Earthquake Coverage and the CEA

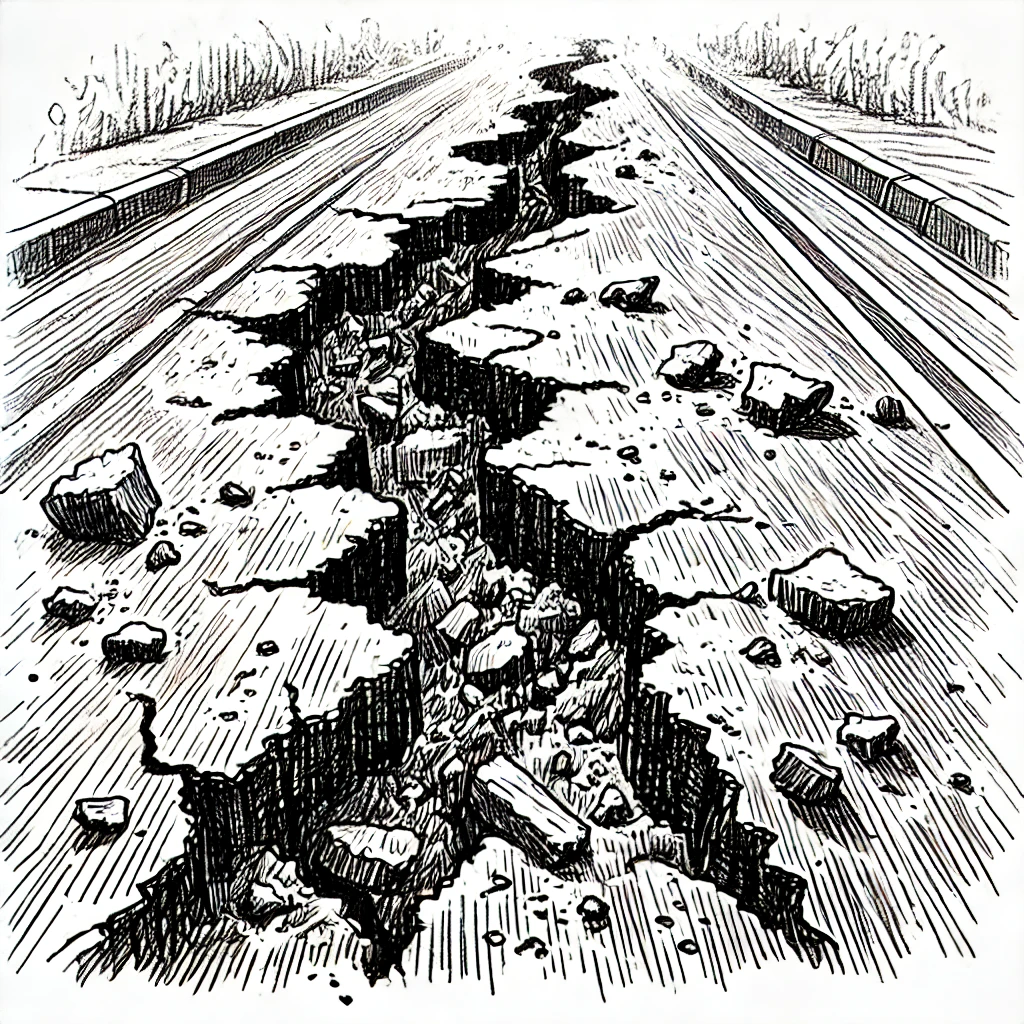

Earthquakes pose a significant risk to homes in certain regions, causing structural damage, landslides, fires, and even total destruction. Standard Homeowners Insurance policies typically do not cover earthquake damage, making separate earthquake insurance essential for comprehensive protection.

This article will explain how earthquake insurance works, the role of the California Earthquake Authority (CEA), and how to obtain adequate coverage.

Why Earthquake Coverage is Important

Earthquakes can cause sudden, severe damage to homes and Personal Property, making separate coverage crucial:

Protects Against Structural Damage: Earthquake coverage provides protection for the Foundation, walls, roof, and other structural elements damaged during seismic events.

Covers Personal Property: It covers personal belongings damaged by earthquakes, including furniture, electronics, and appliances.

Meets Mortgage Requirements: In high-risk areas, lenders may require earthquake insurance to protect the property’s value.

Understanding Earthquake Insurance

Earthquake insurance is designed to provide financial protection for homes and belongings affected by seismic activity. It is generally available as a separate Policy or Endorsement added to a homeowners policy.

What Earthquake Insurance Covers

Earthquake insurance typically covers three main areas:

Dwelling Coverage

Covers damage to the structure of your home, including the foundation, walls, roof, and attached structures.

Includes repair or rebuilding costs if the home is damaged or destroyed by an earthquake.

May include Debris Removal, land stabilization, and Building Code upgrades.

Personal Property Coverage

Covers personal belongings, such as furniture, electronics, clothing, and other possessions damaged by an earthquake.

Limits may vary, and high-value items (e.g., jewelry, collectibles) may need additional coverage.

Additional Living Expenses (ALE)

Provides temporary housing, food, and other living expenses if your home becomes uninhabitable after an earthquake.

What Earthquake Insurance Does Not Cover

While earthquake insurance offers broad protection, it does have exclusions:

Flood Damage: Earthquake insurance does not cover flood damage, including flooding caused by tsunamis or aftershocks. Separate Flood Insurance is needed for this coverage.

Vehicle Damage: Vehicles damaged in an earthquake are not covered under earthquake insurance; they are covered by comprehensive auto insurance.

Pre-Existing Damage: Earthquake policies do not cover damages that occurred before the policy was purchased.

The California Earthquake Authority (CEA)

The California Earthquake Authority (CEA) is the largest provider of residential earthquake insurance in California. It was established to provide affordable and accessible earthquake coverage to homeowners, renters, and condo owners in California.

Key Features of CEA Earthquake Insurance

CEA offers multiple policy options with varying levels of coverage:

Dwelling Coverage

CEA provides up to $200,000 in dwelling coverage for homeowners and up to $100,000 for mobile homes.

Coverage includes costs for repairs, rebuilding, and debris removal after an earthquake.

Personal Property Coverage

Offers up to $200,000 for personal belongings, including damage to furniture, clothing, electronics, and other items inside the home.

Additional Living Expenses (ALE)

Provides up to $100,000 for temporary housing, food, and other expenses if the home is uninhabitable.

Policyholders can choose coverage limits based on their needs and budget.

Deductible Options

CEA policies have deductibles ranging from 5% to 25% of the dwelling coverage limit.

Unlike standard deductibles, earthquake deductibles are calculated as a percentage of the insured dwelling amount (e.g., a $500,000 dwelling with a 15% deductible means $75,000 out-of-pocket before insurance pays).

CEA Policy Types

CEA offers three primary types of earthquake insurance policies:

Homeowners Policy

Designed for single-family homeowners, covering the structure, personal property, and additional living expenses.

Offers a range of deductible and coverage options to suit different needs and budgets.

Condominium Policy

Covers personal property, interior unit improvements, and loss assessments imposed by the homeowners association after an earthquake.

Mobile Home Policy

Similar to the homeowners policy, covering mobile homes, personal belongings, and additional living expenses.

How to Purchase CEA Earthquake Insurance

CEA earthquake insurance is sold through participating insurance companies:

Contact an Agent: Work with a licensed insurance agent who represents a CEA-participating company to discuss coverage options and get a quote.

Select Coverage Levels: Choose the dwelling, personal property, and ALE limits that meet your needs, along with an appropriate deductible.

Review Policy Details: Understand what’s covered, what’s excluded, and how the deductible works before finalizing the purchase.

Other Earthquake Insurance Providers

While the CEA is the largest provider in California, private insurers also offer earthquake insurance across the United States:

Private Earthquake Insurance

Private earthquake insurance is available in many states, offering flexible coverage options, higher limits, and additional coverage features not provided by the CEA.

Private insurers may provide more customizable policies, including lower deductibles, higher personal property limits, and broader coverage for additional structures.

Coverage Beyond California

Homeowners in other states prone to earthquakes, such as Oregon, Washington, Alaska, Nevada, Utah, and Missouri, should also consider earthquake insurance.

Private insurers or state-run programs may offer similar coverage tailored to regional risks.

Loti can help:

Loti can help you organize your homeowner’s insurance polices including earthquake coverage so all your documents, images and policy information are easy to access for future needs.

Factors Affecting Earthquake Insurance Costs

The cost of earthquake insurance depends on several factors:

Location

Homes in high-risk areas, such as near fault lines or seismic zones, will have higher premiums.

California, Oregon, Washington, Alaska, and Nevada are among the states with the highest rates due to increased seismic activity.

Construction Type

Wood-frame homes generally have lower premiums than brick or Masonry homes because they withstand shaking better.

Homes built to modern seismic codes may qualify for lower premiums.

Deductibles

Higher deductibles lower premiums but increase out-of-pocket costs if a Claim is filed.

Selecting a deductible that balances affordability and coverage is key.

Home’s Age & Condition

Older homes or those without retrofitting may face higher premiums due to increased vulnerability to seismic damage.

Earthquake Mitigation Measures to Lower Premiums

Implementing earthquake-resistant features can reduce both risk and premiums (see our book about Hardening Your Home for more ideas):

Seismic Retrofitting

Strengthening the foundation and securing walls to the foundation can reduce earthquake damage and qualify for lower insurance rates.

Bracing Water Heaters

Securing water heaters to prevent tipping reduces the risk of fire or flooding caused by earthquake movement.

Securing Large Items

Anchoring heavy furniture, appliances, and electronics prevents injury and damage during an earthquake, improving safety and potentially lowering premiums.

Building to Seismic Codes

Homes built or remodeled to meet modern seismic building codes may qualify for discounts or lower premiums.

How Earthquake Insurance Impacts Homeowners Insurance

Earthquake insurance works alongside homeowners insurance to provide complete protection:

Fills Coverage Gaps: It covers earthquake-related damages that are excluded from standard homeowners policies, such as structural damage, landslides, and soil movement.

Reduces Financial Exposure: Provides financial relief for rebuilding or repairing after an earthquake, reducing significant out-of-pocket expenses.

May Be Required by Lenders: For homes in high-risk areas, lenders may require earthquake insurance as part of the mortgage agreement.

How to Purchase Earthquake Insurance

Follow these steps to obtain earthquake insurance:

Assess Your Risk

Use resources like the USGS Earthquake Hazard Map to understand your earthquake risk based on location.

Contact an Insurance Agent

Work with a licensed insurance agent to discuss coverage options, deductibles, and premiums based on your home’s location, construction, and value.

Compare Policies

Compare CEA policies with private insurers to find the best combination of coverage, cost, and deductible.

Additional Resources

California Earthquake Authority (CEA): Learn more about CEA policies, coverage options, and seismic safety tips. Visit CEA for more information.

U.S. Geological Survey (USGS): Provides earthquake maps, risk assessments, and preparedness tips. Visit USGS for details.

Insurance Information Institute (III): Offers resources on earthquake insurance and preparedness. Visit III for guidance.

Wrap-Up

Earthquake insurance is a critical component of protecting your home and personal property in seismically active areas. By understanding the CEA, private market options, and potential mitigation strategies, you can make informed decisions about comprehensive coverage.

Consult with an insurance agent to explore your earthquake insurance options, ensuring peace of mind and financial protection in the event of a seismic disaster.