belongings. Here’s how to go about it:

Evaluate Your Risk: Determine whether you live in an area at risk for earthquakes, landslides, sinkholes, or other types of earth movement. This Assessment can be based on local geological reports, history of events, and proximity to fault lines or unstable slopes.

Contact Your Insurance Agent: Speak with your insurance agent about adding an earth movement endorsement to your existing homeowners policy or purchasing a separate earth movement insurance policy. They can help you understand the coverage options available and recommend the best course of action based on your risk level.

Review Coverage Limits and Deductibles: Earth movement insurance typically comes with higher deductibles than standard homeowners insurance, often expressed as a percentage of the home’s insured value. Make sure you understand the Deductible and coverage limits before purchasing a policy.

Understand Exclusions: Be aware of any exclusions in your earth movement coverage, such as coverage limitations for certain types of damage or specific conditions under which the coverage applies.

Consider Additional Coverage: Depending on your needs, you may want to consider additional coverage options, such as increased personal property limits or coverage for specific structures like swimming pools or outbuildings.

Additional Considerations

1. Mitigation Measures

Taking proactive steps to mitigate the potential damage from earth movement can help reduce your risk and may even lower your insurance premiums.

Seismic Retrofitting: Consider retrofitting your home with seismic Bracing, especially if it is an older structure or located on or near a fault line.

Landslide Barriers: If you live on or near a slope, consider installing barriers, retaining walls, or other measures to prevent or minimize the impact of landslides.

Foundation Stabilization: For homes in areas prone to sinkholes, consider foundation stabilization methods to reinforce the structure and reduce the risk of collapse.

2. Emergency Preparedness

Prepare for the possibility of earth movement by creating an emergency plan and assembling an emergency kit with essential supplies, such as food, water, first aid, and medications.

Family Communication Plan: Establish a communication plan with your family members to ensure everyone knows what to do in the event of an earthquake, landslide, or other earth movement events.

Evacuation Routes: Familiarize yourself with evacuation routes and emergency shelters in your area, especially if you live in a high-risk zone.

Wrap-Up

Earth movement peril poses significant risks to homeowners, particularly those living in areas prone to earthquakes, landslides, sinkholes, and mudslides. Since this coverage is generally excluded from standard homeowners insurance policies, it’s essential to consider purchasing additional endorsements or separate policies to protect your home and belongings.

By understanding how this coverage works, reviewing your policy’s limits and exclusions, and taking preventive measures, you can safeguard your home against the potentially devastating effects of earth movement. If you have any questions about your coverage or need to explore additional insurance options, contact your insurance agent for guidance.