Understanding Equipment Breakdown Coverage Endorsements in Your Homeowners Insurance Policy: A Detailed Guide for Small Business Owners

Running a small business from home often involves using a variety of equipment, from computers and appliances to specialized machinery. When this equipment fails, it can disrupt your business operations and lead to costly repairs or replacements. While standard homeowners insurance policies typically cover damage from external perils like fire or theft, they often do not cover internal mechanical or electrical breakdowns. Equipment Breakdown Coverage endorsements can fill this gap, providing critical protection for small business owners.

This detailed guide will explain what Equipment Breakdown Coverage endorsements are, how they work, and provide specific examples to help small business homeowners understand their importance and application.

What is Equipment Breakdown Coverage?

Equipment Breakdown Coverage is an Endorsement that can be added to your homeowners insurance policy to cover the costs associated with the mechanical, electrical, or pressure systems breakdown of your business equipment. This coverage goes beyond the protection offered by standard homeowners insurance, which typically excludes coverage for equipment that fails due to internal issues like mechanical failure, electrical surges, or pressure system malfunctions.

Why You Might Need Equipment Breakdown Coverage

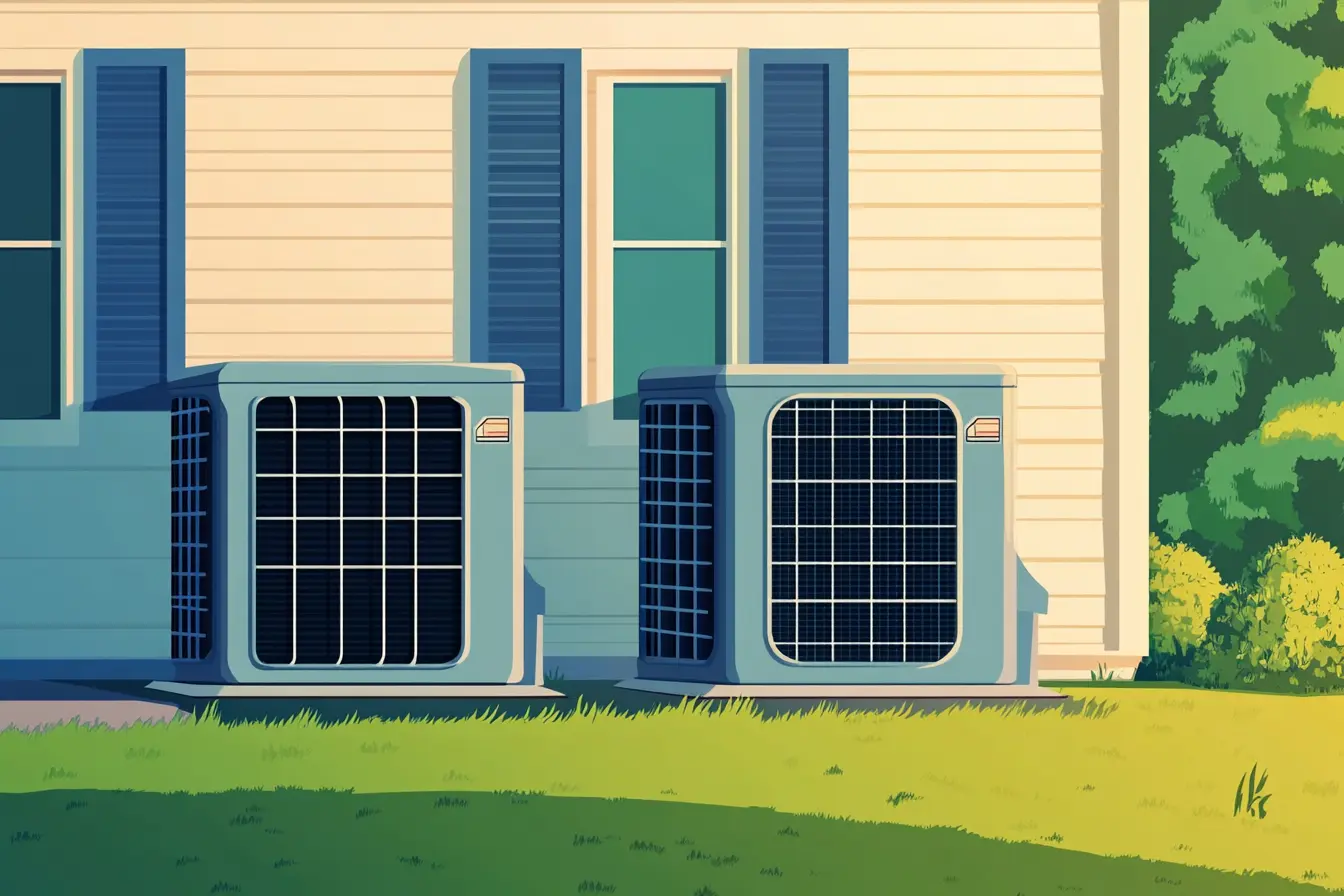

For small business owners who rely on equipment to maintain operations, a breakdown can be financially devastating. Whether it's a malfunctioning HVAC system, a computer server crash, or a broken-down commercial-grade appliance, these incidents can lead to significant repair or replacement costs. Without proper coverage, you may have to pay out-of-pocket for these expenses, which could strain your business finances.

Adding an Equipment Breakdown Coverage endorsement ensures that you are protected against these unexpected costs, allowing you to quickly repair or replace essential equipment and minimize business disruption.

Key Components of Equipment Breakdown Coverage

1. Coverage for Repair or Replacement Costs

What It Is: This coverage reimburses you for the cost of repairing or replacing equipment that breaks down due to internal mechanical or electrical issues. It covers a wide range of equipment, including computers, HVAC systems, refrigerators, boilers, and specialized business machinery.

Example:

If the HVAC system in your home office breaks down due to an internal electrical failure and requires a $5,000 repair, the Equipment Breakdown Coverage endorsement should cover the cost of the repair.

Action Step: Evaluate the equipment you use in your business and consider how costly it would be to repair or replace in the event of a breakdown. Adding this coverage can protect you from these unexpected expenses.

2. Coverage for Electrical Surges

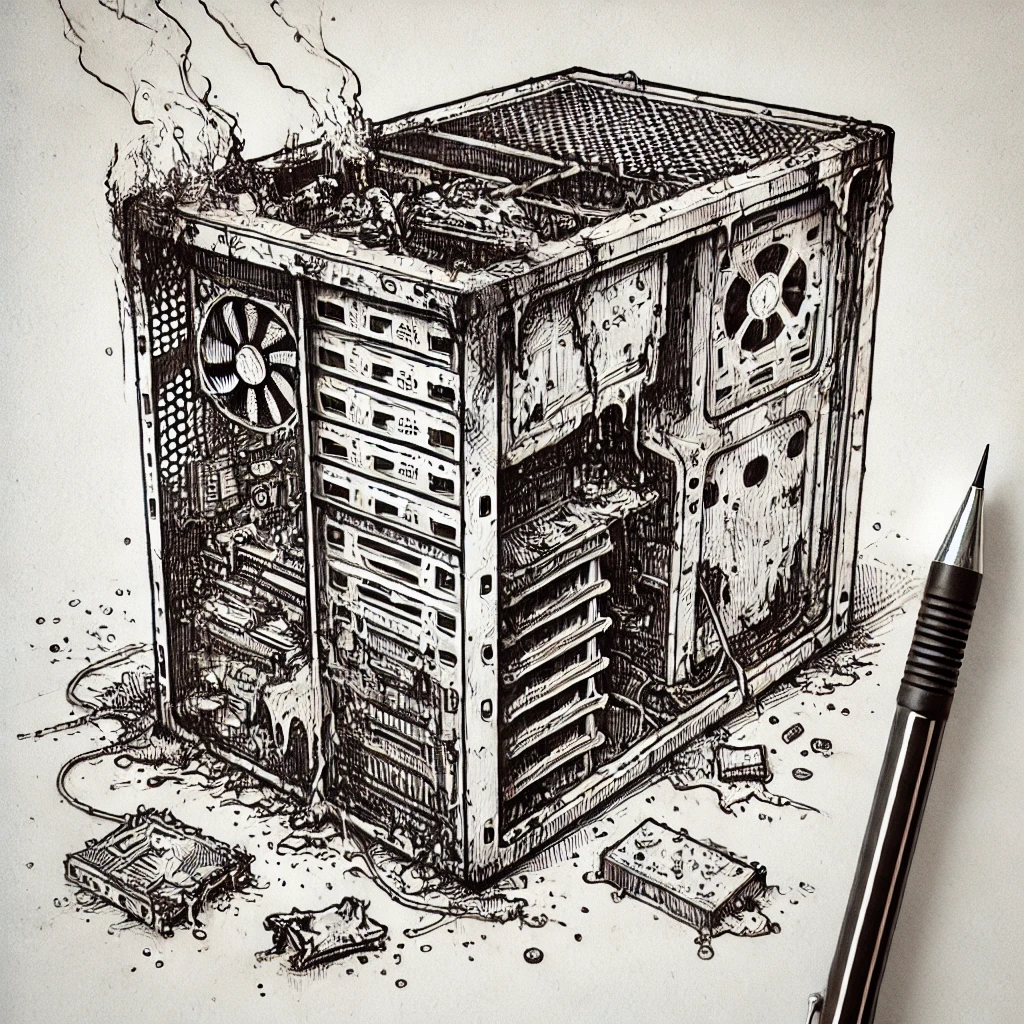

What It Is: This aspect of the coverage protects against damage caused by electrical surges, which can fry circuits, destroy sensitive electronics, and lead to significant equipment damage. Electrical surges are a common cause of equipment failure, especially for businesses that rely on computers and electronic devices.

Example:

If a power surge causes your custom-built computer system to fail, requiring $3,000 in repairs, the Equipment Breakdown Coverage endorsement should cover the repair costs, ensuring you can continue your business operations without significant financial loss.

Action Step: Consider the impact of electrical surges on your business equipment and ensure your coverage includes protection against this common issue.

3. Coverage for Loss of Income

What It Is: Some Equipment Breakdown Coverage endorsements include coverage for loss of income due to Business Interruption caused by equipment failure. This means that if your business operations are halted because of a breakdown, you may be compensated for the income you lose during the downtime.

Example:

If your primary computer system fails, causing your business to be offline for three days and leading to a loss of $2,000 in income, the Equipment Breakdown Coverage endorsement should reimburse you for the lost income, helping to offset the financial impact of the downtime.

Action Step: Assess the potential impact of equipment breakdowns on your business income and consider adding loss of income coverage as part of your Equipment Breakdown Coverage endorsement.

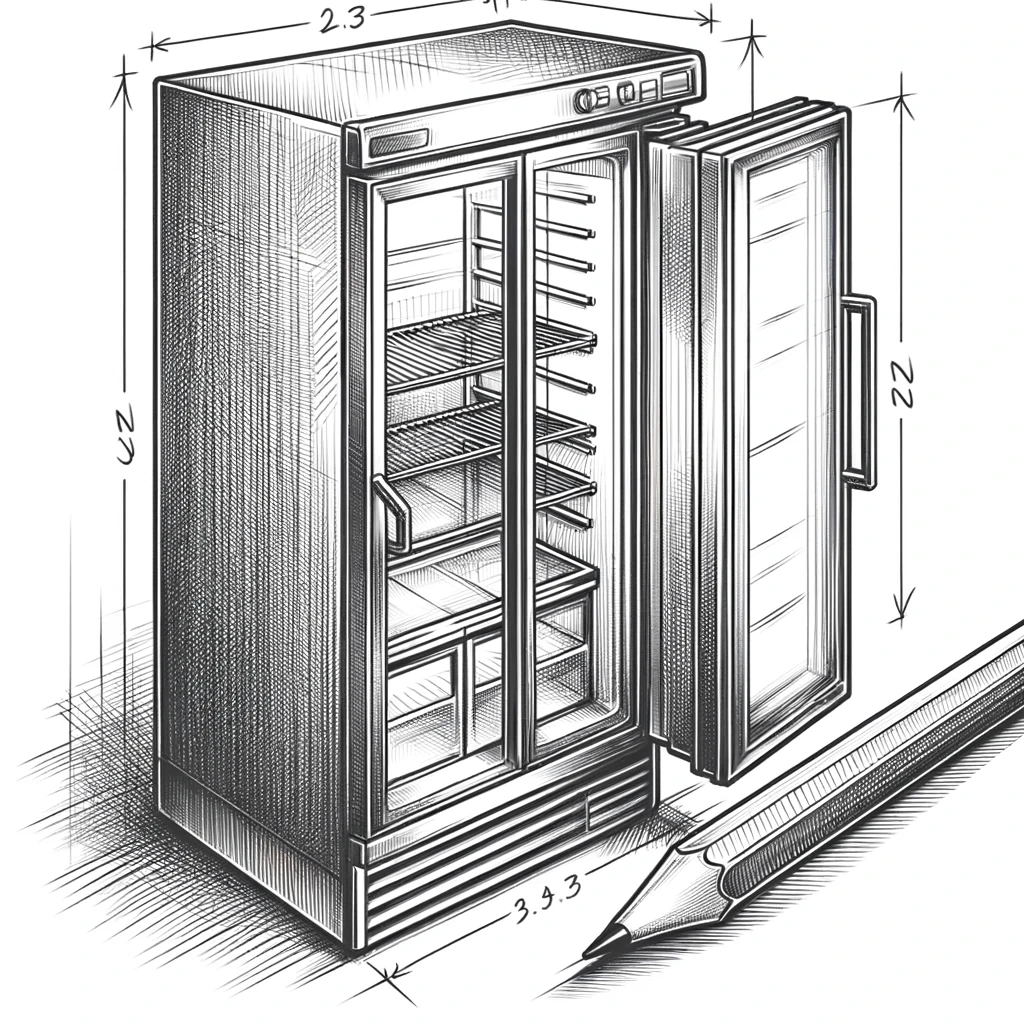

4. Coverage for Spoilage of Perishable Goods

What It Is: If your business involves the storage or sale of perishable goods, Equipment Breakdown Coverage can protect against the loss of these items due to equipment failure, such as a refrigerator or freezer breaking down. This coverage reimburses you for the cost of the spoiled goods.

Example:

If the commercial-grade refrigerator in your home-based catering business fails, causing $1,500 worth of food to spoil, the Equipment Breakdown Coverage endorsement should cover the cost of the spoiled goods, ensuring you don’t suffer a total loss.

Action Step: Consider the risks associated with perishable goods in your business and ensure your coverage limits are sufficient to cover potential losses.

5. Coverage Limits

What It Is: Equipment Breakdown Coverage endorsements come with specified coverage limits, which is the maximum amount the insurer will pay for a Claim related to equipment breakdown. These limits can vary depending on the insurer and the specific endorsement.

Example:

If your policy includes a $10,000 limit for equipment breakdown coverage and the total cost to repair your broken-down machinery is $8,000, your insurance should cover the full amount, up to the $10,000 limit.

Action Step: Review the coverage limits of your endorsement to ensure they meet your needs. Choose limits that provide adequate protection against the potential financial losses you could face from equipment breakdowns.

6. Exclusions and Limitations

What It Is: Like all insurance endorsements, Equipment Breakdown Coverage may come with exclusions and limitations. Common exclusions might include wear and tear, gradual deterioration, or breakdowns resulting from improper maintenance.

Example:

If your equipment fails due to lack of maintenance, your policy may exclude coverage for the loss, requiring you to pay for repairs or replacements out of pocket.

Action Step: Carefully review the exclusions and limitations of your endorsement to understand what is and isn’t covered. Ensure your policy aligns with your needs and potential risks.

Specific Examples of How This Coverage Works

Scenario 1: Computer System Failure

You run an online retail business from home, and your primary computer system, which handles all orders and inventory management, fails due to a mechanical breakdown. The cost to repair the system is $4,500.

Outcome with Standard Coverage: Without Equipment Breakdown Coverage, your standard homeowners insurance policy may not cover the cost of the mechanical breakdown, leaving you responsible for the full amount.

Outcome with Equipment Breakdown Coverage: With the endorsement, your insurance should cover the $4,500 repair cost, ensuring you can get your business back online quickly without significant financial strain.

Scenario 2: Electrical Surge Damages Appliances

A power surge during a storm damages several pieces of equipment in your home office, including a custom-built server and a commercial-grade printer. The total cost of repairs is $6,000.

Outcome with Standard Coverage: Without Equipment Breakdown Coverage, your homeowners insurance may not cover the damage caused by the electrical surge, particularly if it’s considered an internal issue rather than an external Peril.

Outcome with Equipment Breakdown Coverage: With the endorsement, your insurance should cover the $6,000 cost of repairs, allowing you to continue your business operations with minimal disruption.

Scenario 3: HVAC System Breakdown

The HVAC system in your home office breaks down in the middle of summer, rendering your workspace unusable due to extreme heat. The cost to repair the HVAC system is $3,000, and you lose $1,500 in business income during the downtime.

Outcome with Standard Coverage: Without Equipment Breakdown Coverage, your homeowners insurance policy may not cover the mechanical failure, and you would be responsible for both the repair costs and the lost income.

Outcome with Equipment Breakdown Coverage: With the endorsement, your insurance should cover the $3,000 repair cost and reimburse you for the $1,500 in lost income, helping you recover from the incident without significant financial impact.

Loti can help:

We provide support and services for each of these use cases and can help you manage your claim with easy to use tools.

How to Add This Coverage to Your Policy

Evaluate Your Equipment: Start by assessing the types and value of the equipment you use in your business. Consider the potential risks of mechanical or electrical breakdowns and the costs of repair or replacement.

Contact Your Insurance Agent: Discuss your needs with your insurance agent and ask about adding Equipment Breakdown Coverage endorsements to your homeowners policy. They can guide you through the process and help you choose the best coverage options.

Review the Endorsement Terms: Once added, carefully review the terms of the endorsement, including coverage limits, exclusions, and any special conditions. Make sure the policy aligns with your needs and potential risks.

Consider Additional Coverage Options: Depending on your business’s specific needs, you may also want to consider other endorsements, such as business interruption insurance or valuable papers and records coverage, to complement your equipment protection.

Update Your Coverage as Needed: As your business grows or your equipment changes, make sure to update your coverage to reflect these changes. Regular reviews of your policy will help ensure you are adequately protected.

Wrap-Up

Equipment Breakdown Coverage endorsements are a vital addition to your homeowners insurance policy if you operate a small business out of your home and rely on equipment to maintain operations. This coverage provides financial protection against losses that can occur from mechanical, electrical, or pressure system breakdowns, ensuring that you can quickly repair or replace essential equipment and minimize business disruption. By understanding the different aspects of these endorsements and carefully considering your specific needs, you can make informed decisions to protect your business from these risks. Regularly reviewing your policy and adjusting your coverage as needed are key steps in maintaining comprehensive protection.

If you have any questions or need to add this endorsement to your policy, contact your insurance agent for guidance. Properly managing your homeowners insurance with Equipment Breakdown Coverage provides peace of mind and financial security for your home-based business.