Chapter Overview: The Basics of Understanding Your Homeowner’s Insurance Policy

Understanding your Homeowners Insurance policy is crucial for ensuring you have the right coverage and know what to expect in case of a loss. This chapter covers the quick basics to get you started, including:

Declarations Page

What It Is:

The declarations page (often the first page) is a summary of your insurance coverage. It includes key information such as policy number, period, address, premium and coverage limits.

What to Look For:

Verify that all details, like your name, address, and coverage amounts, are accurate.

Check the effective dates to ensure your policy is active.

Types of Coverage

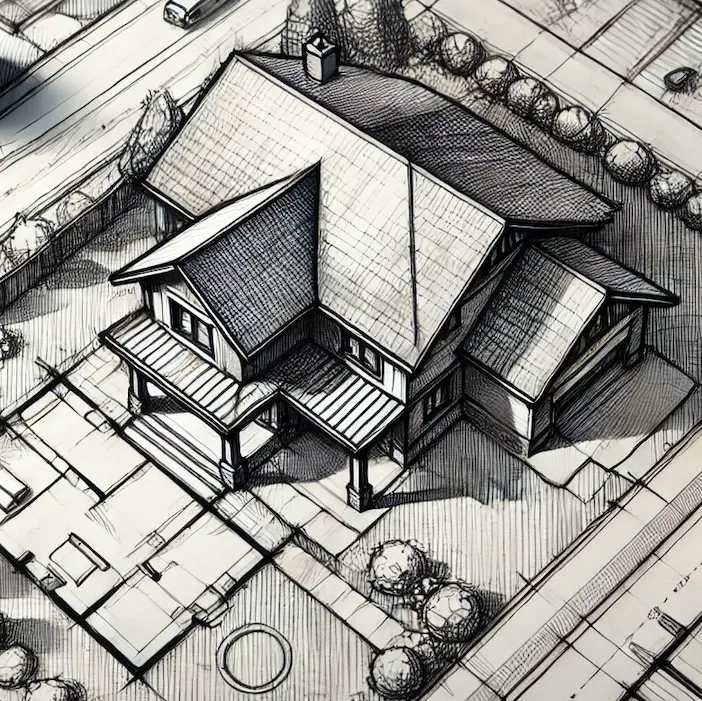

1. Dwelling Coverage (Coverage A):

This covers the structure of your home, including attached structures like garages.

Look for the coverage limit—it should be enough to rebuild your home at current construction costs.

2. Other Structures (Coverage B):

This covers detached structures like sheds, fences, and guest houses.

Typically, this is a percentage of your dwelling coverage, often 10%.

3. Personal Property (Coverage C):

This covers your personal belongings (furniture, electronics, clothing).

Note the coverage amount and whether it’s replacement cost or Actual Cash Value (ACV).

4. Loss of Use (Coverage D):

Covers additional living expenses if you need to live elsewhere while your home is being repaired.

Check the limit and any time restrictions.

5. Personal Liability (Coverage E):

Protects you if you are sued for bodily injury or property damage to others.

Look at the liability limit—common limits are $100,000 to $500,000.

6. Medical Payments to Others (Coverage F):

Pays for medical expenses if someone is injured on your property, regardless of fault.

This is typically a smaller amount, often $1,000 to $5,000.

Learn More

We will dive into each one of these area with their own articles that provide examples, outline industry terminology and more, but first…let’s enjoy a fairy tale…