What to Revisit After a Loss or Major Life Change: How insurance needs shift when circumstances change

Insurance rarely stops working because someone made a bad decision.

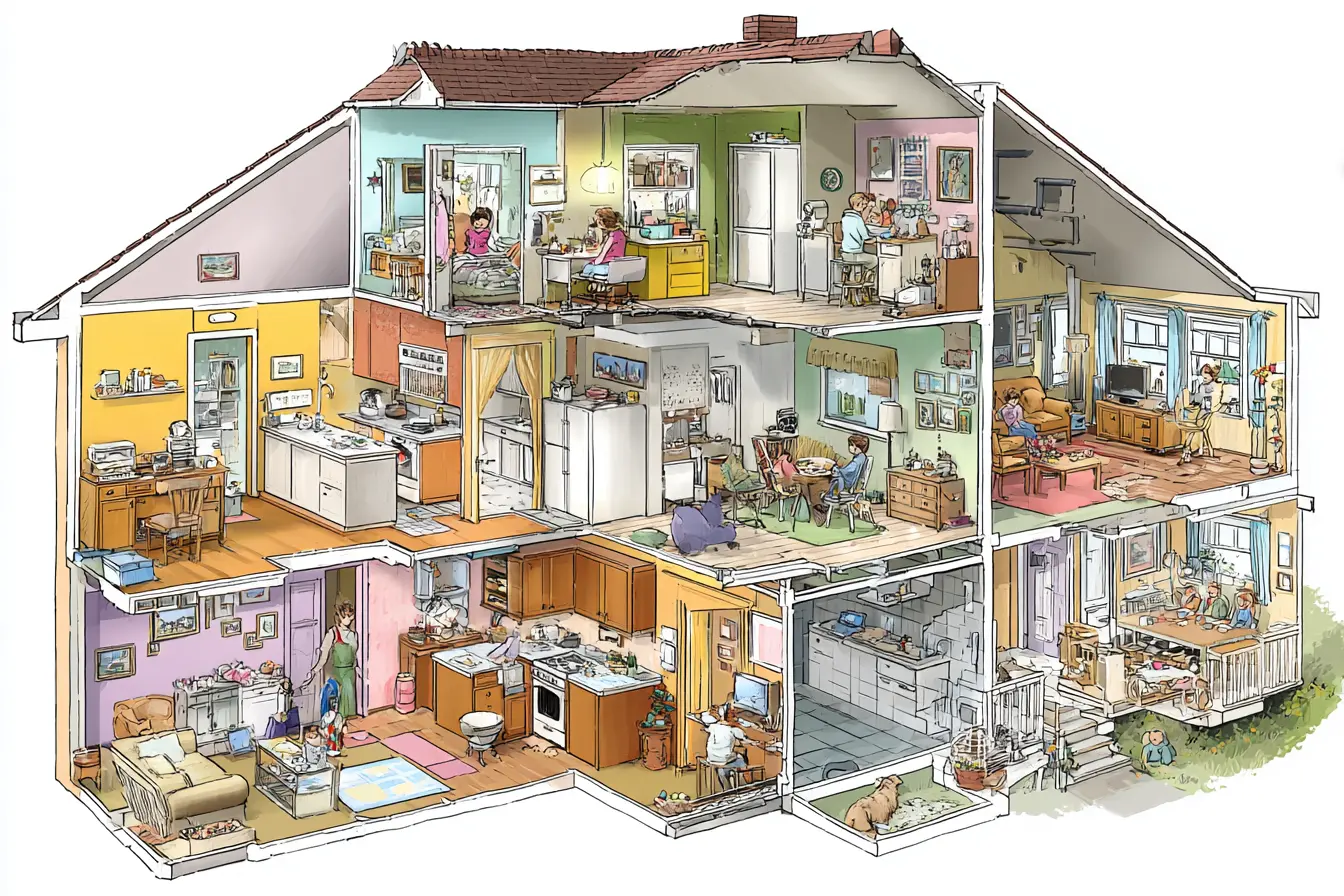

More often, it falls out of alignment because the circumstances it was built around have changed. A loss, a renovation, a move, or a major life shift can quietly alter how a Policy should function, even if nothing feels immediately broken. Once the urgency of the moment passes, it is easy to assume that coverage is settled, when in reality the underlying assumptions may no longer reflect the new reality.

Revisiting insurance after change is less about fixing mistakes and more about recalibrating to where things actually landed.

After a loss, the home is rarely the same as before

When a home is rebuilt or repaired after a loss, it often emerges different than it was going in.

Materials may be upgraded. Layouts may change. Systems may be modernized to meet current codes. Even when the goal is restoration, the end result frequently reflects today’s standards rather than yesterday’s construction. These changes can meaningfully affect rebuild cost going forward, even though they happened in the course of recovery rather than as planned improvements.

Once rebuilding is complete, it is worth stepping back to consider whether dwelling limits, endorsements, and assumptions still reflect the home as it now exists, rather than the version that was originally insured.

Renovations quietly reshape insurance assumptions

Renovations are one of the most common reasons coverage drifts out of alignment, precisely because they are usually positive.

A kitchen update, a bathroom remodel, new flooring, or an addition can all increase complexity and rebuild cost without dramatically changing how the home feels day to day. Because these projects are familiar and incremental, they rarely trigger an insurance review unless someone makes a point of revisiting coverage.

Over time, a policy that once reflected the home accurately may end up anchored to an earlier version, even though the changes were intentional and well planned.

Moves change more than the address

Relocating to a new home or region resets many insurance assumptions at once.

Construction costs, rental markets, building codes, weather exposure, and local labor availability all vary by location. Coverage that worked well in one place may not translate cleanly to another, even if the home itself appears similar on paper.

After a move, reviewing coverage through the lens of local conditions helps ensure that limits and structures are aligned with the new environment rather than inherited from the previous one.

Life changes alter exposure even when the home stays the same

Not all meaningful changes involve construction or relocation.

Growing families, new pets, working from home, rental activity, and accumulating assets all shift exposure in ways that affect personal property and liability coverage. These changes often happen gradually, making them easy to overlook, yet they can significantly influence how a policy should respond if something goes wrong.

Because policies do not automatically adjust for lifestyle, these shifts tend to be where quiet gaps form.

Financial context shapes comfort with risk

Insurance decisions are also shaped by financial circumstances.

Changes in income, savings, long term goals, or responsibilities can alter how much risk feels acceptable. Coverage levels that once felt sufficient may warrant reconsideration as priorities evolve. Revisiting insurance in light of financial context helps keep coverage aligned with what you actually want protected.

This is not about chasing maximum coverage, but about ensuring that limits still reflect your comfort with uncertainty.

Time itself creates distance from original decisions

Even without a defining event, time alone can justify a fresh look.

Details fade. Assumptions are forgotten. Numbers that once felt deliberate quietly become defaults. Periodic reassessment helps surface those inherited choices and evaluate whether they still fit, without requiring constant adjustment.

The goal is awareness, not perpetual change.

Wrap-Up

Losses and life changes reshape insurance needs in ways that are not always obvious in the moment.

Revisiting coverage after these shifts helps realign assumptions with reality and reduces the chance that coverage drifts quietly out of sync. It is not about rewriting a policy after every change, but about recognizing when circumstances have evolved enough to warrant a thoughtful review.

In the final article of this chapter, we will focus on how to move forward without pressure, keeping insurance decisions grounded, intentional, and sustainable over time.