Understanding the Riot and Civil Commotion Peril in Your Homeowners Insurance Policy: A Detailed Guide

In times of social unrest, property damage can occur as a result of riots or civil commotion. Fortunately, most standard homeowners insurance policies include coverage for such events under the riot and civil commotion peril. This peril provides financial protection against damage caused by riots, protests, or other forms of civil disturbance. Understanding how this coverage works, what it includes, and the limitations is crucial for homeowners who want to ensure they are fully protected in the event of such incidents.

This detailed guide will explain what the riot and civil commotion peril is, how it works within a homeowners insurance policy, and provide specific examples to help homeowners understand when and how this coverage might apply.

What Is the Riot and Civil Commotion Peril?

The riot and civil commotion peril in a homeowners insurance policy provides coverage for damage to your property resulting from riots, civil disturbances, or commotions. This peril is designed to cover losses caused by acts of vandalism, looting, fires, or other destructive actions that can occur during riots or protests. It is an essential component of your insurance policy, offering peace of mind in situations of social unrest.

What Does the Riot and Civil Commotion Peril Cover?

The riot and civil commotion peril typically covers the following scenarios:

Damage to the Structure of Your Home: If your home is damaged due to vandalism, arson, or other destructive actions during a riot or civil commotion, this peril would generally cover the cost of repairs.

Damage to Personal Property: Personal belongings inside your home, such as furniture, electronics, clothing, and appliances, are covered if they are damaged or destroyed during a riot.

Damage to Other Structures: This includes damage to garages, sheds, fences, or other structures on your property caused by riot-related activities.

Fire Damage: Fires set intentionally during a riot, whether by individuals or as a result of clashes, are typically covered under this peril.

Vandalism and Graffiti: Acts of vandalism, such as graffiti or the breaking of windows, are also covered.

Looting: If looters enter your home and steal or destroy personal property during a riot or civil commotion, the loss is usually covered.

What Is Not Covered?

While the riot and civil commotion peril provides essential coverage, there are some exclusions and limitations that homeowners should be aware of:

Business Property: If you operate a business out of your home, damage to business property may not be fully covered under a standard homeowners insurance policy. You may need additional business insurance or endorsements.

Vehicles: Damage to vehicles parked on your property during a riot or civil commotion is not typically covered under homeowners insurance. Such damage would be covered under the comprehensive coverage of your auto insurance policy.

Intentional Acts by the Homeowner: If the homeowner is involved in the riot or civil commotion and intentionally causes damage, this may not be covered.

Government Action: Damage caused by government action, such as the seizure or destruction of property by authorities during a state of emergency, may not be covered.

Specific Examples of Riot and Civil Commotion Peril Coverage

1. Fire Damage to a Home During a Riot

Scenario: A homeowner's property is located in an area where a large-scale riot breaks out. During the disturbance, rioters set fire to a building nearby, and the fire spreads to the homeowner's property, causing significant damage to the exterior and interior of the home.

Coverage: The riot and civil commotion peril in the homeowner's insurance policy would cover the cost of repairing the fire damage to the home, including the structure and any personal belongings destroyed in the fire.

Outcome: The homeowner files a Claim and should receive compensation for the cost of repairs and replacements, ensuring that the home is restored to its previous condition.

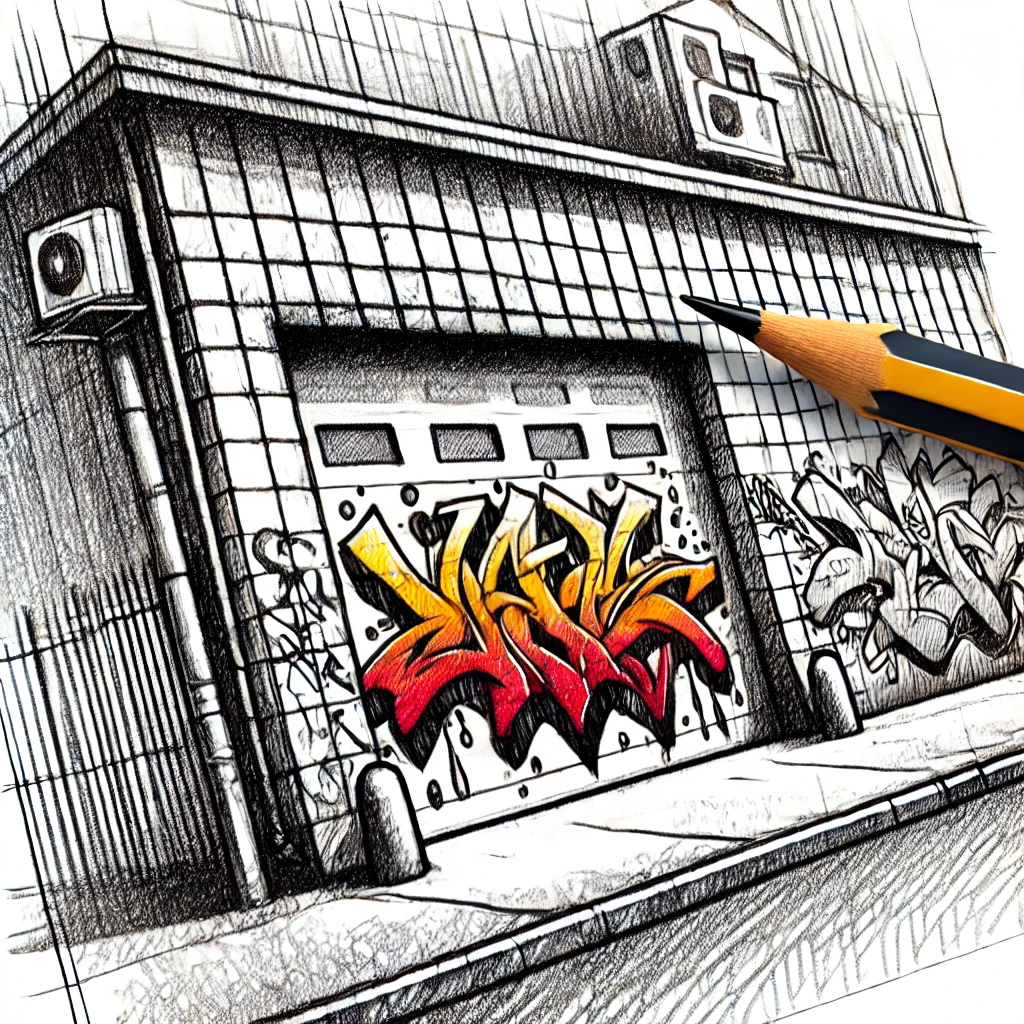

2. Vandalism and Graffiti on a Garage

Scenario: During a civil commotion, vandals spray-paint graffiti on the homeowner's detached garage and break several windows.

Coverage: The riot and civil commotion peril would cover the cost of removing the graffiti, repairing or replacing the broken windows, and restoring the garage to its original condition.

Outcome: The homeowner files a claim and should be reimbursed for the cost of the necessary repairs and cleaning.

3. Looting During a Protest

Scenario: A peaceful protest in a homeowner's neighborhood turns violent, and looters break into the homeowner's house, stealing electronics, jewelry, and other valuable items.

Coverage: The riot and civil commotion peril would cover the cost of replacing the stolen items, as well as repairing any damage caused by the break-in, such as broken doors or windows.

Outcome: The homeowner files a claim and should receive compensation for the stolen items and the repairs needed to secure the home.

4. Damage to a Fence and Landscaping

Scenario: During a civil disturbance, rioters damage the homeowner's fence and landscaping while moving through the neighborhood. They knock over part of the fence and trample plants and shrubs.

Coverage: The riot and civil commotion peril would cover the cost of repairing the fence and replacing the damaged landscaping. However, coverage for landscaping might be limited, depending on the policy.

Outcome: The homeowner files a claim and should be reimbursed for the cost of repairing the fence and restoring the landscaping, subject to any Policy Limits for landscaping.

How to Maximize Your Coverage

1. Review Your Policy’s Coverage Limits

To ensure you have adequate protection in the event of a riot or civil commotion, review your homeowners insurance policy to understand the coverage limits for this peril.

Coverage Limits: Ensure that the policy limits are sufficient to cover the full cost of rebuilding your home and replacing personal property in the event of significant damage.

Exclusions: Be aware of any exclusions, such as damage to business property, vehicles, or landscaping, and consider additional coverage if necessary.

2. Document Your Property

Having detailed documentation of your home and belongings can help support your claim in the event of damage during a riot or civil commotion.

Home Inventory: Create a comprehensive inventory of your personal property, including photos, descriptions, and receipts for high-value items.

Regular Updates: Update your inventory regularly, especially after making significant purchases or home improvements.

3. Secure Your Home

Taking steps to secure your home can help prevent or minimize damage during a riot or civil commotion.

Reinforce Windows and Doors: Consider installing impact-resistant windows, security doors, or shutters to protect against vandalism and break-ins.

Install Security Systems: A home security system with cameras and alarms can deter vandals and looters, and provide evidence if damage occurs.

4. Consider Additional Endorsements

If you have concerns about specific risks that may not be fully covered by your standard policy, consider adding endorsements to enhance your coverage.

Business Property Endorsement: If you operate a home-based business, consider adding an endorsement that covers business property against riot-related damage.

Landscaping Endorsement: If you have valuable landscaping, consider an endorsement that increases coverage for outdoor plants, trees, and structures.

Additional Considerations

1. High-Risk Areas

If your home is located in an area with a history of social unrest or near venues where protests or large gatherings frequently occur, you may be at higher risk for damage from riots or civil commotion.

Increased Risk Areas: Consider the specific risks associated with your location, and take extra precautions to protect your property.

Additional Coverage: Discuss with your insurance agent whether you need additional coverage based on the risk level in your area.

2. Post-Event Safety

After a riot or civil commotion, ensure that your home is safe to enter and assess the damage carefully.

Inspect for Hazards: Check for any structural damage, broken glass, or other hazards before entering your home.

Secure the Property: If necessary, make temporary repairs to secure your property and prevent further damage.

Wrap-Up

The riot and civil commotion peril in homeowners insurance policies provides essential protection against the unexpected and potentially significant damage caused by social unrest. By understanding how this coverage works, reviewing your policy’s limits and exclusions, and taking preventive measures, you can safeguard your home and belongings from the risks associated with riots and civil disturbances.

If you have any questions about your coverage or need to explore additional insurance options, contact your insurance agent for guidance.