Understanding Uninhabited Property Exclusions in Your Homeowners Insurance Policy: A Detailed Guide

Owning a property that is uninhabited, whether due to construction, renovation, or prolonged vacancy, presents unique challenges and risks. Homeowners insurance is designed to protect your property, but there are specific uninhabited property exclusions that you need to be aware of. These exclusions can leave you vulnerable to significant financial losses if your property is unoccupied for an extended period.

This detailed guide will explain what uninhabited property exclusions are, how they affect your coverage, and provide specific examples to help homeowners navigate these issues.

What Are Uninhabited Property Exclusions?

Uninhabited property exclusions refer to specific conditions or events related to properties that are unoccupied, under construction, or vacant for an extended period. These exclusions often include events such as theft, vandalism, and damage resulting from the property being left unmonitored.

Insurance companies often view uninhabited properties as higher risk due to the increased likelihood of undetected damage and criminal activity.

Key Uninhabited Property Exclusions

1. Theft to a Dwelling Under Construction Exclusion

What It Is: Theft to a dwelling under construction refers to the exclusion of coverage for stolen building materials, appliances, or fixtures from a home that is being built or renovated but is not yet occupied. This exclusion is based on the premise that construction sites are more vulnerable to theft due to the lack of a permanent presence.

Example:

Scenario: A homeowner is in the process of building a new home. Before moving in, thieves break in and steal high-end appliances and building materials, such as copper piping and wiring.

Outcome: Because the property was under construction and not yet inhabited, the theft would likely be excluded from coverage under a standard homeowners insurance policy. The homeowner would need a builder’s risk policy or a specific Endorsement to cover the stolen items.

Action Step: If you are building a new home or undergoing major renovations, consider purchasing a builder’s risk policy or adding a construction endorsement to your existing policy to cover theft and other risks during construction.

2. Vandalism to Long-Term Vacant Property Exclusion

What It Is: Vandalism to a long-term vacant property refers to the exclusion of coverage for damage caused by vandalism to a home that has been unoccupied for an extended period, typically 30 to 60 days or more. Insurers often exclude this coverage because vacant homes are more likely to be targeted by vandals.

Example:

Scenario: A homeowner moves out of their home and leaves it vacant for several months while trying to sell it. During this time, vandals break in and cause extensive damage to the property, including broken windows and graffiti.

Outcome: Because the property was vacant for an extended period, the vandalism would likely be excluded from coverage under a standard homeowners insurance policy. The homeowner would need to cover the repair costs themselves or have a vacancy permit or endorsement in place.

Action Step: If your property is going to be vacant for an extended period, inform your insurance company and consider purchasing a vacancy permit or endorsement to ensure coverage for vandalism and other risks.

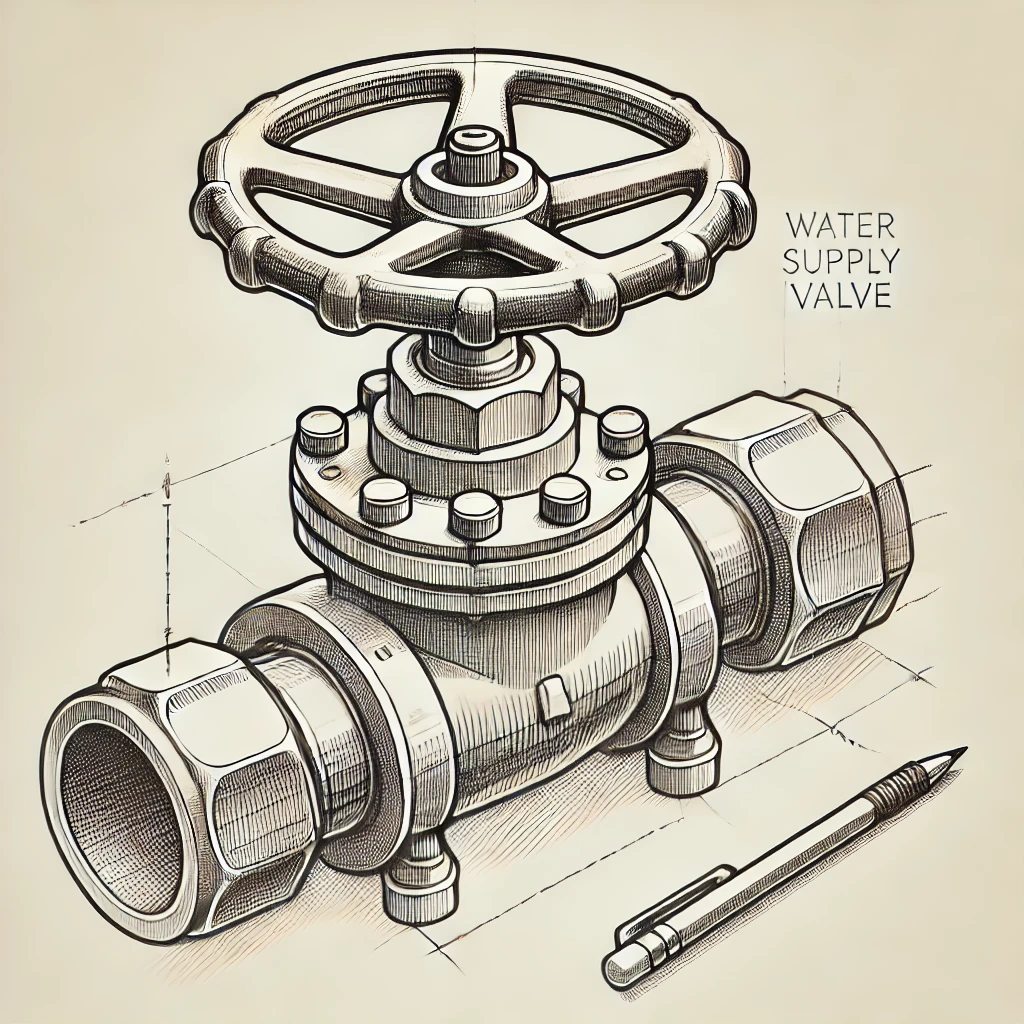

3. Water Damage Exclusion for Uninhabited Properties

What It Is: Water damage exclusion for uninhabited properties refers to the exclusion of coverage for water damage that occurs when a property is left unoccupied and unmonitored for an extended period. This can include damage from burst pipes, leaks, or other water-related issues that go undetected.

Example:

Scenario: A homeowner leaves their property vacant for several months during the winter without shutting off the Water Supply or properly winterizing the home. A pipe bursts, causing significant water damage to the interior of the home.

Outcome: Because the property was uninhabited and the damage resulted from the homeowner’s failure to maintain the property (e.g., not shutting off the water supply), the water damage would likely be excluded from coverage under a standard homeowners insurance policy.

Action Step: If you plan to leave your property uninhabited for an extended period, take preventive measures such as shutting off the water supply, draining pipes, or hiring someone to regularly check on the property. Consider adding an endorsement for uninhabited properties that provides coverage for water damage.

4. Fire Damage Exclusion for Unoccupied Homes

What It Is: Fire damage exclusion for unoccupied homes refers to the exclusion of coverage for fire damage that occurs in a home that has been left unoccupied for an extended period. Fire risk increases in unmonitored properties due to the potential for undetected issues like electrical problems or arson.

Example:

Scenario: A homeowner leaves their property unoccupied for six months while traveling. During this time, an electrical fault causes a fire that destroys a portion of the home.

Outcome: Because the home was unoccupied for an extended period, the fire damage may be excluded from coverage under a standard homeowners insurance policy. The homeowner would need an endorsement for unoccupied property or a specialized policy to cover the damage.

Action Step: If your home will be unoccupied for an extended period, inform your insurance company and consider adding coverage for fire and other risks associated with unoccupied properties.

5. Personal Property Exclusion for Uninhabited Properties

What It Is: Personal property exclusion for uninhabited properties refers to the exclusion of coverage for personal belongings left in an unoccupied home that are damaged or stolen. This exclusion is based on the increased risk of theft and damage when a home is unmonitored.

Example:

Scenario: A homeowner leaves valuable items such as electronics, jewelry, and artwork in their unoccupied home while they are away for several months. During this time, the home is broken into, and the items are stolen.

Outcome: Because the home was unoccupied and the theft occurred during this period, the stolen personal property may not be covered under the standard homeowners insurance policy. The homeowner would need to cover the loss themselves or have an endorsement that provides coverage for personal property in uninhabited homes.

Action Step: If you plan to leave personal property in an uninhabited home, consider adding an endorsement that covers these items or store them in a secure location while the property is unoccupied.

How to Manage Uninhabited Property Risks and Exclusions

1. Purchase the Right Insurance Coverage

If your property will be uninhabited for an extended period, it’s essential to have the right insurance coverage in place to protect against the specific risks associated with vacant or under-construction properties.

Builder’s Risk Policy: This policy covers properties under construction or renovation, protecting against risks such as theft, vandalism, and fire.

Vacancy Permit or Endorsement: This endorsement extends coverage to vacant properties, ensuring protection against risks such as vandalism, theft, and water damage.

Unoccupied Property Insurance: A specialized policy that covers homes that will be unoccupied for an extended period, providing protection against various risks.

2. Take Preventive Measures

Preventive measures can significantly reduce the risks associated with uninhabited properties and may help maintain coverage under your insurance policy.

Winterize the Property: If leaving your home uninhabited during winter, shut off the water supply, drain pipes, and maintain a minimum temperature to prevent freezing.

Install Security Systems: A security system with cameras, alarms, and motion detectors can deter vandalism and theft, especially in uninhabited properties.

Regular Inspections: Arrange for a trusted neighbor, friend, or property manager to regularly inspect your home while it’s uninhabited to catch and address any issues early.

3. Inform Your Insurance Company

Always inform your insurance company if your property will be uninhabited for an extended period. This transparency ensures that you are aware of any exclusions that may apply and allows you to purchase the necessary endorsements or additional coverage.

Report Extended Vacancies: Let your insurer know if your property will be vacant for more than the standard 30 to 60 days, as this is typically when exclusions start to apply.

Update Your Coverage: Work with your insurance agent to update your policy and add any necessary endorsements to maintain coverage for uninhabited properties.

Wrap-Up

Uninhabited property exclusions in homeowners insurance policies can leave you vulnerable to significant financial losses if you're not adequately prepared. By understanding these exclusions, taking preventive measures, and securing the appropriate insurance coverage, you can better protect your property and finances against the risks associated with unoccupied, vacant, or under-construction homes.

Properly managing your homeowners insurance with a focus on uninhabited property-related risks provides peace of mind and ensures that your property remains protected, even when it’s unoccupied. If you have any questions about your coverage or need to explore additional insurance options, contact your insurance agent for guidance.