Federal Tax Deductions for Homeowners Rebuilding or Repairing Their Home: A Comprehensive Guide

Rebuilding or repairing your home after a disaster can be costly, but federal tax deductions can help ease the financial burden. Homeowners may be eligible for several tax deductions related to casualty losses, energy-efficient improvements, and specific upgrades such as windows, Insulation, and roofs. Understanding these deductions and how to claim them can significantly reduce your tax liability and help you recover more effectively.

This detailed article will explore the various federal tax deductions available to homeowners rebuilding or repairing their homes, provide practical advice on how to claim these deductions, and offer specific examples to illustrate their application. Relevant web links for further reading are also included.

1. Casualty Loss Deduction

Overview

The casualty loss deduction allows you to deduct losses resulting from sudden, unexpected, or unusual events, such as natural disasters, theft, or vandalism. This deduction can be particularly valuable for homeowners who have suffered significant property damage.

Eligibility

Qualifying Events: Casualty losses must result from sudden, unexpected events, such as hurricanes, floods, fires, or earthquakes. Routine wear and tear or gradual damage does not qualify.

Filing Requirements: To claim a casualty loss deduction, you must itemize your deductions on your tax return using IRS Form 4684. The loss must also exceed $100 per event, and the total loss must exceed 10% of your Adjusted Gross Income (AGI) after subtracting any insurance reimbursements.

Calculation

Determine the Loss: Calculate the difference between the Fair Market Value of your property before and after the disaster. The amount of the loss is the lesser of this difference or your Adjusted Basis in the property.

Subtract Insurance Reimbursement: Subtract any insurance reimbursements or other compensation you received for the loss.

Apply Limits: The remaining loss amount is subject to a $100 per event reduction and a further reduction equal to 10% of your AGI.

Example

Scenario: A homeowner’s house is damaged by a wildfire. The fair market value of the home before the fire was $300,000, and after the fire, it is valued at $150,000. The homeowner’s insurance covers $100,000 of the damage, and their AGI is $75,000.

Calculation:

Loss before limits: $150,000 (loss in value) - $100,000 (insurance) = $50,000

Deductible loss: $50,000 - $100 = $49,900

Final deductible loss: $49,900 - (10% of $75,000) = $42,400

Tax Impact: The homeowner can deduct $42,400 as a casualty loss on their tax return.

Further Reading

IRS Publication 547: Casualties, Disasters, and Thefts: IRS Publication 547

IRS Form 4684: Casualties and Thefts: IRS Form 4684

2. Energy Efficiency Improvements Deduction

Overview

The federal government encourages energy efficiency by offering tax credits and deductions for specific home improvements. These incentives can reduce your tax liability while helping to make your home more energy-efficient, potentially lowering your utility bills in the long run.

Eligible Improvements

Energy-Efficient Windows: Replacing old windows with energy-efficient models can qualify for a Tax Credit. The windows must meet specific energy efficiency standards set by the federal government.

Insulation: Adding or upgrading insulation to improve your home’s energy efficiency can also qualify for a tax credit.

Energy-Efficient Roofs: Certain types of roofs designed to reflect more sunlight and absorb less heat (known as "cool roofs") may qualify for a tax credit.

Tax Credits vs. Deductions

Tax Credit: A tax credit directly reduces the amount of tax you owe, making it more valuable than a deduction. For energy-efficient improvements, the credit is typically 10% of the cost, up to a certain limit.

Tax Deduction: A tax deduction reduces your taxable income, which indirectly reduces the amount of tax you owe. While energy-efficient improvements generally qualify for credits rather than deductions, they still offer significant tax savings.

Example

Scenario: A homeowner installs new energy-efficient windows and a cool roof while rebuilding after a storm. The windows cost $8,000, and the roof costs $12,000.

Tax Credit Calculation:

Windows: 10% of $8,000 = $800

Roof: 10% of $12,000 = $1,200

Tax Impact: The homeowner qualifies for a $2,000 tax credit ($800 for windows + $1,200 for the roof), directly reducing their tax liability.

Further Reading

Energy Star: Federal Tax Credits for Consumer Energy Efficiency: Energy Star Tax Credits

IRS Form 5695: Residential Energy Credits: IRS Form 5695

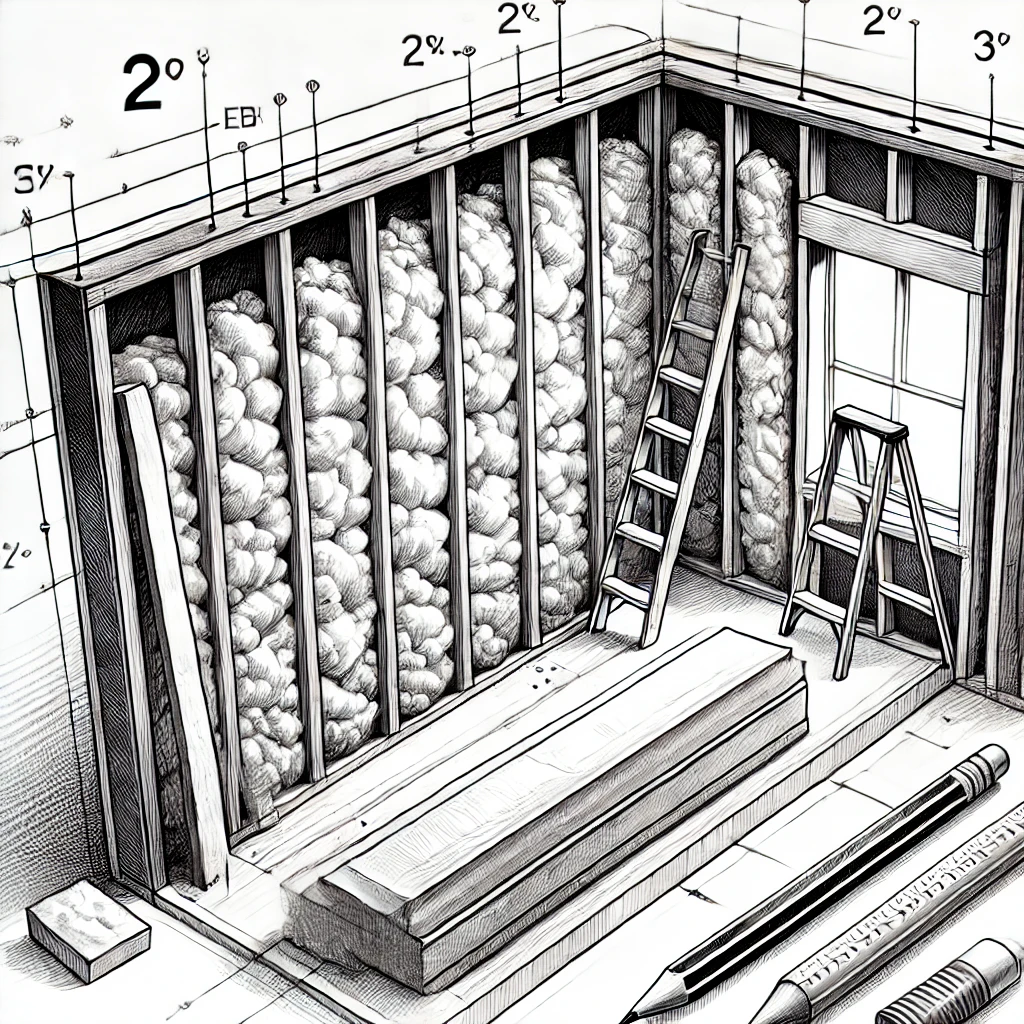

3. Tax Deduction for Insulation

Overview

Adding or upgrading insulation is one of the most cost-effective ways to improve your home’s energy efficiency. While the primary benefit is lower energy bills, you may also be eligible for a federal tax credit.

Eligibility

Qualifying Materials: Insulation materials that qualify for the tax credit include bulk insulation products such as batts, rolls, blow-in fibers, rigid boards, expanding spray, and pour-in-place. Products that air seal (such as Caulk, weather stripping, and spray foam) also qualify if they meet specific energy efficiency criteria.

Tax Credit

Credit Amount: The tax credit for insulation improvements is generally 10% of the cost of the materials, up to a maximum of $500. Labor costs are not eligible for the credit.

Example

Scenario: A homeowner spends $5,000 on new insulation materials while repairing their home after a hurricane.

Tax Credit Calculation: 10% of $5,000 = $500

Tax Impact: The homeowner qualifies for a $500 tax credit, reducing their tax liability.

Further Reading

Energy Star: Federal Tax Credits for Consumer Energy Efficiency: Energy Star Tax Credits

IRS Form 5695: Residential Energy Credits: IRS Form 5695

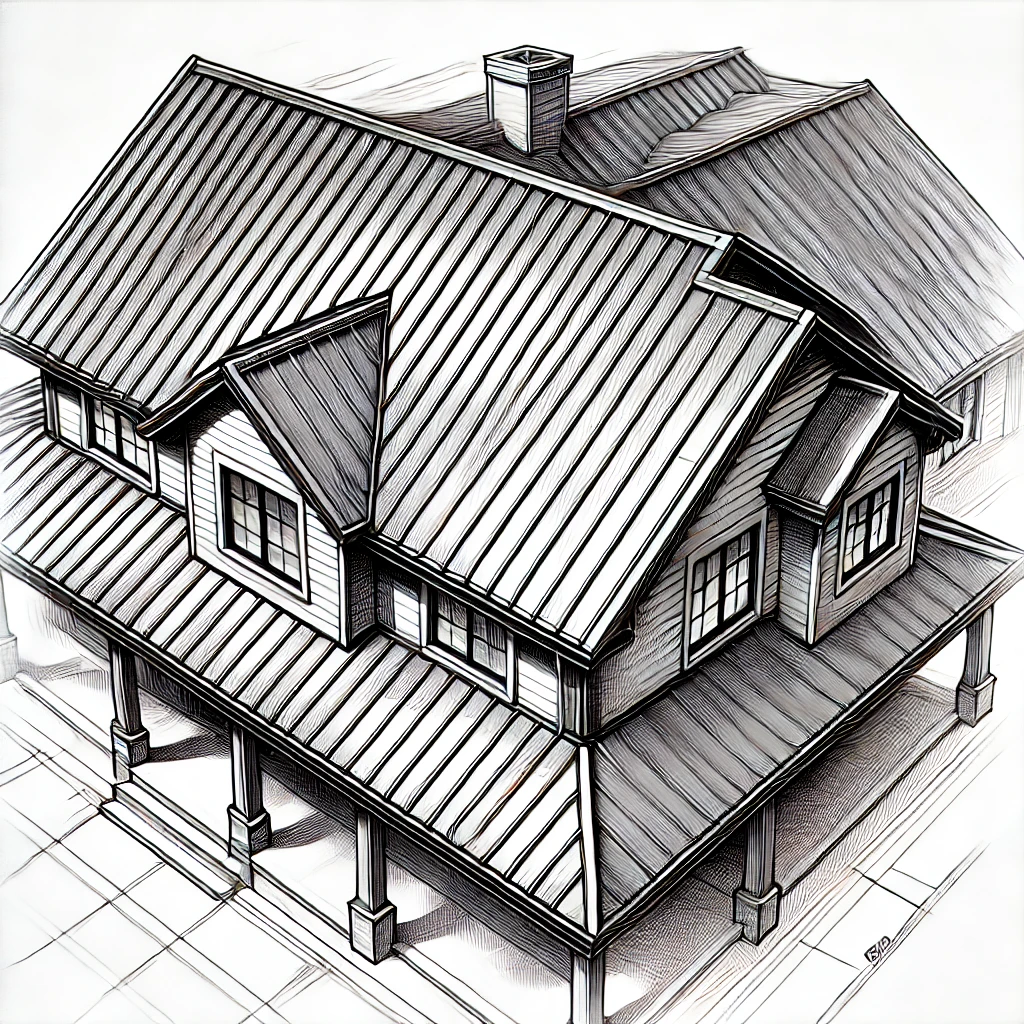

4. Roof Replacement Tax Deduction

Overview

Replacing your roof with energy-efficient materials can qualify you for a federal tax credit. Eligible roofs include those that reflect more sunlight and absorb less heat, such as metal roofs with appropriate pigmented coatings or Asphalt roofs with cooling granules.

Eligibility

Qualifying Roofs: To qualify, the roof must meet the energy efficiency standards set by the federal government. The roof must be installed on your primary residence, and the credit is only available for materials, not labor.

Tax Credit

Credit Amount: The tax credit for a qualifying roof is generally 10% of the cost of materials, up to a maximum of $500.

Example

Scenario: A homeowner spends $10,000 on a new cool roof while repairing their home after a tornado.

Tax Credit Calculation: 10% of $10,000 = $1,000 (subject to the $500 cap)

Tax Impact: The homeowner qualifies for a $500 tax credit, reducing their tax liability.

Further Reading

Energy Star: Federal Tax Credits for Consumer Energy Efficiency: Energy Star Tax Credits

IRS Form 5695: Residential Energy Credits: IRS Form 5695

Advice for Homeowners

Keep Detailed Records

Document Expenses: Maintain thorough documentation of all expenses related to rebuilding or repairing your home, including receipts, contracts, and invoices. This documentation is essential for claiming tax deductions and credits.

Consult a Tax Professional

Seek Expert Advice: The rules surrounding tax deductions and credits can be complex. Consider consulting a tax professional or CPA to ensure you maximize your eligible deductions and credits and comply with IRS regulations.

File the Correct Forms

Use IRS Forms: Ensure you file the appropriate IRS forms when claiming tax deductions or credits. For example, use Form 4684 for casualty losses and Form 5695 for energy efficiency credits.

Monitor Tax Law Changes

Stay Updated: Tax laws can change, especially concerning energy efficiency credits. Stay informed about any updates to ensure you take full advantage of available benefits.

Consider Timing

Plan Ahead: If possible, time your home improvements to maximize tax benefits. For example, making energy-efficient upgrades before the end of the tax year ensures you can claim the credit on your next return.

Wrap-Up

Federal tax deductions and credits can provide significant financial relief for homeowners rebuilding or repairing their homes. By understanding the available deductions for casualty losses, energy efficiency improvements, insulation, and roofs, you can reduce your tax liability and make your recovery more manageable.

For more information on federal tax deductions and related topics, consider visiting the following resources:

IRS: Tax Information for Disaster Assistance: IRS Disaster Tax Relief

Energy Star: Federal Tax Credits for Consumer Energy Efficiency: Energy Star Tax Credits

IRS: Casualty, Disaster, and Theft Losses: IRS Publication 547

IRS: Residential Energy Credits: IRS Form 5695

These resources can help you better understand and apply for federal tax deductions and credits, ensuring you maximize your savings and manage your finances effectively during the rebuilding process.