Inland Marine Insurance

Inland Marine Insurance is a specialized type of insurance that covers valuable Personal Property that is highly portable or used for business purposes. Despite its name, this insurance has nothing to do with water; it was originally created to cover goods in transit over land. Today, it protects a wide range of high-value, mobile items, such as art collections, jewelry, photography equipment, and other valuable Assets that may not be adequately covered under standard Homeowners Insurance.

This article explains how Inland Marine Insurance works, what it covers, and who should consider it.

Why Inland Marine Insurance is Important

Inland Marine Insurance offers coverage beyond what is typically provided by standard homeowners insurance:

Protects Portable Property: It provides comprehensive coverage for high-value items that are frequently moved or used outside the home.

Broadens Protection: Inland Marine Insurance covers a wider range of risks than standard homeowners policies, including accidental loss, damage, and theft.

Customizable Coverage: Policies can be tailored to specific items, their use, and associated risks, offering flexible and robust protection.

How Inland Marine Insurance Works

Inland Marine Insurance is designed to protect property that is mobile or highly valuable, both in transit and at various locations:

What Inland Marine Insurance Covers

Inland Marine Insurance covers a wide range of valuable items, including:

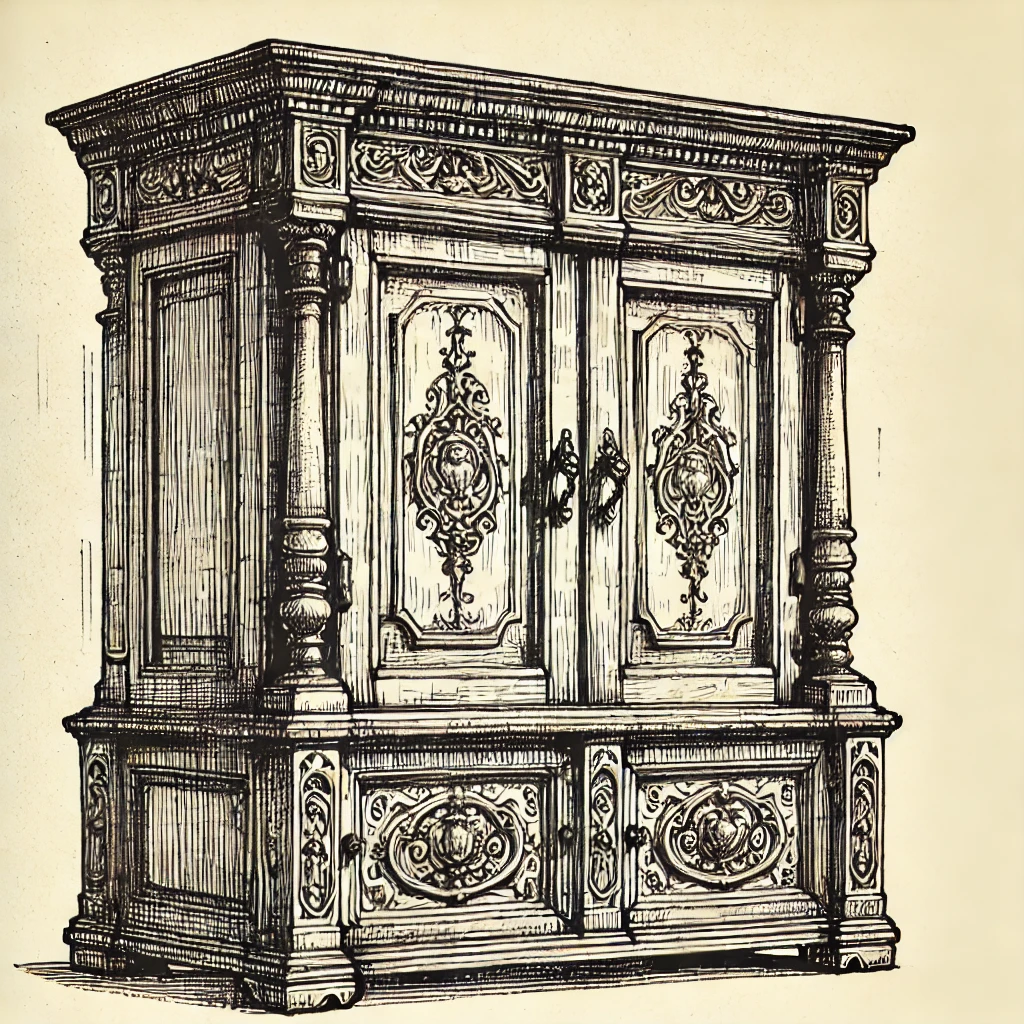

Fine Art & Antiques

Protects paintings, sculptures, antique furniture, and rare artifacts from theft, fire, accidental damage, or loss, whether on display, in transit, or in storage.

Jewelry & Watches

Covers engagement rings, heirloom jewelry, luxury watches, and other valuable jewelry items against a broader range of risks, including mysterious disappearance.

Photography & Film Equipment

Provides protection for cameras, lenses, lighting, and other professional photography or filmmaking equipment, covering damage during transit or on location.

Musical Instruments

Covers professional and personal musical instruments against loss, theft, or damage, whether used at home, in studios, or while touring.

Sports Equipment

Protects valuable sports equipment, such as golf clubs, ski gear, or fishing equipment, ensuring coverage during travel or recreational use.

Collectibles & Memorabilia

Covers rare stamps, coins, sports memorabilia, and other collections against theft, damage, or accidental loss.

Mobile Business Property

Includes portable business equipment, such as laptops, tools, medical equipment, or Contractor tools, protecting them while in transit, on-site, or in storage.

High-Value Electronics

Covers high-value electronics, including drones, computers, audio-visual equipment, and GPS devices, whether used for personal or business purposes.

What Inland Marine Insurance Does Not Cover

While Inland Marine Insurance offers comprehensive coverage, it does have certain exclusions:

Wear & Tear: Normal wear and tear, gradual deterioration, or inherent defects are not covered.

Intentional Damage: Damages caused by intentional acts or illegal activities are not covered.

Flood or Earthquake Damage: Coverage for flood or earthquake damage must be purchased separately, unless specifically added to the inland marine Policy.

How Inland Marine Insurance Works

Specified Coverage: Unlike general personal property coverage, Inland Marine Insurance covers specific items that are individually listed in the policy.

Broader Coverage: It offers "all-risk" protection, meaning it covers all perils except those specifically excluded, making it more comprehensive than standard homeowners insurance.

Worldwide Protection: Inland Marine Insurance generally provides worldwide coverage, protecting items while traveling, during business use, or even at temporary locations.

No or Low Deductibles: Most Inland Marine policies have no or low deductibles, making it easier to replace or repair high-value items without significant out-of-pocket costs.

When to Consider Inland Marine Insurance

Inland Marine Insurance is ideal for individuals or businesses with high-value, portable property that needs broader protection:

Frequent Travelers

Homeowners who frequently travel with valuable items, such as jewelry, photography gear, or musical instruments, should consider Inland Marine coverage to ensure full protection.

Collectors & Art Enthusiasts

Art collectors or antique enthusiasts with valuable collections should use Inland Marine Insurance to cover their pieces at home, in transit, or during exhibitions.

Professional Photographers & Musicians

Professionals with high-value equipment that is regularly transported or used at different locations will benefit from the all-risk coverage provided by Inland Marine Insurance.

Business Owners

Businesses that rely on portable equipment, such as contractors, consultants, or event planners, should consider Inland Marine coverage to protect tools and business property on-site or in transit.

Luxury Item Owners

Owners of high-value jewelry, watches, or other luxury items that require coverage beyond standard homeowners insurance limits should consider Inland Marine Insurance.

Examples of Inland Marine Insurance Claims

Understanding real-world scenarios can help illustrate the benefits of Inland Marine Insurance:

Lost Painting During Transit

An art collector ships a valuable painting to an exhibition, but it is lost in transit. Inland Marine Insurance covers the full value of the painting, as it was specifically listed in the policy.

Stolen Musical Instrument

A professional violinist’s instrument is stolen from a performance venue. Inland Marine Insurance covers the theft, providing the funds needed to replace the high-value instrument.

Damaged Camera Equipment

A professional photographer’s camera lens is accidentally damaged during a shoot. Inland Marine Insurance covers the repair or replacement cost of the lens.

Jewelry Lost Abroad

A homeowner loses a $10,000 engagement ring while traveling internationally. Inland Marine Insurance covers the loss, providing full reimbursement for the ring's value.

How to Purchase Inland Marine Insurance

Follow these steps to obtain Inland Marine Insurance for your high-value items:

Identify Items for Coverage

Make a list of valuable items that are frequently moved, used for business, or need broader protection than what your homeowners policy provides.

Obtain Appraisals or Documentation

Provide professional appraisals, receipts, photos, or other documentation to support the item’s value and ensure accurate coverage.

Contact Your Insurance Agent

Discuss your specific needs with your insurance agent, who can provide quotes, explain policy details, and help determine the right amount of coverage.

Choose Coverage Limits

Decide on the appropriate coverage limits for each item based on its appraised value or replacement cost.

Review Policy Terms

Carefully review the policy to understand covered perils, exclusions, deductibles, and Claim procedures.

Benefits of Inland Marine Insurance

Inland Marine Insurance offers several advantages:

Broader Protection: It covers more perils than standard homeowners insurance, including accidental loss, mysterious disappearance, and damage in transit.

Higher Coverage Limits: Inland Marine policies have higher limits for specific items, ensuring full reimbursement in the event of a loss.

Flexible Coverage: It can be customized to fit the value, use, and movement of each item, making it ideal for both personal and business needs.

Worldwide Coverage: Protects items globally, ensuring that valuables are covered whether at home, in transit, or abroad.

How Inland Marine Insurance Affects Your Homeowners Insurance

Inland Marine Insurance complements homeowners insurance by filling coverage gaps for high-value, portable items:

Fills Coverage Gaps: It provides broader coverage for items that standard homeowners policies may limit or exclude, such as fine art, jewelry, or business property.

Reduces Out-of-Pocket Costs: With higher limits and no or low deductibles, Inland Marine Insurance minimizes the financial impact of replacing or repairing valuable items.

Works Seamlessly with Existing Coverage: It enhances overall protection for high-value items, ensuring full replacement or repair in the event of a loss.

Who Needs Inland Marine Insurance?

Inland Marine Insurance is suitable for:

Collectors & Enthusiasts: Those with fine art, antiques, rare books, or other valuable collections that require specialized protection.

Luxury Item Owners: Individuals with high-value jewelry, watches, or other luxury items that exceed the limits of standard homeowners policies.

Business Owners & Professionals: Contractors, consultants, photographers, musicians, or other professionals with valuable, portable equipment used for work.

Frequent Travelers: Homeowners who travel regularly with high-value items like jewelry, electronics, or instruments.

Additional Resources

Insurance Information Institute (III): Provides guidance on Inland Marine Insurance, explaining what it covers and who should consider it. Visit III for more information.

National Association of Insurance Commissioners (NAIC): Offers resources on different types of Property Insurance, including Inland Marine Insurance. Visit NAIC for more details.

Appraisers Association of America: Offers information on appraising valuable items, which is essential for securing accurate Inland Marine coverage. Visit Appraisers Association for guidance.

Wrap-Up

Inland Marine Insurance provides essential protection for high-value, portable items that may not be adequately covered by standard homeowners insurance. With broader coverage, higher limits, and flexible policy options, it is an ideal solution for homeowners, collectors, business owners, and travelers who need comprehensive protection for their most valuable possessions.

Consult with your insurance agent to assess your needs, obtain appraisals, and customize an Inland Marine policy that fits your high-value items.