Understanding the Theft Peril in Your Homeowners Insurance Policy: A Detailed Guide

Theft can be a devastating experience, both emotionally and financially. Fortunately, most standard homeowners insurance policies include coverage for theft, helping to protect homeowners from the financial loss associated with stolen property. The theft peril is an essential part of your homeowners insurance, offering coverage for the loss of personal property due to theft, whether the incident occurs at your home or in some cases, even off-premises. Understanding how this coverage works, what it includes, and its limitations is crucial for homeowners who want to ensure they are fully protected.

This detailed guide will explain what the theft peril is, how it works within a homeowners insurance policy, and provide specific examples to help homeowners understand when and how this coverage might apply.

What Is the Theft Peril?

The theft peril in a homeowners insurance policy provides coverage for the loss of personal property due to theft. This coverage generally applies whether the theft occurs inside your home, on your property, or in certain circumstances, away from your home. The coverage also typically includes damage caused by the theft, such as broken windows or doors, during the break-in.

What Does the Theft Peril Cover?

The theft peril typically covers the following scenarios:

Theft of Personal Property Inside the Home: If someone breaks into your home and steals personal property, such as electronics, jewelry, or furniture, this peril would generally cover the cost of replacing the stolen items.

Theft of Personal Property from Other Structures: Items stolen from other structures on your property, such as a garage, Shed, or guest house, are usually covered under this peril.

Damage Caused During the Break-In: If the thief damages your home during the break-in, such as breaking a window or forcing a door open, the cost of repairing this damage is typically covered.

Theft of Personal Property Off-Premises: Some policies extend coverage to personal property stolen away from your home, such as during a vacation or from a storage unit. However, coverage limits may vary.

Theft by a Household Member’s Guest: If a guest of a household member steals personal property from your home, this may be covered under the theft peril, depending on the specifics of your policy.

What Is Not Covered?

While the theft peril provides essential coverage, there are some exclusions and limitations that homeowners should be aware of:

Theft by Household Members: Theft by someone who lives in the home, such as a family member or roommate, is typically not covered.

Theft from a Home Under Construction: If your home is under construction or renovation, theft of materials or items from the site may not be covered unless you have specific endorsements.

Business Property: Theft of business-related property may have limited coverage under a standard homeowners policy. Separate business insurance or endorsements may be needed.

High-Value Items: Certain high-value items, such as expensive jewelry, artwork, or collectibles, may have sub-limits under the theft peril, meaning that only a portion of their value is covered unless additional endorsements are purchased.

Unoccupied or Vacant Homes: If the home is left unoccupied or vacant for an extended period, theft coverage may be limited or excluded unless specific measures are taken or endorsements are added.

Specific Examples of Theft Peril Coverage

1. Burglary Inside the Home

Scenario: A homeowner returns from a weekend trip to find that their home has been burglarized. The thief entered through a broken window, stealing a laptop, jewelry, and a television.

Coverage: The theft peril in the homeowner’s insurance policy would cover the cost of replacing the stolen items (laptop, jewelry, and television) and repairing the broken window. The homeowner may be reimbursed based on the Actual Cash Value (ACV) or replacement cost, depending on their policy.

Outcome: The homeowner files a Claim and should receive compensation for the stolen items and the cost of repairing the damage to the window.

2. Theft from a Detached Garage

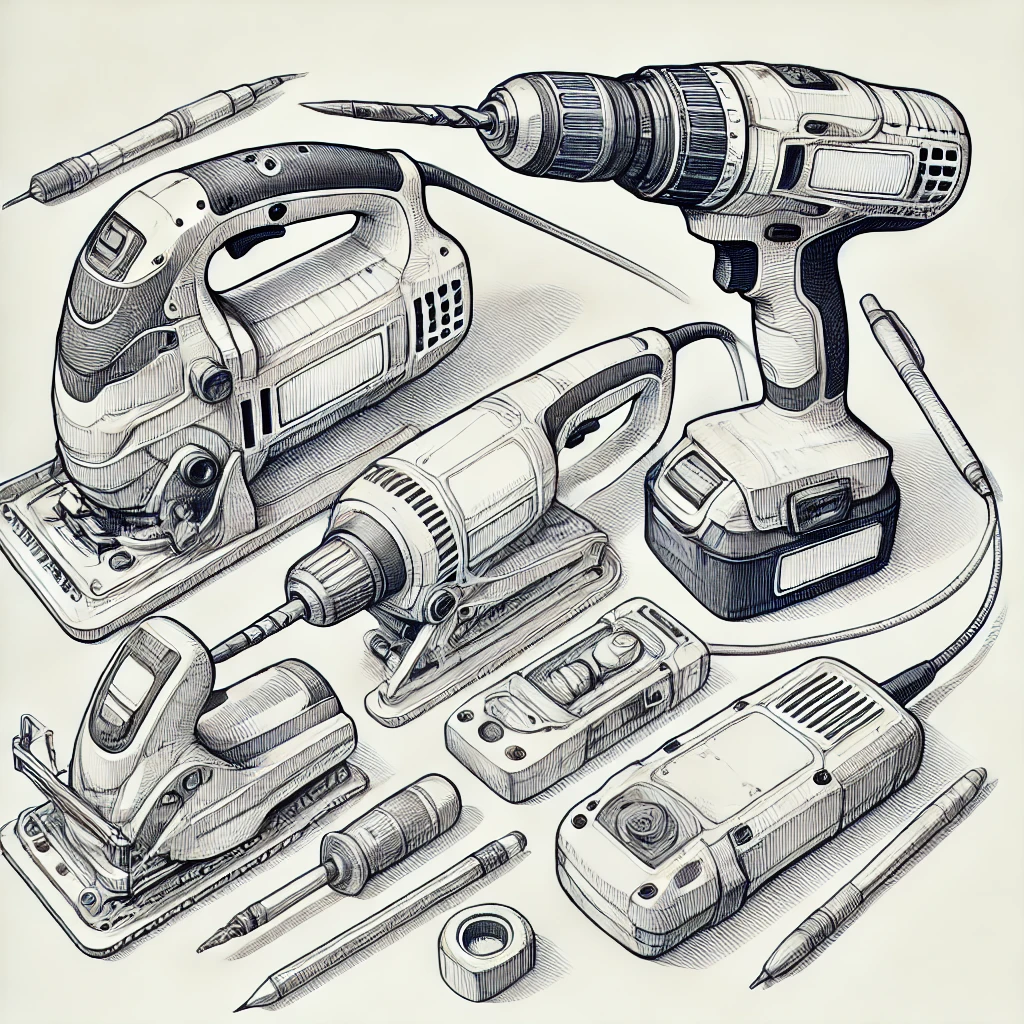

Scenario: A homeowner stores expensive tools and equipment in their detached garage. One night, someone breaks into the garage and steals several power tools.

Coverage: The theft peril would typically cover the stolen tools, as they were taken from a structure on the insured property. The policy would reimburse the homeowner for the value of the stolen tools.

Outcome: The homeowner files a claim and should be reimbursed for the cost of replacing the stolen tools.

3. Theft of Personal Property While Traveling

Scenario: While on vacation, a homeowner’s luggage is stolen from their hotel room, including a laptop, camera, and clothing.

Coverage: Many homeowners insurance policies extend theft coverage to personal property stolen off-premises. In this case, the theft peril would cover the stolen items, though coverage limits may apply.

Outcome: The homeowner files a claim and should receive compensation for the stolen items, subject to any Policy Limits for off-premises theft.

4. Theft of Jewelry Exceeding Policy Limits

Scenario: A thief breaks into a homeowner’s house and steals several pieces of expensive jewelry worth $10,000. However, the homeowner’s policy has a $1,500 sub-limit for jewelry theft.

Coverage: The theft peril would cover the stolen jewelry, but the homeowner would only receive $1,500 due to the policy’s sub-limit. To cover the full value, the homeowner would need to have purchased a scheduled personal property Endorsement for the jewelry.

Outcome: The homeowner files a claim but only receives the sub-limit amount. In the future, they might consider adding an endorsement to fully cover high-value items.

How to Maximize Your Coverage

1. Review and Understand Your Policy’s Limits

To ensure you have adequate protection, review your homeowners insurance policy to understand the coverage limits for theft, especially for high-value items.

Policy Limits: Check the coverage limits for theft, including any sub-limits for specific items like jewelry, electronics, or collectibles.

Endorsements: Consider purchasing endorsements or riders to cover high-value items that exceed your policy’s standard limits.

2. Create a Home Inventory

A detailed home inventory can help support your claim and ensure you receive full compensation for stolen items.

Document Your Belongings: Create a comprehensive inventory of your personal property, including photos, descriptions, and receipts for high-value items.

Regular Updates: Update your inventory regularly, especially after making significant purchases or receiving valuable gifts.

3. Enhance Home Security

Taking steps to secure your home can help prevent theft and may also qualify you for discounts on your homeowners insurance.

Install Security Systems: Consider installing a home security system with cameras, alarms, and motion detectors to deter burglars.

Reinforce Entry Points: Reinforce doors and windows with high-quality locks, deadbolts, and security bars to make break-ins more difficult.

Use Safes for Valuables: Store high-value items like jewelry, important documents, and cash in a secure, fireproof safe.

4. Consider Additional Coverage for High-Value Items

If you own high-value items that may exceed your policy’s limits, consider purchasing additional coverage.

Scheduled Personal Property Endorsement: This endorsement provides coverage for specific high-value items, such as jewelry, art, or collectibles, at their full value.

Blanket Coverage: Some policies offer blanket coverage for high-value items without requiring them to be itemized, though this may come with higher premiums.

Additional Considerations

1. Off-Premises Coverage

If you frequently travel or store items off-site, consider the extent of off-premises theft coverage provided by your policy.

Off-Premises Limits: Be aware of any limits on off-premises theft coverage, and consider additional coverage if necessary.

Storage Units: If you use a storage unit, check whether your policy covers theft from the unit and consider purchasing additional coverage if needed.

2. Vacant or Unoccupied Homes

If your home will be unoccupied or vacant for an extended period, take steps to maintain theft coverage.

Vacancy Permit: If you plan to leave your home vacant, consider obtaining a vacancy permit or endorsement to maintain coverage.

Security Measures: Enhance security measures, such as timers for lights and regular check-ins by neighbors or friends, to deter potential thieves.

Wrap-Up

The theft peril in homeowners insurance policies provides valuable protection against the financial loss associated with stolen property. By understanding how this coverage works, reviewing your policy’s limits and exclusions, and taking preventive measures, you can safeguard your home and belongings from the risks associated with theft.

If you have any questions about your coverage or need to explore additional insurance options, contact your insurance agent for guidance.