Landscaping Related Deductions: A Guide for Homeowners Rebuilding or Repairing Their Home

Landscaping plays a crucial role in the aesthetic appeal, functionality, and overall value of a home. For homeowners rebuilding or repairing their homes after a disaster, restoring or redesigning the landscape can be an integral part of the recovery process. While many may not realize it, there are certain tax deductions and credits that may apply to landscaping expenses, particularly when these improvements are part of a larger renovation project or related to specific needs such as Erosion Control, Energy Efficiency, or medical requirements.

This detailed article explores the potential tax deductions and incentives related to landscaping, provides practical advice on how to take advantage of these opportunities, and includes specific examples and relevant web links for further reading. As always, consult a professional CPA for implementation and further help.

Understanding Landscaping Deductions

Landscaping deductions are not as straightforward as deductions for home improvements, but under certain circumstances, landscaping costs may be deductible as part of larger capital improvements, medical expenses, energy-efficient improvements, or casualty losses. Understanding the criteria and how to document your expenses is key to maximizing your tax benefits.

1. Landscaping as a Capital Improvement

Overview

Landscaping can be considered a capital improvement if it is part of a broader project that adds value to your home, prolongs its useful life, or adapts it to new uses. When landscaping is done as part of a significant renovation or restoration project, it may be added to the cost basis of your home. This can reduce your Capital Gains Tax when you sell the property.

Eligibility

Capital Improvement Projects: Landscaping costs can be included in the cost basis if they are part of a larger capital improvement, such as building an addition, installing a new patio, or restoring the home after a disaster.

Increases Value or Extends Life: The landscaping must add value, prolong the useful life of the property, or adapt the property to a different use.

Documentation: You must keep detailed records of all expenses, including invoices, receipts, and contracts.

How to Claim

Include in Cost Basis: Landscaping expenses should be added to the cost basis of the property. When you sell the property, the increased basis will reduce your taxable gain.

File IRS Form 8949 and Schedule D: When selling your home, use IRS Form 8949 and Schedule D to report the capital gain or loss and to apply the increased basis from landscaping and other capital improvements.

Example

Scenario: A homeowner rebuilds a deck and installs new landscaping, including trees, shrubs, and a Retaining Wall, at a cost of $15,000. These improvements add significant value to the home.

Tax Impact: The $15,000 spent on landscaping is added to the cost basis of the property. If the homeowner later sells the home for $400,000, having a higher cost basis will reduce the taxable gain.

Further Reading

IRS Publication 523: Selling Your Home: IRS Publication 523

2. Landscaping for Medical Reasons

Overview

In certain situations, landscaping expenses may be deductible as medical expenses if the modifications are medically necessary. For example, if you need to install Ramps, pathways, or other accessibility features in your yard for a person with disabilities, these costs may be deductible.

Eligibility

Medically Necessary: The landscaping modifications must be directly related to a medical condition and prescribed by a healthcare provider.

Medical Expense Deduction Threshold: Medical expenses, including eligible landscaping costs, must exceed 7.5% of your Adjusted Gross Income (AGI) to be deductible.

Permanent Improvement: The modification must be a permanent improvement to your property, not just a temporary or cosmetic change.

How to Claim

Itemize Deductions: You must itemize your deductions using Schedule A (Form 1040) to claim medical expenses, including landscaping.

Documentation: Keep all receipts, invoices, and a doctor’s prescription or letter explaining the medical necessity of the landscaping improvements.

Example

Scenario: A homeowner installs a paved pathway and ramp in their garden to provide wheelchair access for a family member with a disability. The total cost of these improvements is $8,000.

Tax Impact: If the homeowner’s total medical expenses, including the landscaping improvements, exceed 7.5% of their AGI, they can deduct the portion of expenses that exceed the threshold as a medical expense on their tax return.

Further Reading

IRS Publication 502: Medical and Dental Expenses: IRS Publication 502

3. Landscaping for Energy Efficiency

Overview

Landscaping can contribute to energy efficiency by reducing heating and cooling costs. For example, strategically planting trees to provide shade or act as windbreaks can lower energy bills. Some of these improvements may qualify for tax deductions or credits as part of energy efficiency programs.

Eligibility

Energy Efficiency Improvements: Landscaping that contributes to energy efficiency, such as planting trees to reduce cooling costs or installing a Green Roof, may be eligible for certain energy efficiency tax credits or rebates.

Documentation: You must document how the landscaping contributes to energy savings and keep records of all related expenses.

How to Claim

File IRS Form 5695: If your landscaping improvements qualify as energy efficiency improvements, you can claim the Residential Energy Credit using IRS Form 5695.

Check State and Local Programs: Some states and local utilities offer additional credits or rebates for energy-efficient landscaping.

Example

Scenario: A homeowner plants Deciduous trees on the south side of their home to provide shade in the summer and reduce air conditioning costs. They spend $3,000 on the trees and planting services.

Tax Impact: If the improvements qualify under energy efficiency guidelines, the homeowner may be able to claim a portion of the expenses as a Tax Credit or take advantage of state and local rebates.

Further Reading

IRS Form 5695: Residential Energy Credits: IRS Form 5695

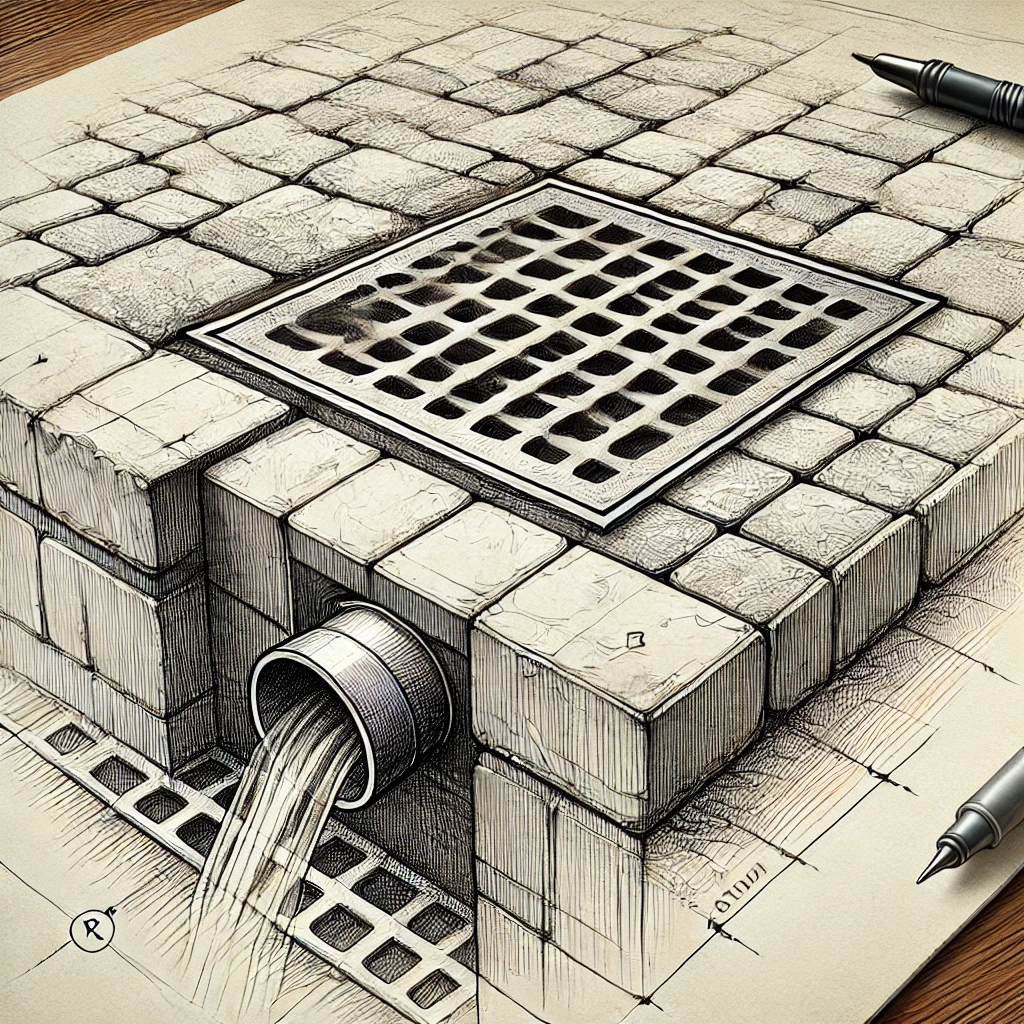

4. Landscaping for Erosion Control and Flood Prevention

Overview

If your property requires landscaping to control erosion or prevent flooding, especially after a disaster, these costs may be deductible as casualty losses. Erosion control measures such as installing retaining walls, terraces, or drainage systems may qualify.

Eligibility

Casualty Losses: The landscaping must be necessary to repair damage from a casualty event, such as a flood, hurricane, or other natural disasters. It must be part of a reasonable effort to prevent further damage to the property.

Unreimbursed Costs: Only the costs not covered by insurance or other reimbursements are deductible.

Threshold Requirements: The total casualty loss must exceed $100 per event, and the total losses must exceed 10% of your AGI after subtracting any insurance reimbursements.

How to Claim

File IRS Form 4684: To claim landscaping expenses as a casualty loss, file IRS Form 4684, "Casualties and Thefts," along with your federal tax return.

Document the Loss: Keep all documentation, including photographs, insurance claims, and receipts for the landscaping work.

Example

Scenario: A homeowner’s property is damaged by a landslide, requiring the installation of retaining walls and regrading to prevent further erosion. The total cost is $20,000, and insurance covers $10,000.

Tax Impact: The homeowner can deduct the remaining $10,000 as a casualty loss, assuming the total losses exceed 10% of their AGI and meet other casualty loss requirements.

Further Reading

IRS Publication 547: Casualties, Disasters, and Thefts: IRS Publication 547

IRS Form 4684: Casualties and Thefts: IRS Form 4684

5. Landscaping for Home Office Use

Overview

If you use part of your home for business purposes and the landscaping is directly related to the business area, such as maintaining a professional appearance for clients or providing necessary outdoor space for a home-based daycare, you may be able to deduct a portion of the landscaping expenses.

Eligibility

Home Office Deduction: The landscaping must be directly related to the business use of your home and be necessary for the operation of the business.

Exclusive Use Requirement: The area must be used exclusively and regularly for business purposes.

How to Claim

File IRS Form 8829: Use IRS Form 8829, "Expenses for Business Use of Your Home," to claim the landscaping expenses related to your home office.

Calculate the Deduction: The deduction is typically based on the percentage of your home used for business purposes.

Example

Scenario: A homeowner operates a home-based daycare and installs a new play area with landscaping to meet state licensing requirements. The total cost is $5,000.

Tax Impact: The homeowner can deduct the $5,000 as part of the home office deduction on their federal tax return, reducing their taxable income.

Further Reading

IRS Publication 587: Business Use of Your Home: IRS Publication 587

IRS Form 8829: Expenses for Business Use of Your Home: IRS Form 8829

Additional Considerations and Tips

Consult a Tax Professional

Seek Expert Advice: Navigating landscaping-related deductions can be complex. A tax professional can help you determine which expenses are deductible and ensure that you maximize your tax benefits while complying with IRS regulations.

Keep Detailed Records

Document Every Expense: Maintain thorough records of all landscaping-related expenses, including receipts, contracts, photographs, and any documentation that supports the eligibility of the deductions or credits.

Understand Local Incentives

Research Local Programs: In addition to federal tax benefits, some local governments and utilities may offer rebates or incentives for landscaping improvements, particularly those related to energy efficiency, water conservation, or environmental restoration.

Consider Long-Term Value

Think Beyond Taxes: While tax deductions and credits can reduce the immediate cost, well-planned landscaping can also increase your property’s value, enhance curb appeal, and improve the overall functionality of your outdoor space.

Loti can help:

In addition to storing documents and photographs for insurance purposes, our services also provide a great place to centralize your information for tax purposes as well.

Wrap-Up

Landscaping can be a significant aspect of rebuilding or repairing a home, especially after a disaster. Understanding the potential tax deductions and credits related to landscaping can help homeowners reduce their out-of-pocket expenses while enhancing their property’s value and functionality.

For more information on landscaping-related deductions and other tax benefits, consider visiting the following resources:

IRS Publication 523: Selling Your Home: IRS Publication 523

IRS Publication 502: Medical and Dental Expenses: IRS Publication 502

IRS Publication 547: Casualties, Disasters, and Thefts: IRS Publication 547

IRS Form 4684: Casualties and Thefts: IRS Form 4684

IRS Publication 587: Business Use of Your Home: IRS Publication 587

These resources can help you better understand and apply for landscaping-related tax deductions, ensuring you maximize your savings and manage your landscaping expenses effectively during the rebuilding process.