Understanding Water or Steam Seepage or Leakage Coverage Endorsements in Your Homeowners Insurance Policy: A Detailed Guide

Water damage is one of the most common and potentially devastating problems homeowners can face. While standard homeowners insurance policies generally cover sudden and accidental water damage, they often exclude damage caused by slow leaks, seepage, or steam over time. To protect your home from these often-overlooked risks, you may need to add a Water or Steam Seepage or Leakage Coverage Endorsement to your policy.

This detailed guide will explain what Water or Steam Seepage or Leakage Coverage endorsements are, how they work, and provide specific examples to help homeowners understand their importance and application.

What is Water or Steam Seepage or Leakage Coverage?

Water or Steam Seepage or Leakage Coverage is an endorsement that can be added to your homeowners insurance policy to cover damage caused by gradual water or steam leaks. This includes issues like slow leaks from Plumbing, HVAC systems, or appliances, as well as steam that escapes and causes damage over time. Without this endorsement, standard homeowners insurance may not cover these types of damage, leaving homeowners to bear the costs themselves.

Why You Might Need Water or Steam Seepage or Leakage Coverage

Slow leaks and seepage can go unnoticed for weeks, months, or even years, leading to significant damage by the time they are discovered. This type of damage often includes Mold, rot, and structural deterioration, which can be costly to repair. Standard homeowners policies typically exclude coverage for damage caused by slow leaks, seepage, or steam, as these are considered maintenance issues rather than sudden and accidental events.

Adding Water or Steam Seepage or Leakage Coverage ensures that you are protected from the financial burden of repairing this type of damage.

Key Components of Water or Steam Seepage or Leakage Coverage

1. Coverage for Gradual Water Damage

What It Is: This coverage protects against damage caused by water that leaks or seeps slowly over time, such as from a plumbing Fixture, appliance (like a refrigerator), or roof. It covers the cost of repairing the damage to your home and Personal Property.

Example:

If a small, undetected leak from a water heater slowly damages your floor and walls over several months, causing $10,000 in damage, Water or Steam Seepage or Leakage Coverage should help pay for the repairs.

Action Step: Assess the risk of slow leaks in your home, particularly in areas where water lines and appliances are located, and consider adding this coverage if you are concerned about potential damage.

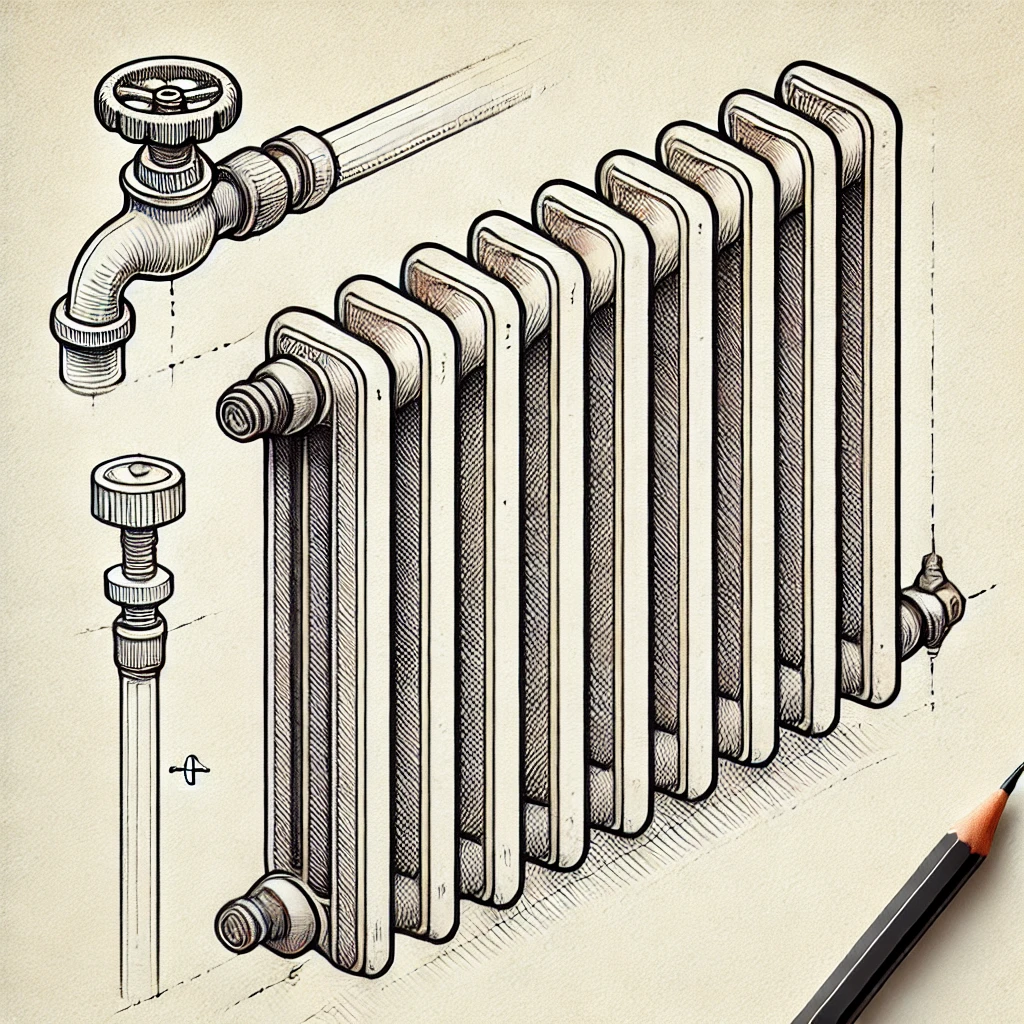

2. Coverage for Steam Damage

What It Is: This coverage protects against damage caused by steam that escapes from a Boiler, radiator, or other heating systems and causes damage over time. This can include damage to walls, ceilings, and personal property.

Example:

If a steam pipe in your basement develops a small crack, releasing steam that causes mold growth and damage to the Drywall over several weeks, Water or Steam Seepage or Leakage Coverage should cover the cost of mold Remediation and repairs.

Action Step: Review the condition of your heating systems and consider adding this coverage if you have older systems prone to steam leaks.

3. Coverage Limits

What It Is: Water or Steam Seepage or Leakage Coverage endorsements typically come with specified coverage limits, which is the maximum amount the insurer will pay for a Claim under this endorsement. These limits can vary depending on the insurer and the specific endorsement.

Example:

If your policy includes a $20,000 limit for water or steam seepage damage and the total repair cost is $25,000, your insurance would cover up to $20,000, leaving you responsible for the remaining $5,000.

Action Step: Review the coverage limits of your endorsement to ensure they meet your needs. Consider the potential costs of water or steam damage and choose limits that provide adequate protection.

4. Exclusions and Limitations

What It Is: Like all insurance endorsements, Water or Steam Seepage or Leakage Coverage may come with exclusions and limitations. Common exclusions may include damage caused by poor maintenance, intentional acts, or certain types of water sources, such as Groundwater or sewer backups (which often require separate endorsements).

Example:

If the damage is found to be caused by a roof leak that was neglected and not repaired in a timely manner, your claim might be denied if your policy excludes coverage for damage due to lack of maintenance.

Action Step: Carefully review the exclusions and limitations of your endorsement to understand what is and isn’t covered. Ensure your policy aligns with your needs and potential risks.

Specific Examples of How Water or Steam Seepage or Leakage Coverage Works

Scenario 1: Slow Leak from a Refrigerator Water Line

A small, undetected leak develops in the water line to your refrigerator, slowly seeping into the flooring and causing significant damage over several months. By the time you discover it, the damage totals $15,000.

Outcome with Standard Coverage: Without Water or Steam Seepage or Leakage Coverage, your standard homeowners insurance policy may not cover the damage, leaving you to pay the full $15,000 out of pocket.

Outcome with Water or Steam Seepage or Leakage Coverage: With the endorsement, your insurance should cover the $15,000 cost of repairs, including replacing the damaged flooring and any other affected areas.

Scenario 2: Steam Damage from a Faulty Radiator

A faulty radiator in your home releases steam into the room, causing mold growth and damage to the Wallpaper and paint. The total cost of remediation and repairs is $8,000.

Outcome with Standard Coverage: Without Water or Steam Seepage or Leakage Coverage, your standard homeowners policy might not cover the damage caused by steam, considering it a maintenance issue.

Outcome with Water or Steam Seepage or Leakage Coverage: With the endorsement, your insurance should cover the $8,000 cost of mold remediation and repairs, ensuring your home is restored to its original condition.

Scenario 3: Seepage from a Basement Pipe

A pipe in your basement develops a slow leak, seeping water into the walls and causing structural damage over several months. By the time you notice the issue, the damage amounts to $25,000.

Outcome with Standard Coverage: Without Water or Steam Seepage or Leakage Coverage, your standard homeowners policy may exclude coverage for damage caused by slow leaks or seepage, leaving you responsible for the full cost of repairs.

Outcome with Water or Steam Seepage or Leakage Coverage: With the endorsement, your insurance should cover the $25,000 cost of repairs, including fixing the leak, replacing damaged walls, and addressing any structural issues.

Loti can help:

We offer tools and support to help you organize your repair expenses and submit documentation to your insurance to help with your claims. These tools make it easy to understand what invoices might still need reimbursement and keeps communications simple and straightforward for your insurance carrier.

How to Add Water or Steam Seepage or Leakage Coverage to Your Policy

Assess Your Risk: Start by evaluating your home for potential risks of slow leaks or steam damage. Pay particular attention to older plumbing systems, appliances with water connections, and heating systems that might release steam.

Contact Your Insurance Agent: Discuss your needs with your insurance agent and ask about adding Water or Steam Seepage or Leakage Coverage to your homeowners policy. They can guide you through the process and help you choose the best coverage options.

Review the Endorsement Terms: Once added, carefully review the terms of the endorsement, including coverage limits, deductibles, exclusions, and any special conditions. Make sure the policy aligns with your needs and potential risks.

Consider Additional Coverage Options: Depending on your situation, you may also want to consider other endorsements, such as sewer backup coverage or Flood Insurance, to complement your Water or Steam Seepage or Leakage Coverage.

Update Your Coverage as Needed: As you make improvements to your home or as plumbing systems age, make sure to update your coverage to reflect these changes. Regular reviews of your policy will help ensure you are adequately protected.

Wrap-Up

Water or Steam Seepage or Leakage Coverage is an essential endorsement for homeowners who want to protect themselves from the potentially significant costs of repairing slow leaks, seepage, and steam damage. This coverage fills a critical gap in standard homeowners insurance policies, providing financial protection against damage that often goes unnoticed until it becomes a major issue. By understanding the different aspects of Water or Steam Seepage or Leakage Coverage and carefully considering your specific needs, you can make informed decisions to protect your home from these risks. Regularly reviewing your policy and adjusting your coverage as needed are key steps in maintaining comprehensive protection.

If you have any questions or need to add this endorsement to your policy, contact your insurance agent for guidance. Properly managing your homeowners insurance with Water or Steam Seepage or Leakage Coverage provides peace of mind and financial security for your home.