Chapter Overview of Non-Covered “Perils” in Homeowners Insurance

Understanding Non-Covered Perils

Non-covered perils are specific risks or events that standard homeowners insurance policies typically do not cover. Homeowners need to be aware of these exclusions to avoid unexpected expenses and consider additional coverage where necessary. Some of these aren’t necessarily “perils” from an industry standpoint - like house vacany or wear & tear - but we have included them in this chapter so you have a complete picture of relevant risks.

Common Non-Covered Perils

Earthquakes

What It Is: Damage caused by earthquakes, including shaking, ground rupture, and aftershocks.

Coverage Tip: Earthquake insurance must be purchased separately as an Endorsement or standalone Policy.

Flooding

What It Is: Damage from flooding due to heavy rain, storm surges, overflowing rivers, or other water-related events.

Coverage Tip: Flood Insurance is available through the National Flood Insurance Program (NFIP) or private insurers.

Mold

What It Is: Damage or health issues caused by mold growth, often due to moisture buildup or poor maintenance.

Coverage Tip: Some policies offer limited mold coverage through an endorsement, but significant mold damage is usually excluded.

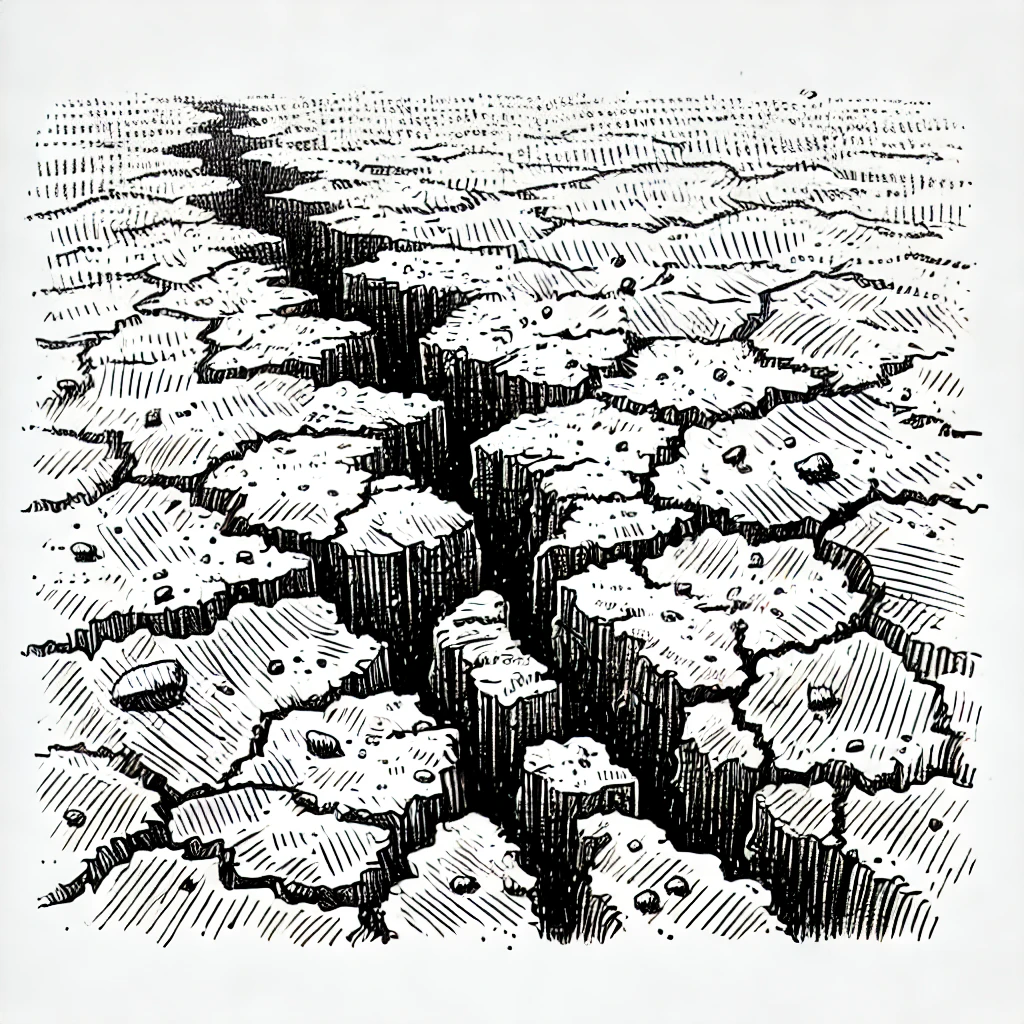

Earth Movement

What It Is: Damage from earth movements, including landslides, mudslides, sinkholes, and other ground shifts.

Coverage Tip: Special endorsements or separate policies are needed for earth movement coverage.

Termites

What It Is: Damage caused by termites, which can weaken the structural integrity of a home over time.

Coverage Tip: Termite damage is considered a maintenance issue and is not covered; regular inspections and treatments are essential.

Rats & Mice

What It Is: Damage caused by rodents, such as chewing through wiring, Insulation, and other materials.

Coverage Tip: Like termite damage, rodent damage is excluded and considered a maintenance responsibility.

Water Damage Caused by Seepage or Leaks

What It Is: Gradual water damage due to continuous seepage, leaks, or poor maintenance.

Coverage Tip: Coverage is typically excluded for slow leaks; only sudden and accidental water damage is covered.

Losses to House Vacant for 60 Days or More

What It Is: Damage to a home that has been unoccupied for 60 days or more, such as theft, vandalism, or burst pipes.

Coverage Tip: Notify your insurer if your home will be vacant for an extended period, and consider adding vacancy coverage.

Wear & Tear or Deferred Maintenance

What It Is: Damage from normal wear and tear or failure to maintain the home, including deterioration, corrosion, and rust.

Coverage Tip: Homeowners are responsible for regular maintenance; insurance does not cover these types of damage.

War

What It Is: Damage caused by acts of war, including military actions and invasions.

Coverage Tip: War-related damage is universally excluded from all insurance policies.

Insurrection

What It Is: Damage resulting from acts of rebellion, revolution, or civil unrest.

Coverage Tip: Similar to war, insurrection is typically excluded from standard policies.

Tidal Wave

What It Is: Damage caused by tidal waves, which can be related to tsunamis or extreme ocean conditions.

Coverage Tip: Coverage for tidal wave damage is generally part of flood insurance, not standard homeowners policies.

Nuclear Hazard

What It Is: Damage caused by nuclear reactions, radiation, or contamination.

Coverage Tip: Nuclear hazards are excluded from coverage, with no option for endorsement due to the catastrophic nature of these events.

Learn More

By being aware of non-covered perils, homeowners can take proactive steps to manage risks and ensure their property is adequately protected. Let’s dive into each of the above and keep learning…