Understanding Other Structures Increase Endorsements in Your Homeowners Insurance Policy: A Detailed Guide

Homeowners insurance policies are designed to protect not only your home but also other structures on your property, such as detached garages, sheds, fences, and pools. This coverage is typically included under the "Other Structures" provision, also known as Coverage B. However, the standard coverage limit for other structures is often set at a percentage of your dwelling coverage, which may not be sufficient if you have high-value or extensive additional structures on your property. To address this gap, you can add an Other Structures Increase Endorsement to your policy.

This detailed guide will explain what Other Structures Increase endorsements are, how they work, and provide specific examples to help homeowners understand their importance and application.

What is an Other Structures Increase Endorsement?

An Other Structures Increase endorsement is an add-on to your homeowners insurance policy that increases the coverage limit for structures on your property that are not attached to your main dwelling. This endorsement is particularly useful if the standard coverage limit, typically 10% of your dwelling coverage, is insufficient to cover the full value of your additional structures.

Why You Might Need an Other Structures Increase Endorsement

The standard coverage for other structures is often adequate for homeowners with minimal additional structures, such as a small Shed or Fence. However, if you have larger or more valuable structures—such as a detached garage, pool house, Gazebo, or extensive fencing—the standard coverage limit might not be enough to fully repair or replace these structures in the event of a loss.

Key Components of Other Structures Increase Endorsement

1. Increased Coverage Limits

What It Is: The primary function of the endorsement is to increase the coverage limit for other structures on your property. This ensures that in the event of damage or loss, you have sufficient coverage to repair or replace these structures.

Example:

If your dwelling coverage (Coverage A) is $300,000, your standard coverage for other structures would be $30,000 (10% of $300,000). If you have a detached garage and a pool house valued at $50,000, you would be underinsured by $20,000 without the endorsement. By adding an Other Structures Increase endorsement, you can raise your coverage limit to adequately protect these structures.

Action Step: Assess the value of all additional structures on your property to determine if the standard coverage limit is sufficient. If not, consider adding this endorsement to ensure full protection.

2. Types of Structures Covered

What It Is: The endorsement applies to a wide range of structures that are not physically attached to your main home. Common examples include:

Detached garages

Sheds

Gazebos

Fences

Pool houses

Guest houses

Barns

Detached decks or patios

Example:

Suppose you have a large detached garage that serves as a workshop and storage area, valued at $40,000, and a custom-built gazebo worth $15,000. Together, these structures are valued at $55,000. With an endorsement, you can ensure that your policy provides enough coverage to rebuild or repair these structures if they are damaged.

Action Step: Make a detailed list of all other structures on your property, including their estimated value. Compare this total to your current coverage limit and decide if an increase is necessary.

3. How the Endorsement Affects Premiums

What It Is: Adding an Other Structures Increase endorsement to your policy will result in a higher Premium, as you are purchasing additional coverage. However, the cost is typically modest compared to the potential out-of-pocket expenses you could face if your structures are damaged and you are underinsured.

Example:

If increasing your other structures coverage from $30,000 to $60,000 results in an additional $100 per year in premium costs, this increase could save you tens of thousands of dollars in the event of a covered loss.

Action Step: Discuss with your insurance agent how the endorsement will affect your premium and weigh the cost against the benefits of having adequate coverage.

4. Coverage Exclusions and Limitations

What It Is: While the endorsement increases your coverage limit, it’s important to understand that it does not change the types of perils covered or remove any exclusions that apply to other structures under your standard policy.

Example:

If your policy excludes coverage for flood damage and your pool house is damaged in a flood, the increased coverage limit would not apply unless you have a separate Flood Insurance policy.

Action Step: Review your policy’s exclusions and limitations to understand what is and isn’t covered under the Other Structures Increase endorsement. Consider additional policies or endorsements if needed to cover excluded risks.

Specific Examples of How Other Structures Increase Endorsement Works

Scenario 1: Storm Damage to a Detached Garage

A severe windstorm causes a large tree to fall on your detached garage, severely damaging the roof and structure. The estimated cost to repair the garage is $45,000. Your standard coverage limit for other structures is $30,000, based on your dwelling coverage.

Outcome with Standard Coverage: Without the endorsement, you would receive only $30,000 from your insurance, leaving you to cover the remaining $15,000 out of pocket.

Outcome with Other Structures Increase Endorsement: If you had increased your coverage limit to $50,000 with the endorsement, your insurance would cover the full $45,000 repair cost.

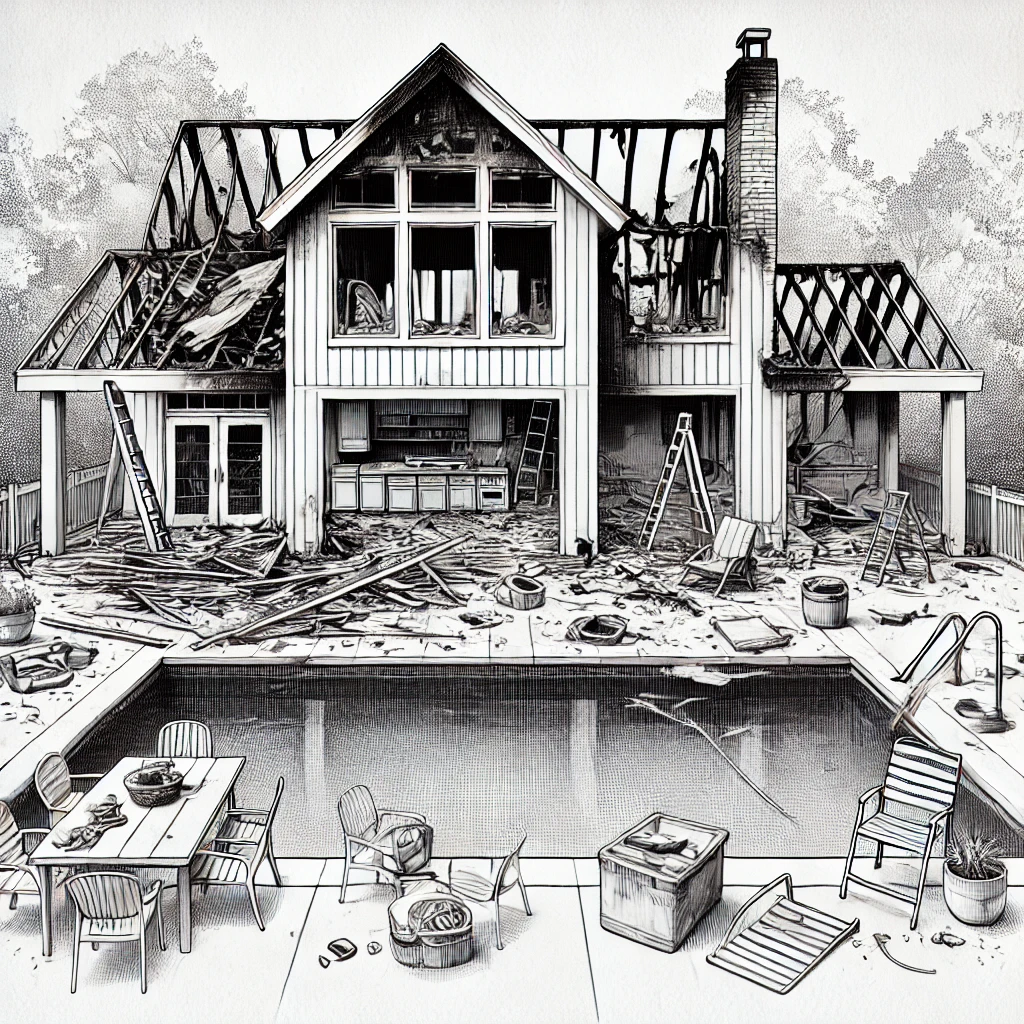

Scenario 2: Fire Damage to a Pool House

A fire breaks out in your pool house, destroying the structure and the equipment stored inside. The total value of the pool house and its contents is $60,000. Your standard coverage limit is $30,000.

Outcome with Standard Coverage: Without the endorsement, your insurance would cover up to $30,000, leaving you to pay the remaining $30,000 out of pocket.

Outcome with Other Structures Increase Endorsement: With an increased coverage limit of $60,000, your policy would cover the full cost of rebuilding the pool house and replacing the damaged contents.

Scenario 3: Fence and Gazebo Damaged by Hail

A severe hailstorm damages your custom-built gazebo and the extensive fencing around your property. The total repair cost is $20,000, but your current coverage limit for other structures is only $15,000.

Outcome with Standard Coverage: Without the endorsement, your insurance would cover $15,000, leaving you responsible for the additional $5,000.

Outcome with Other Structures Increase Endorsement: If you had increased your coverage limit to $25,000, your policy would cover the full cost of repairing the gazebo and fence.

How to Add an Other Structures Increase Endorsement to Your Policy

Evaluate Your Property: Take stock of all the detached structures on your property, including their condition and estimated value. Use this information to determine if your current coverage is adequate.

Contact Your Insurance Agent: Discuss your needs with your insurance agent and inquire about adding an Other Structures Increase endorsement to your policy. They can help you determine the appropriate coverage limit based on the value of your structures.

Review the Endorsement: Once the endorsement is added, review it carefully to ensure it provides the coverage you need. Understand how it affects your premium and whether any additional endorsements or policies are necessary to fully protect your property.

Regularly Update Your Coverage: As you make improvements to your property or add new structures, be sure to update your insurance policy to reflect these changes and ensure continued adequate coverage.

Wrap-Up

An Other Structures Increase endorsement is an important addition to your homeowners insurance policy if you have valuable or extensive detached structures on your property. By increasing your coverage limits, this endorsement ensures that you have sufficient protection in the event of damage or loss, helping you avoid significant out-of-pocket expenses. Regularly reviewing your policy and adjusting your coverage as needed are key steps in maintaining comprehensive protection for your home and other structures.

If you have any questions or need to add this endorsement to your policy, contact your insurance agent for guidance. Properly managing your homeowners insurance with an Other Structures Increase endorsement provides peace of mind and financial security for all aspects of your property.