Understanding Functional Replacement Cost Loss Settlement Coverage Endorsements in Your Homeowners Insurance Policy: A Detailed Guide

When you insure your home, one of the key considerations is how your insurance policy will cover the cost of repairs or rebuilding after a loss. Traditional replacement cost coverage pays to replace or repair your home with materials of "like kind and quality." However, for older homes or those with unique features, rebuilding exactly as before might not be practical or affordable. This is where a Functional Replacement Cost Loss Settlement endorsement comes into play.

This detailed guide will explain what Functional Replacement Cost Loss Settlement coverage is, how it works, and provide specific examples to help homeowners understand its importance and application.

What is Functional Replacement Cost Loss Settlement Coverage?

Functional Replacement Cost Loss Settlement is an endorsement that can be added to your homeowners insurance policy. Instead of covering the cost to rebuild or repair your home with exactly the same materials and design, it pays to restore your home using modern, cost-effective materials that perform the same function. This type of coverage is often used for older homes where original materials may be outdated, hard to find, or prohibitively expensive.

Why You Might Need Functional Replacement Cost Coverage

For homeowners with older properties, rebuilding with the original materials and craftsmanship can be extremely costly or even impossible if those materials are no longer available. Functional Replacement Cost coverage offers a more affordable alternative by allowing for the use of modern materials that are less expensive but still restore the home to a similar level of functionality and appearance. This option can also be beneficial for those who want to keep insurance costs lower while still maintaining adequate coverage.

Key Components of Functional Replacement Cost Coverage

1. Coverage for Cost-Effective Materials

What It Is: Functional Replacement Cost Coverage pays to replace damaged or destroyed parts of your home with modern, cost-effective materials that serve the same function as the original materials but may not be exact matches.

Example:

If a fire destroys the Plaster walls in your century-old home, traditional replacement cost coverage might require that the walls be rebuilt with plaster, which can be expensive and difficult to find. With Functional Replacement Cost coverage, the walls could be rebuilt using modern Drywall, which is more affordable and readily available, while still providing the same functionality.

Action Step: Evaluate the materials used in your home, especially if it’s an older property. If you’re concerned about the cost of replacing these materials, consider adding this endorsement to your policy.

2. Lower Insurance Premiums

What It Is: Because Functional Replacement Cost coverage uses modern materials that are generally less expensive than traditional or original materials, this type of endorsement can help lower your insurance premiums compared to standard replacement cost coverage.

Example:

If you own a home with custom woodwork and detailed moldings, insuring it for exact replacement could be costly. By opting for Functional Replacement Cost coverage, which would allow for simpler, less expensive woodwork that still maintains the home's integrity, you could lower your insurance premiums.

Action Step: Discuss with your insurance agent the potential cost savings of switching to or adding Functional Replacement Cost coverage, especially if you’re looking for ways to manage your insurance expenses.

3. Focus on Functionality

What It Is: The core principle of Functional Replacement Cost coverage is that it focuses on restoring the functionality and livability of your home, rather than replicating exact historical or architectural details.

Example:

If a storm damages the Slate roof on your older home, replacing it with new slate could be very expensive. With Functional Replacement Cost coverage, your insurance would pay to replace the slate roof with modern Asphalt Shingles that perform the same function of protecting your home from the elements, even though they do not replicate the original appearance.

Action Step: Consider whether you prioritize functionality over exact historical replication. If so, this endorsement may be a good fit for your needs.

4. Applicability to Historic and Older Homes

What It Is: Functional Replacement Cost coverage is particularly useful for historic and older homes where original materials are either no longer available or prohibitively expensive. It allows homeowners to maintain the integrity and value of their property without the financial burden of using rare or custom materials.

Example:

If your home was built in the 1920s with original Hardwood floors that are damaged in a flood, replacing them with the exact type of wood might be difficult or costly. Functional Replacement Cost coverage would allow you to replace the floors with modern, Engineered Wood that looks similar but is more affordable and easier to install.

Action Step: If you own a historic home, discuss with your insurance agent how Functional Replacement Cost coverage can be tailored to protect your home while managing costs.

5. Coverage Limits and Policy Terms

What It Is: As with any insurance endorsement, Functional Replacement Cost coverage comes with its own set of limits and terms. It’s important to understand how these limits apply to your overall policy and how claims will be settled under this endorsement.

Example:

If your policy’s dwelling coverage limit is $300,000 and you opt for Functional Replacement Cost coverage, the insurance company will cover the cost of repairs or rebuilding using modern materials up to the coverage limit. However, if the cost of using original materials would exceed this limit, the endorsement ensures that you can still rebuild within the policy limit by using more affordable alternatives.

Action Step: Review your Policy Limits and discuss with your agent how the Functional Replacement Cost endorsement integrates with your overall coverage. Ensure that the coverage limit is sufficient to restore your home using modern materials.

Specific Examples of How Functional Replacement Cost Coverage Works

Scenario 1: Fire Damage to an Older Home

A fire damages the original wooden beams in the Ceiling of your early 1900s home. The cost to replace these beams with identical wood is extremely high, as the wood is rare and requires specialized labor.

Outcome with Standard Replacement Cost: Without the endorsement, you might be required to use the same type of wood and craftsmanship, leading to higher costs that could exceed your coverage limit or force you to pay out of pocket.

Outcome with Functional Replacement Cost Coverage: The endorsement would allow you to replace the beams with modern materials like engineered wood or Steel beams, which are more affordable and widely available. This option keeps the repair within your policy limits and restores the home’s structural integrity.

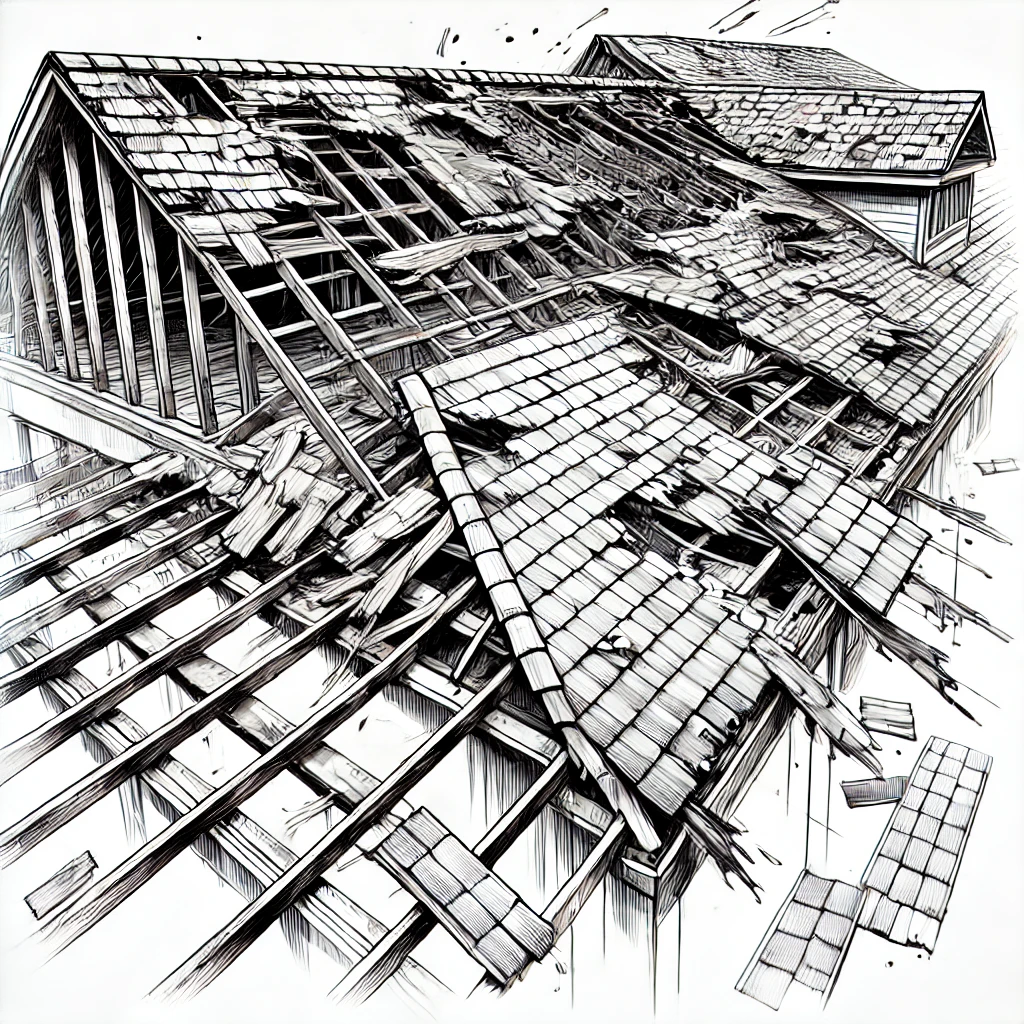

Scenario 2: Storm Damage to Windows and Roof

A severe storm shatters the original stained glass windows and damages the Clay Tile roof of your historic home. Replacing these features exactly as they were would be very expensive.

Outcome with Standard Replacement Cost: Traditional replacement might require custom work to replicate the original windows and roof, potentially leading to high costs and delays.

Outcome with Functional Replacement Cost Coverage: Your insurance would cover the cost to install modern windows that maintain a similar aesthetic but are more cost-effective and a modern roofing material that provides the same protection without the high cost of Clay tiles.

Scenario 3: Water Damage to Plaster Walls

A burst pipe causes significant water damage to the original plaster walls in your home, built in the 1800s. Restoring the plaster to its original condition would require specialized skills and materials, making it very costly.

Outcome with Standard Replacement Cost: You might need to hire specialists to restore the plaster, leading to high expenses.

Outcome with Functional Replacement Cost Coverage: The endorsement would cover the cost to replace the plaster with modern drywall, which is more affordable and easier to install, while still maintaining the home’s appearance and functionality.

How to Add Functional Replacement Cost Coverage to Your Policy

Evaluate Your Home’s Materials: Take inventory of the materials used in your home, especially if it’s an older or historic property. Consider the cost and availability of these materials in the event of a loss.

Contact Your Insurance Agent: Discuss with your insurance agent the benefits of adding Functional Replacement Cost coverage to your policy. They can help you understand the potential savings and the coverage options available.

Review the Endorsement Terms: Once the endorsement is added, review the terms carefully, including how claims will be settled and any limitations or exclusions that apply. Make sure you’re comfortable with the use of modern materials in place of originals.

Consider Your Priorities: Decide whether maintaining the exact historical accuracy of your home is more important than managing insurance costs. If functionality and affordability are your priorities, this endorsement may be a good fit.

Update Your Coverage as Needed: As your home ages or if you make updates or renovations, be sure to review your insurance coverage to ensure it still meets your needs. Adjust your policy or endorsement as necessary to reflect any changes.

Wrap-Up

Functional Replacement Cost Loss Settlement coverage is a valuable endorsement for homeowners with older or historic homes who want to ensure their property can be restored after a loss without incurring prohibitively high costs. By allowing the use of modern, cost-effective materials, this coverage provides a practical solution for maintaining the integrity and livability of your home while keeping insurance costs manageable. Regularly reviewing your policy and adjusting your coverage as needed are key steps in ensuring comprehensive protection for your home.

If you have any questions or need to add this endorsement to your policy, contact your insurance agent for guidance. Properly managing your homeowners insurance with Functional Replacement Cost coverage can provide peace of mind and financial security, especially for owners of older properties.