Understanding Service Line Coverage Endorsements in Your Homeowners Insurance Policy: A Detailed Guide for Small Business Owners

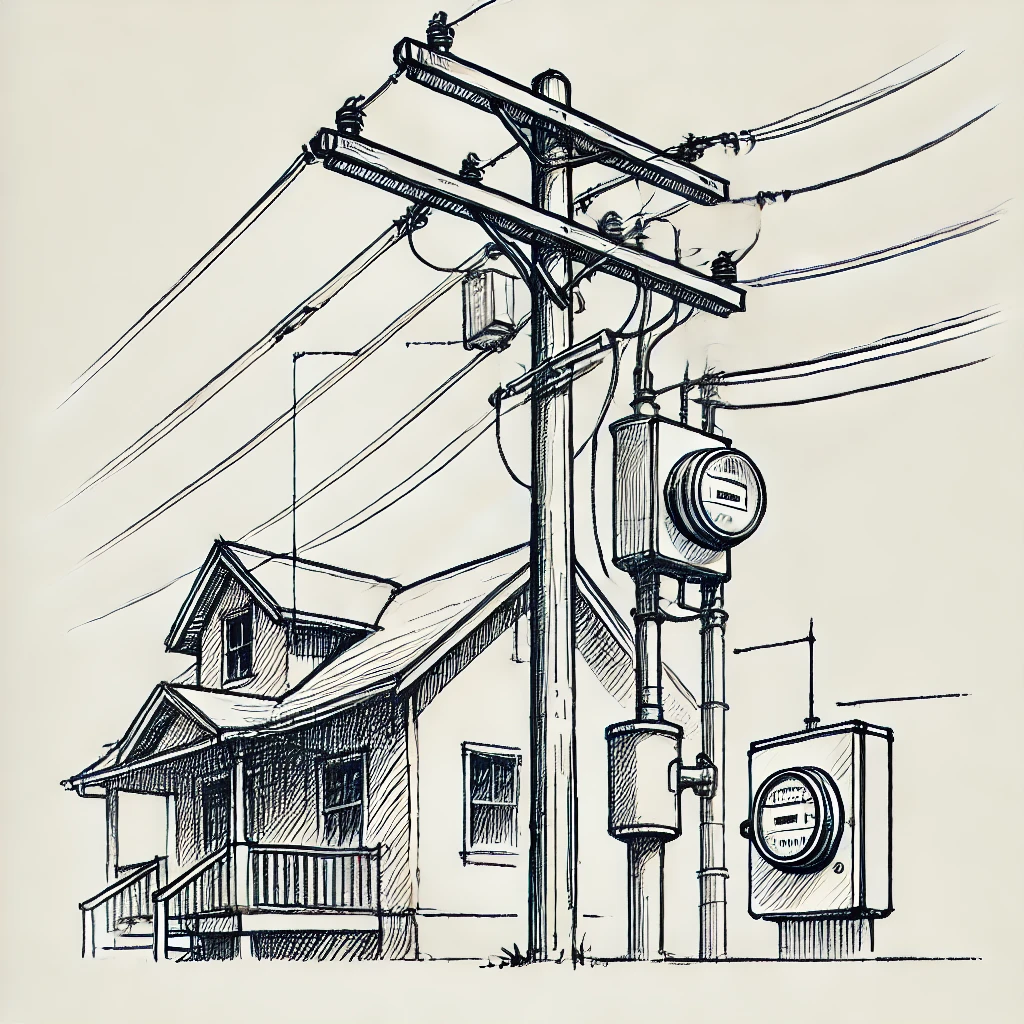

As a small business owner operating from home, the integrity and functionality of your property’s infrastructure are vital to your business operations. One often overlooked aspect of this infrastructure is the network of service lines—such as water, sewer, gas, and electrical lines—that connect your property to the broader utility networks. These service lines are crucial for maintaining your business activities, yet damage to them is typically not covered by standard homeowners insurance policies. Service Line Coverage endorsements can provide essential protection for these vital connections.

This detailed guide will explain what Service Line Coverage endorsements are, how they work, and provide specific examples to help small business homeowners understand their importance and application.

What is Service Line Coverage?

Service Line Coverage is an Endorsement that can be added to your homeowners insurance policy to cover the costs associated with the repair or replacement of damaged service lines on your property. This includes underground utility lines that connect your home to municipal services, such as water, sewer, electrical, gas, and internet lines. Without this coverage, homeowners are typically responsible for the full cost of repairing or replacing these lines if they are damaged due to events like wear and tear, root intrusion, or ground movement.

Why You Might Need Service Line Coverage

Service line failures can be costly and disruptive, especially if you rely on your home’s infrastructure to support your business activities. For instance, a damaged sewer line could lead to a major disruption in your business operations, or a severed electrical line could result in a complete loss of power. Standard homeowners insurance policies do not usually cover the cost of repairing or replacing damaged service lines, which means you could be left with a significant financial burden.

Adding a Service Line Coverage endorsement ensures that you are protected against these unexpected and potentially expensive repairs.

Key Components of Service Line Coverage

1. Coverage for Repair or Replacement of Service Lines

What It Is: This coverage reimburses you for the cost of repairing or replacing damaged service lines on your property. This includes lines for water, sewer, electricity, natural gas, internet, and other utilities that are essential to your business operations.

Example:

If a tree root grows into your sewer line, causing it to break and require replacement, the Service Line Coverage endorsement should cover the cost of replacing the damaged sewer line, which could otherwise cost thousands of dollars.

Action Step: Assess the importance of your service lines to your business operations and consider adding this coverage if a service line failure would significantly impact your business.

2. Coverage for Excavation Costs

What It Is: Repairing or replacing a damaged service line often involves excavation to access the line. This coverage includes the costs associated with digging up the ground to repair or replace the damaged line.

Example:

If your underground water line bursts, and the ground around it needs to be excavated to access and repair the line, the Service Line Coverage endorsement should cover the excavation costs, which can be substantial.

Action Step: Consider the potential costs of excavation in the event of a service line failure and ensure your policy includes sufficient coverage for these expenses.

3. Coverage for Additional Living Expenses

What It Is: If a service line failure renders your home temporarily uninhabitable, this coverage helps pay for additional living expenses (ALE), such as hotel stays, while repairs are being made. This is particularly important if the disruption affects your ability to run your business from home.

Example:

If a gas line break causes your home to be evacuated, making it unsafe to stay, the Service Line Coverage endorsement should cover the cost of staying in a hotel until the gas line is repaired and it’s safe to return home.

Action Step: Evaluate the potential impact of a service line failure on your living situation and business operations, and consider adding ALE coverage if you would need to relocate temporarily.

4. Coverage for Loss of Income

What It Is: Some Service Line Coverage endorsements include coverage for loss of income if your business operations are interrupted due to a service line failure. This coverage ensures that you are compensated for the income you lose during the downtime.

Example:

If a severed electrical line causes a power outage that shuts down your home-based business for several days, the Service Line Coverage endorsement should reimburse you for the income lost during that period.

Action Step: Assess the potential impact of a service line failure on your business income and consider adding this coverage to protect against such risks.

5. Coverage Limits

What It Is: Service Line Coverage endorsements come with specified coverage limits, which is the maximum amount the insurer will pay for a Claim related to damaged service lines. These limits can vary depending on the insurer and the specific endorsement.

Example:

If your policy includes a $10,000 limit for service line coverage and the cost to repair a damaged sewer line is $7,500, your insurance would cover the full amount, up to the $10,000 limit.

Action Step: Review the coverage limits of your endorsement to ensure they meet your needs. Choose limits that provide adequate protection against the potential financial losses you could face from service line repairs.

6. Exclusions and Limitations

What It Is: Like all insurance endorsements, Service Line Coverage may come with exclusions and limitations. Common exclusions might include damage caused by neglect, intentional acts, or pre-existing conditions.

Example:

If you are aware of a service line issue, such as a small leak in a water line, and fail to address it, resulting in significant damage later, your policy may exclude coverage for the repair due to neglect.

Action Step: Carefully review the exclusions and limitations of your endorsement to understand what is and isn’t covered. Ensure your policy aligns with your needs and potential risks.

Specific Examples of How This Coverage Works

Scenario 1: Sewer Line Failure

A sewer line running from your home to the municipal sewer system becomes blocked and eventually collapses due to root intrusion. The line needs to be excavated and replaced, and the total cost for the repairs and excavation is $8,000.

Outcome with Standard Coverage: Without Service Line Coverage, you would be responsible for the full $8,000 cost of repairs, which could significantly impact your finances.

Outcome with Service Line Coverage: With the endorsement, your insurance should cover the full $8,000 cost of repairing and replacing the sewer line, ensuring you are not left with a substantial out-of-pocket Expense.

Scenario 2: Electrical Line Damage

A construction crew accidentally cuts the underground electrical line supplying power to your home-based business, resulting in a power outage and the need for immediate repairs. The total cost to repair the line and restore power is $5,500.

Outcome with Standard Coverage: Without Service Line Coverage, your standard homeowners insurance policy may not cover the cost of repairing the damaged electrical line, leaving you responsible for the full amount.

Outcome with Service Line Coverage: With the endorsement, your insurance should cover the $5,500 cost of repairing the electrical line and restoring power to your business.

Scenario 3: Water Line Burst

An underground water line on your property bursts due to freezing temperatures, causing water to flood your yard and requiring immediate replacement. The total cost for the repair and excavation is $6,000.

Outcome with Standard Coverage: Without Service Line Coverage, you would be responsible for the entire $6,000 cost of repairs and excavation, which could strain your business finances.

Outcome with Service Line Coverage: With the endorsement, your insurance should cover the full $6,000 cost of repairing and replacing the water line, ensuring that your business can continue operating without significant financial disruption.

Loti can help:

We provide a large suite of products and services to help you manage your claims with your insurance carrier for any of the above scenarios.

How to Add This Coverage to Your Policy

Evaluate Your Service Line Risks: Start by assessing the service lines on your property and their importance to your business operations. Consider the potential risks of damage and the costs associated with repairs or replacements.

Contact Your Insurance Agent: Discuss your needs with your insurance agent and ask about adding Service Line Coverage endorsements to your homeowners policy. They can guide you through the process and help you choose the best coverage options.

Review the Endorsement Terms: Once added, carefully review the terms of the endorsement, including coverage limits, exclusions, and any special conditions. Make sure the policy aligns with your needs and potential risks.

Consider Additional Coverage Options: Depending on your property’s specific needs, you may also want to consider other endorsements, such as Flood Insurance or equipment breakdown coverage, to complement your service line protection.

Update Your Coverage as Needed: As your property ages or your business grows, make sure to update your coverage to reflect these changes. Regular reviews of your policy will help ensure you are adequately protected.

Wrap-Up

Service Line Coverage endorsements are an essential addition to your homeowners insurance policy if you rely on the integrity of your property’s infrastructure to support your home-based business. This coverage provides financial protection against the high costs of repairing or replacing damaged service lines, ensuring that your business operations are not disrupted by unexpected failures. By understanding the different aspects of these endorsements and carefully considering your specific needs, you can make informed decisions to protect your business from these risks. Regularly reviewing your policy and adjusting your coverage as needed are key steps in maintaining comprehensive protection.

If you have any questions or need to add this endorsement to your policy, contact your insurance agent for guidance. Properly managing your homeowners insurance with Service Line Coverage provides peace of mind and financial security for your home-based business.