Understanding the Termites Peril in Homeowners Insurance: What You Need to Know

Termites are one of the most destructive pests that can invade a home, causing significant damage to the structure and potentially leading to costly repairs. Despite the risks, termite damage is generally not covered under standard homeowners insurance policies. This Exclusion is often surprising to homeowners, particularly when they face the extensive damage these pests can cause. Understanding why termite damage is typically not included in standard policies, what termite coverage might include if you opt for additional protection, and how you can protect your home from termites is crucial for homeowners.

This detailed guide will explain what termite coverage might involve, why it’s generally excluded from standard homeowners insurance, and provide specific examples to help homeowners understand how they can manage this risk.

What Is the Termites Peril?

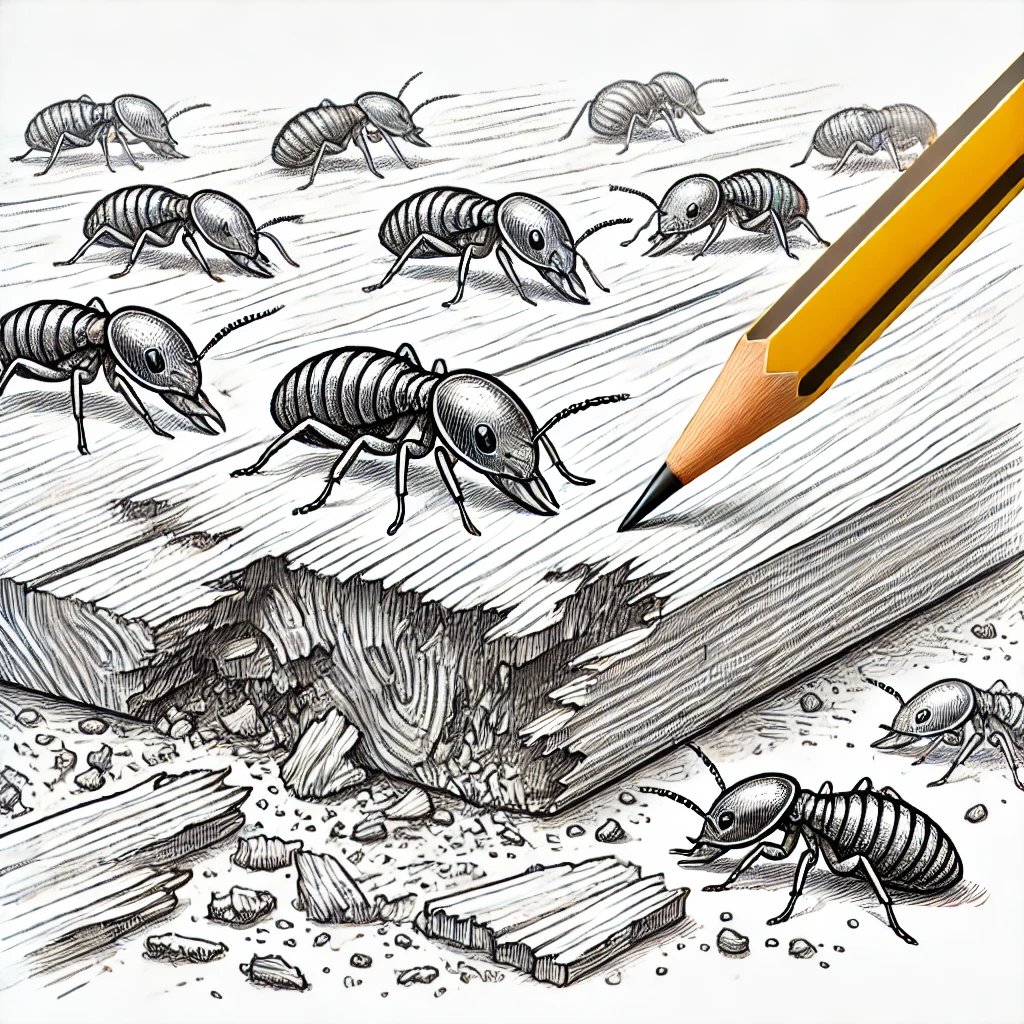

The termites peril refers to damage caused by termites, a type of wood-eating insect that can destroy the wooden structures within a home. Termites feed on cellulose, which is found in wood, paper, and other plant-based materials, making homes with wooden frameworks particularly vulnerable. Over time, termites can cause severe structural damage, including weakened beams, collapsed floors, and damaged walls, leading to extensive and costly repairs.

Types of Termites in the U.S.

Before discussing the insurance aspects, it’s helpful to understand the common types of termites that homeowners might encounter in the U.S.:

Subterranean Termites (Reticulitermes spp.): These are the most common type of termites in the U.S. They live in the soil and build mud tubes to access above-ground food sources. Subterranean termites are highly destructive because they build extensive networks and can damage a home’s foundation, walls, and other wooden structures.

Drywood Termites (Incisitermes spp.): Drywood termites do not require contact with soil and typically infest dry wood, such as the Framing of homes, wooden furniture, and Hardwood floors. They can enter homes through cracks and crevices, and their colonies can grow undetected for years, leading to significant damage.

Dampwood Termites (Zootermopsis spp.): Dampwood termites prefer wood that is moist and decaying, often infesting homes with leaks or high humidity. They are less common in residential areas but can cause damage in homes with poor Ventilation or water damage.

Why Termite Damage Is Not Included in Standard Homeowners Policies

There are several reasons why termite damage is generally excluded from standard homeowners insurance policies:

Preventable Damage: Termite damage is considered preventable through regular maintenance, inspections, and Pest control measures. Insurance companies view it as the homeowner’s responsibility to protect their property from termite infestations, similar to other maintenance-related issues.

Gradual Damage: Termite damage typically occurs gradually over time, rather than as a sudden event. Homeowners insurance is designed to cover sudden and accidental damage, such as a fire or storm, rather than issues that develop due to neglect or lack of maintenance.

High Costs of Coverage: The cost of repairing termite damage can be substantial, particularly if the Infestation has gone undetected for an extended period. Covering termite damage would likely lead to higher premiums for all policyholders, which insurers aim to avoid by excluding this peril from standard coverage.

Specialized Pest Control: Addressing termite infestations and damage often requires specialized pest control services and repairs. Insurers prefer to keep these risks separate from standard homeowners policies to manage costs and coverage more effectively.

What Termite Coverage Might Include

If a homeowner chooses to add termite coverage through an Endorsement or a separate Policy, it may include the following:

Inspection and Treatment Costs: Coverage may include the cost of regular termite inspections and treatment to prevent infestations. This proactive approach can help detect termites early and minimize damage.

Damage Repair: If termites are discovered and have caused damage to the home’s structure, such as wooden beams, floors, or walls, the coverage might include the cost of repairing or replacing the damaged areas.

Personal Property Protection: Some policies or endorsements might cover damage to personal property caused by termites, such as wooden furniture, books, or stored items made of wood or paper.

Preventive Measures: Coverage might also include the cost of installing preventive measures, such as termite barriers or treatments, to protect the home from future infestations.

Specific Examples of Termite-Related Coverage

1. Termite Damage to Structural Beams

Scenario: A homeowner discovers that termites have infested the wooden beams in their basement, causing significant weakening of the structure and the risk of collapse.

Coverage: If the homeowner has purchased termite coverage, the policy would cover the cost of removing the termites, repairing or replacing the damaged beams, and ensuring the structure is safe.

Outcome: The homeowner files a Claim under their termite coverage and should receive compensation for the repairs needed to restore their home’s structural integrity.

2. Termite Infestation in Wooden Flooring

Scenario: After noticing soft spots in the Hardwood Flooring, a homeowner discovers that termites have been eating away at the wood beneath the surface, causing extensive damage.

Coverage: With termite coverage in place, the homeowner’s policy would cover the cost of treating the infestation, replacing the damaged flooring, and possibly addressing any underlying issues that allowed the termites to thrive.

Outcome: The homeowner files a claim and should be reimbursed for the cost of treating the termites and replacing the damaged flooring.

3. Termite Damage to Outdoor Structures

Scenario: A homeowner finds that termites have infested the wooden deck attached to their home, leading to significant deterioration of the structure and making it unsafe to use.

Coverage: If the homeowner has an endorsement or policy that includes termite coverage, the cost of repairing or replacing the damaged deck would be covered, along with treatment to prevent future infestations.

Outcome: The homeowner files a claim and should receive compensation for the necessary repairs to restore the deck.

How to Protect Your Home from Termite Damage

Since standard homeowners insurance typically does not cover termite damage, it’s important for homeowners to take proactive steps to protect their property from termites. Here are some key strategies:

Regular Inspections: Schedule regular termite inspections with a licensed pest control professional, especially if you live in an area prone to termite infestations. Early detection can prevent extensive damage.

Moisture Control: Termites are attracted to moisture, so it’s essential to keep your home dry. Fix any leaks, ensure proper drainage around your home, and use dehumidifiers in damp areas like basements or crawl spaces.

Proper Storage: Avoid storing wood or other cellulose materials directly on the ground near your home, as this can attract termites. Keep firewood, Mulch, and other wood products at least several feet away from your home’s Foundation.

Maintain the Exterior: Regularly inspect and maintain the exterior of your home, including Siding, wooden decks, and fences. Repair any cracks or holes that could allow termites to enter your home.

Use Termite-Resistant Materials: When building or renovating, consider using termite-resistant materials, such as treated wood or metal, for parts of your home that are most vulnerable to termite damage.

Install Barriers: Consider installing termite barriers or treatment systems around your home’s foundation. These can provide an additional layer of protection against termites.

Additional Considerations

1. Choosing Termite Coverage

If you are concerned about the risk of termite damage, you may want to consider purchasing termite coverage. Here are some options:

Termite Endorsement: Some insurance companies offer endorsements that can be added to your standard homeowners policy to cover termite damage. This can be a cost-effective way to gain some protection.

Separate Termite Insurance: In some cases, you can purchase a separate termite insurance policy, which provides more comprehensive coverage, including inspections, treatment, and damage repair.

Pest Control Plans: Many pest control companies offer annual plans that include regular termite inspections and treatment. While not insurance, these plans can help prevent infestations and may be more affordable than repairing damage after the fact.

2. Understanding Exclusions

Even with termite coverage, it’s essential to understand the exclusions and limitations of your policy:

Maintenance Requirements: Many termite policies require homeowners to perform regular maintenance and inspections to keep the coverage in force. Failing to meet these requirements could result in denied claims.

Coverage Limits: Termite coverage often comes with specific limits on the amount that can be claimed for damage repair, treatment, or preventive measures. Be sure to review these limits to ensure they meet your needs.

Wrap-Up

Termites can cause extensive and costly damage to your home, but unfortunately, this peril is typically not covered under standard homeowners insurance policies. By understanding the risks associated with termites and taking proactive measures to protect your home, you can reduce the likelihood of a serious infestation. If you live in an area prone to termites or are particularly concerned about this risk, consider purchasing additional termite coverage through an endorsement or a separate policy.

Regular maintenance, inspections, and preventive measures are key to safeguarding your home against these destructive pests. If you have any questions about your coverage or need to explore additional insurance options, contact your insurance agent for guidance.