Chapter Overview: Off Property Damage and Your Homeowners Insurance

Off-property damage refers to situations where you or your family members accidentally cause damage to someone else's property, even when you’re away from your own home. Homeowners insurance policies often include liability coverage that extends to certain off-property incidents, protecting you financially when accidents occur outside your residence.

Understanding common scenarios, the immediate steps to take, and typical expenses associated with off-property damage can help you manage these situations more effectively and ensure a smooth claims process.

Sections in This Chapter

1. Common Incidents

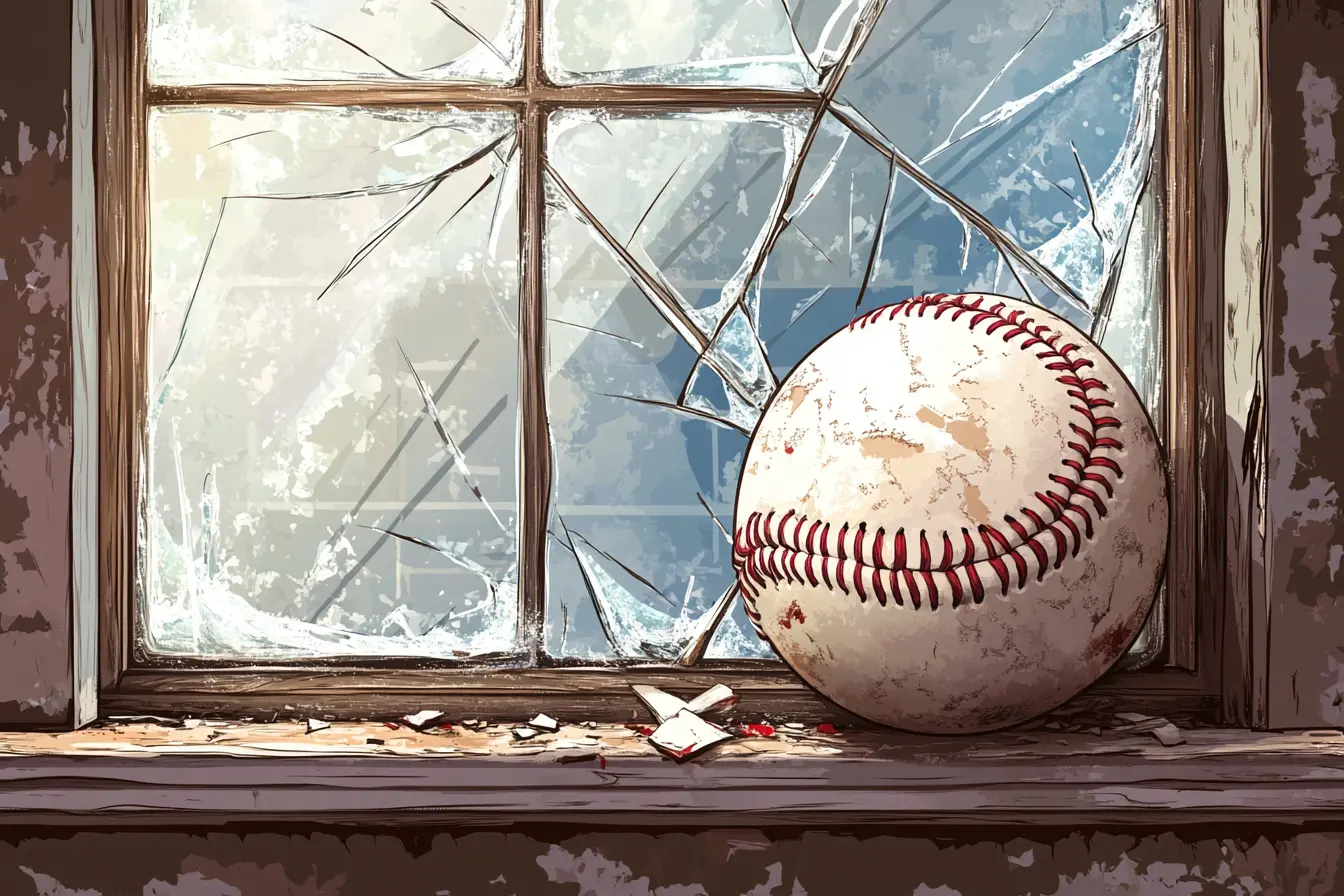

Off-property damage can happen in a variety of situations, from accidentally breaking a neighbor’s window to your child causing damage to someone else’s belongings. This section covers:

Typical Scenarios: Examples of common incidents such as property damage at a neighbor’s house, damage caused by pets, or accidental damage while renting a vacation home.

Unexpected Situations: Discussion of less common scenarios, such as damage caused by your drone or personal belongings.

Risk Prevention Tips: Simple strategies for minimizing the likelihood of accidental off-property damage.

2. First Steps & Process

Knowing the right steps to take immediately after causing off-property damage can help prevent misunderstandings and simplify the claims process. This section covers:

Immediate Actions: Tips for responding promptly, communicating with the property owner, and documenting the incident.

Notifying Your Insurance Company: How to contact your insurer, provide details of the incident, and initiate the claims process.

Working with the Claims Adjuster: Understanding what to expect during the Claim, including providing documentation, assessments, and cooperating with the investigation.

3. Typical Expenses

Off-property damage can result in a range of financial costs, depending on the severity of the incident. This section outlines:

Common Costs: Typical expenses related to property repairs, replacement of damaged items, and any related legal fees.

Insurance Coverage and Limits: Explanation of how homeowners insurance policies cover off-property incidents and what coverage limits may apply.

Out-of-Pocket Considerations: Information on potential gaps in coverage, Deductible considerations, and options for managing uncovered expenses.

Learn More

This chapter provides essential information for homeowners on handling off-property damage incidents, from understanding common scenarios to managing the associated costs. By knowing the first steps to take and what expenses may be involved, you can handle these situations with confidence and work with your insurance provider to ensure a smooth and efficient resolution.

Whether you’re dealing with minor damage or a more serious incident, this chapter equips you with the knowledge needed to protect yourself financially and resolve off-property damage claims effectively.