Understanding Home Business Exclusions in Your Homeowners Insurance Policy: A Detailed Guide

Running a business from home offers convenience and flexibility, but it also comes with unique risks that may not be covered by your standard homeowners insurance policy. Home business exclusions are specific conditions or activities related to operating a business from your residence that are typically not covered under a standard homeowners insurance policy. Understanding these exclusions is crucial for protecting your home-based business and ensuring that you have the appropriate coverage in place.

This detailed guide will explain what home business exclusions are, how they affect your coverage, and provide specific examples to help homeowners navigate these complexities.

What Are Home Business Exclusions?

Home business exclusions refer to specific activities, equipment, or circumstances related to operating a business from your home that are not covered under a standard homeowners insurance policy. While homeowners insurance is designed to protect your residence and Personal Property, it often excludes or limits coverage for business-related activities and Assets. This can leave your home-based business vulnerable to significant financial losses if you don't have the proper coverage.

Key Home Business Exclusions

1. Limited Coverage for Business Property

What It Is: Standard homeowners insurance policies typically offer limited coverage for business property, such as computers, printers, tools, or inventory. The coverage limit is often significantly lower than what is needed to replace business equipment or stock, and may not cover losses that occur while the property is off-premises (e.g., while you’re traveling for business).

Example:

Scenario: A homeowner runs a graphic design business from home and has $10,000 worth of computer equipment. A fire damages the equipment, but the homeowner’s policy only provides $2,500 in coverage for business property.

Outcome: The homeowner would be underinsured for their business equipment, receiving only $2,500 toward the replacement of the damaged items. To fully protect business property, the homeowner would need to purchase a business property Endorsement or a separate business insurance policy.

Action Step: If you operate a business from your home, assess the value of your business property and consider adding a business property endorsement or a separate business insurance policy to ensure full coverage.

2. Liability Exclusion for Business Activities

What It Is: Homeowners insurance policies generally exclude liability coverage for injuries or damages related to business activities conducted on the premises. This means that if a client or customer is injured while visiting your home office, or if your business activities cause damage to someone else’s property, your homeowners insurance may not cover the resulting claims or legal expenses.

Example:

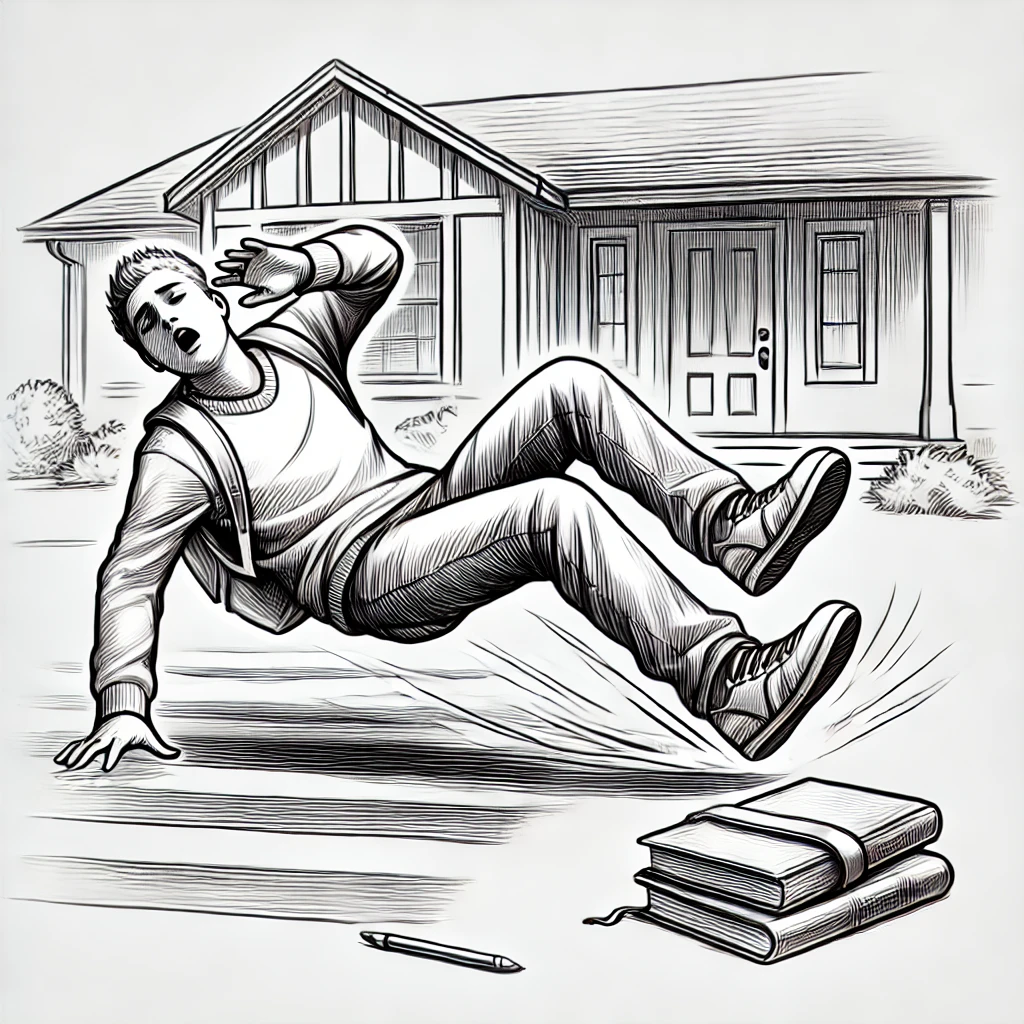

Scenario: A homeowner offers piano lessons from their home. A student slips on the Driveway and sustains an injury. The homeowner’s insurance policy excludes liability coverage for business activities, leaving the homeowner responsible for medical expenses and potential legal costs.

Outcome: The homeowner would be responsible for covering the student’s medical bills and any legal expenses out of pocket. To protect against these risks, the homeowner would need a home business liability endorsement or a separate business liability insurance policy.

Action Step: If clients, customers, or other business-related visitors come to your home, consider purchasing a home business liability endorsement or a business liability insurance policy to protect against potential lawsuits and medical expenses.

3. Exclusion for Loss of Income Due to Business Interruptions

What It Is: Standard homeowners insurance policies do not cover loss of income resulting from a Business Interruption, such as a fire or natural disaster that forces you to temporarily close or relocate your home-based business. Without proper coverage, you could face significant financial losses if your business is unable to operate.

Example:

Scenario: A storm causes significant damage to a homeowner’s property, making it impossible to continue operating their home-based bakery. The homeowner loses income during the weeks it takes to repair the damage.

Outcome: Because loss of income due to business interruption is excluded from the homeowner’s policy, the homeowner would need a business interruption insurance policy to cover the lost income during the downtime.

Action Step: If your home-based business is a primary source of income, consider purchasing business interruption insurance to protect against financial losses caused by unforeseen events that temporarily halt your operations.

4. Exclusion for Professional Liability

What It Is: Professional liability, also known as errors and omissions (E&O) insurance, is typically excluded from homeowners insurance policies. This type of coverage is crucial for businesses that provide professional services or advice, as it protects against claims of Negligence, mistakes, or failure to perform services.

Example:

Scenario: A homeowner operates a home-based consulting business. A client sues for alleged negligence after following the homeowner’s advice, which led to financial losses.

Outcome: Because professional liability is excluded from the homeowner’s insurance policy, the homeowner would need a professional liability insurance policy to cover legal defense costs and any settlements or judgments.

Action Step: If you provide professional services or advice from your home, consider purchasing professional liability insurance to protect against claims of negligence or errors in your work.

5. Exclusion for Inventory and Goods

What It Is: Homeowners insurance policies generally exclude or severely limit coverage for inventory or goods intended for sale or distribution. If you run a home-based retail business or sell products, losses related to inventory, such as theft or damage, may not be covered under your standard policy.

Example:

Scenario: A homeowner operates an online store from their home and keeps $15,000 worth of inventory in their basement. A burst pipe floods the basement, damaging the inventory. The homeowner’s policy only covers $1,000 for business inventory.

Outcome: The homeowner would be significantly underinsured for their inventory, receiving only $1,000 towards replacing the damaged goods. To protect their inventory, the homeowner would need a business inventory endorsement or a commercial insurance policy.

Action Step: If you store inventory or goods for sale in your home, assess the value and consider adding a business inventory endorsement or a separate commercial insurance policy to ensure adequate protection.

6. Exclusion for Business Vehicles

What It Is: If you use a vehicle primarily for business purposes, it may not be covered under your personal auto insurance or homeowners insurance. Business-related use often requires commercial auto insurance, especially if the vehicle is essential to your operations.

Example:

Scenario: A homeowner uses their personal vehicle to deliver products for their home-based business. The vehicle is involved in an accident while making deliveries, and the personal auto insurance policy excludes coverage for business use.

Outcome: The homeowner would need to cover the costs of repairs and liability out of pocket unless they have a commercial auto insurance policy that covers business-related driving.

Action Step: If you use a vehicle for business purposes, consult with your insurance provider to determine whether you need a commercial auto insurance policy to cover business-related activities.

Managing Home Business Risks and Exclusions

1. Assess Your Business Needs and Risks

Start by evaluating the specific needs and risks of your home-based business. Consider the value of your business property, the potential for liability claims, and the impact of business interruptions on your income.

Inventory Assessment: Make a list of all business-related property, including equipment, inventory, and supplies, and determine their value.

Risk Evaluation: Identify potential risks, such as liability from client visits, professional liability claims, and the impact of a business interruption.

2. Purchase the Right Insurance Coverage

Once you’ve assessed your business needs and risks, consider purchasing additional coverage or endorsements to fill the gaps in your homeowners insurance.

Home Business Endorsement: Increases coverage limits for business property and liability, and may include coverage for business interruptions.

Commercial Insurance Policy: Provides comprehensive coverage for business property, liability, and interruptions, and is especially important for larger home-based businesses.

Professional Liability Insurance: Covers claims of negligence or errors in professional services, protecting you from costly lawsuits.

3. Regularly Review and Update Your Policy

As your home-based business grows, your insurance needs may change. Regularly review your insurance coverage to ensure it remains adequate for your evolving business.

Annual Review: Conduct an annual review of your insurance policies to assess whether your coverage limits and endorsements are still sufficient.

Policy Adjustments: Make necessary adjustments to your coverage as your business expands or changes, such as adding new equipment, inventory, or services.

4. Consult with an Insurance Professional

If you’re unsure about your insurance needs or how to address specific exclusions, consult with an insurance professional who specializes in home-based businesses.

Expert Advice: An insurance agent can help you identify the right coverage options based on your specific business activities and risks.

Tailored Policies: Work with your insurance provider to tailor your coverage to your business’s unique needs, ensuring comprehensive protection.

Wrap-Up

Home business exclusions in homeowners insurance policies can leave you vulnerable to significant financial losses if you're not adequately prepared. By understanding these exclusions, assessing your business risks, and purchasing the appropriate coverage, you can protect your home-based business and ensure its long-term success.

Properly managing your homeowners insurance with a focus on home business-related risks provides peace of mind and financial security, allowing you to focus on growing your business. If you have any questions about your coverage or need to explore additional insurance options, contact your insurance agent for guidance.