Understanding the Freezing Peril in Your Homeowners Insurance Policy: A Detailed Guide

Freezing temperatures can cause significant damage to your home, particularly if water pipes burst or heating systems fail. Fortunately, the freezing peril is typically covered under most standard homeowners insurance policies. This peril provides coverage for damage caused by freezing temperatures, but there are specific conditions and exclusions that homeowners need to understand to ensure they are fully protected.

This detailed guide will explain what the freezing peril is, how it works within a homeowners insurance policy, and provide specific examples to help homeowners understand when and how this coverage might apply.

What Is the Freezing Peril?

The freezing peril refers to coverage within a homeowners insurance policy that protects against damage caused by freezing temperatures. This typically includes damage to Plumbing, heating, air conditioning systems, and appliances that use water. The freezing peril is especially important in regions that experience harsh winters, where the risk of pipes freezing and bursting is high.

What Does the Freezing Peril Cover?

The freezing peril generally covers the following scenarios:

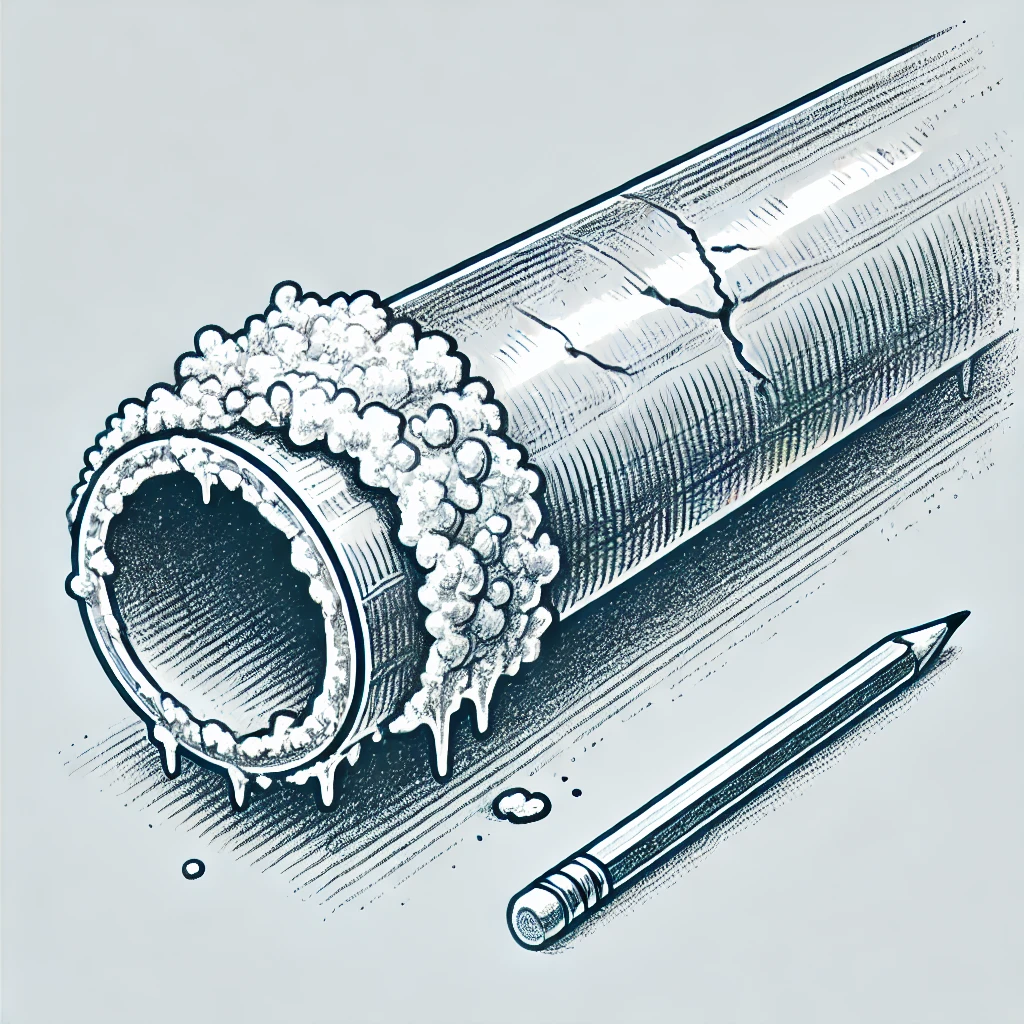

Burst Pipes: If the water in your plumbing pipes freezes, expands, and causes the pipes to burst, the resulting water damage to your home is typically covered.

Damage to Heating Systems: If a heating system fails due to freezing temperatures, and this leads to further damage (such as pipes freezing), the repairs for both the system and any related damage are usually covered.

Frozen Appliances: If appliances like water heaters, refrigerators with water lines, or washing machines suffer damage due to freezing, the repairs or replacement may be covered.

Damage to Other Systems: HVAC systems, sprinkler systems, and other home systems that use water and are damaged by freezing temperatures may also be covered under this peril.

What Is Not Covered?

While the freezing peril provides essential coverage, there are conditions and exclusions that may apply:

Neglect or Lack of Maintenance: If the homeowner failed to maintain adequate heat in the home or did not properly winterize the property, the damage may not be covered. Insurers often require that reasonable care is taken to prevent freezing.

Unoccupied or Vacant Homes: If the home is left unoccupied or vacant without proper precautions (like maintaining heat or draining water systems), coverage may be denied.

Exterior Property: Damage to exterior property, such as outdoor pipes or irrigation systems, might not be covered unless specific endorsements are in place.

Wear and Tear: If the damage is due to wear and tear or an existing issue that was not addressed, it may not be covered.

Specific Examples of Freezing Peril Coverage

1. Burst Pipes in an Occupied Home

Scenario: A homeowner experiences a cold snap during the winter. Despite maintaining the heat in their home, a pipe in an unheated area of the basement freezes and bursts, causing significant water damage to the basement flooring and walls.

Coverage: The freezing peril in the homeowner’s insurance policy would cover the cost of repairing the burst pipe and the water damage to the basement. The homeowner took reasonable steps to maintain heat, so the damage would be covered.

Outcome: The homeowner files a Claim and should receive compensation for the necessary repairs to the basement and plumbing system.

2. Frozen Pipes in an Unoccupied Vacation Home

Scenario: A homeowner has a vacation home in a cold climate. They leave the property for several months during the winter without turning off the Water Supply or properly winterizing the home. A pipe freezes and bursts, flooding the home and causing extensive damage.

Coverage: Since the homeowner did not take reasonable precautions to prevent the pipes from freezing, the damage may not be covered under the freezing peril. Insurance policies typically require that heat be maintained or the home be properly winterized when unoccupied.

Outcome: The homeowner’s claim could be denied due to neglect, leaving them responsible for the full cost of repairs.

3. Frozen Water Heater

Scenario: A homeowner’s water heater is located in an unheated garage. During an unusually cold winter, the water in the heater freezes, causing the unit to crack and leak.

Coverage: The freezing peril would likely cover the damage to the water heater and any resulting water damage in the garage, provided the homeowner took reasonable precautions to prevent freezing.

Outcome: The homeowner files a claim and should be reimbursed for the cost of repairing or replacing the water heater and fixing any water damage in the garage.

4. Damage to a Sprinkler System

Scenario: A homeowner forgets to drain the water from their in-ground sprinkler system before winter. The water freezes, causing the pipes to burst and damage the system.

Coverage: The freezing peril typically does not cover damage to outdoor systems like sprinklers unless specific endorsements are in place. The homeowner may need to pay for repairs out of pocket.

Outcome: The homeowner’s claim might be denied due to the Exclusion of exterior systems from standard coverage.

How to Maximize Your Coverage

1. Maintain Adequate Heat in Your Home

One of the most important steps to ensure your home is protected from freezing damage is to maintain adequate heat, especially in colder areas of the home like basements and garages.

Thermostat Settings: Keep your home’s thermostat set at a temperature that prevents pipes from freezing, even if you are away from home.

Insulate Pipes: Insulate pipes in unheated areas to reduce the risk of freezing.

2. Winterize Unoccupied Homes

If you plan to leave your home unoccupied during the winter, take steps to properly winterize the property.

Turn Off Water Supply: Shut off the main water supply and drain pipes and appliances to prevent water from freezing inside them.

Use Antifreeze: In plumbing systems that cannot be drained, consider using antifreeze solutions to protect against freezing.

3. Understand Your Policy’s Coverage Conditions

Review your homeowners insurance policy to understand the specific conditions and exclusions related to the freezing peril.

Occupied vs. Unoccupied Coverage: Be aware of the difference in coverage between occupied and unoccupied homes, and take the necessary precautions if you plan to leave your home vacant.

Exterior System Exclusions: Know what exterior systems are excluded from coverage, and consider additional endorsements if needed.

4. Regular Maintenance

Perform regular maintenance on your heating and plumbing systems to ensure they are in good working order and less likely to fail during a freeze.

Annual Inspections: Have your heating and plumbing systems inspected annually by a professional to catch any potential issues before they become serious.

Repairs: Address any small problems as soon as they are detected to prevent them from leading to larger, more expensive repairs.

Additional Considerations

1. Region-Specific Risks

If you live in a region with harsh winters, you may face a higher risk of freezing-related damage.

Increased Risk Areas: Consider the specific risks associated with your region’s climate, and take extra precautions to protect your home from freezing temperatures.

Additional Coverage: Discuss with your insurance agent whether you need additional coverage based on the climate in your area.

2. Vacant Homes

Homes left vacant for long periods are particularly vulnerable to freezing damage. Ensure that you take the necessary steps to maintain coverage.

Vacancy Permit: If your home will be vacant for an extended period, consider obtaining a vacancy permit or Endorsement to maintain coverage.

Winter Watch: Arrange for a neighbor, friend, or professional service to check on the home regularly during the winter.

Wrap-Up

The freezing peril in homeowners insurance policies provides essential protection against the damage that freezing temperatures can cause to your home and its systems. By understanding how this coverage works, taking appropriate precautions, and being prepared to file a claim if necessary, you can safeguard your home against the risks associated with freezing temperatures.

If you have any questions about your coverage or need to explore additional insurance options, contact your insurance agent for guidance.