Understanding Collectibles Coverage Endorsements in Your Homeowners Insurance Policy: A Detailed Guide

Many homeowners own valuable collections of items such as stamps, coins, comics, or other collectibles. These items can hold significant monetary and sentimental value, but they may not be adequately covered under a standard homeowners insurance policy. To ensure your collection is protected, you may need to add a Collectibles Coverage Endorsement to your policy.

This detailed guide will explain what Collectibles Coverage endorsements are, how they work, and provide specific examples to help homeowners understand their importance and application.

What is Collectibles Coverage?

Collectibles Coverage is a specialized endorsement that can be added to your homeowners insurance policy to provide coverage for valuable collections. This coverage typically includes protection against risks such as theft, fire, water damage, and accidental damage. It is designed to cover items that are considered collectibles and that may not be fully covered under standard Personal Property insurance.

Why You Might Need Collectibles Coverage

Standard homeowners insurance policies often have limits on coverage for valuable items, such as collections of stamps, coins, or comics. These limits may be significantly lower than the actual value of your collection. Additionally, standard policies might not cover certain risks that are particularly relevant to collectibles, such as accidental damage or loss during transit.

A Collectibles Coverage endorsement ensures that your valuable items are adequately protected and that you can recover their full value if they are damaged, lost, or stolen.

Key Components of Collectibles Coverage

1. Coverage for a Wide Range of Collectibles

What It Is: Collectibles Coverage typically extends to a wide range of collectible items, including but not limited to:

Stamps

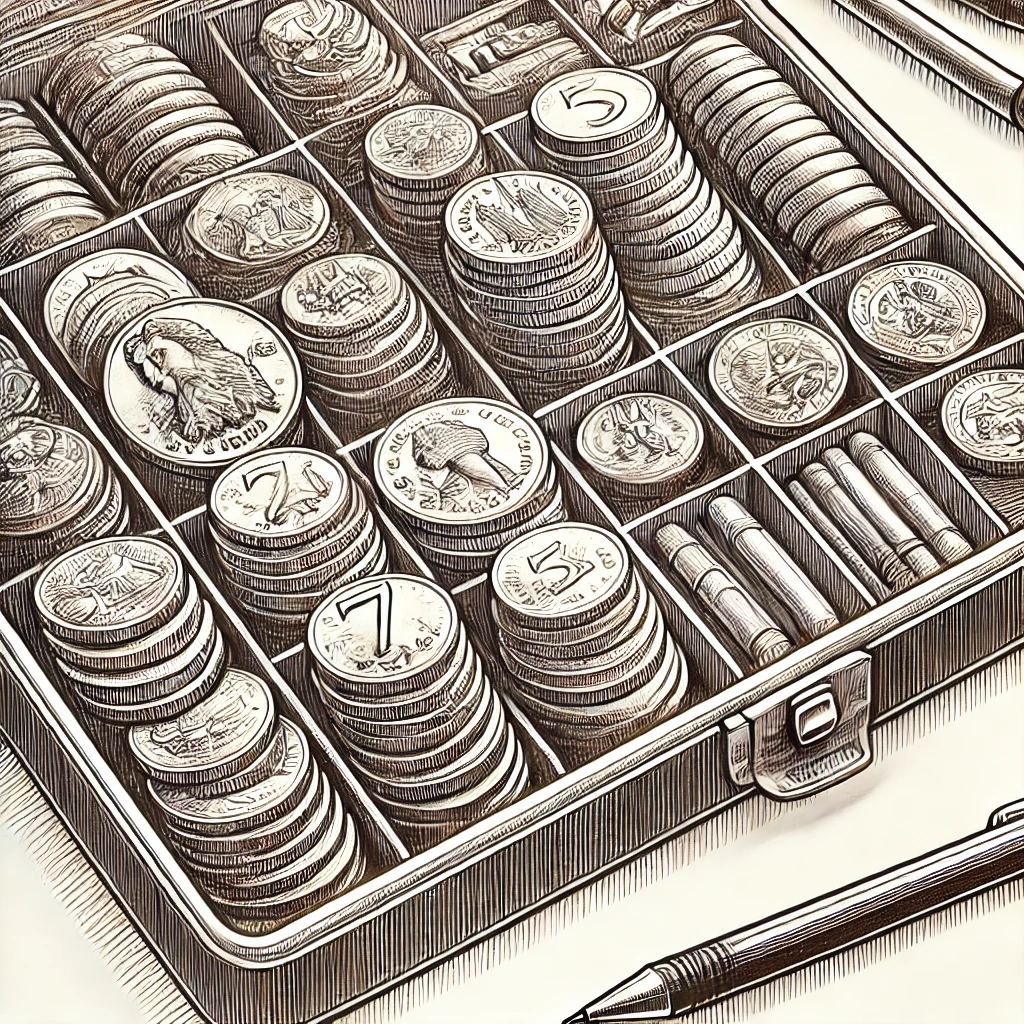

Coins and currency

Comic books

Sports memorabilia

Fine wines

Antique toys

Trading cards

Rare books

Example:

If you have a collection of rare comic books valued at $50,000, a standard homeowners policy might only cover up to $1,500 for valuable items like collectibles. With Collectibles Coverage, you can ensure the full value of your collection is covered.

Action Step: Inventory your collection and have it appraised to determine its value. This will help you understand the level of coverage you need.

2. Agreed Value vs. Market Value

What It Is: Similar to fine art coverage, Collectibles Coverage often allows for coverage based on an agreed value or market value. Agreed value is determined at the time the policy is issued, and this is the amount you will be reimbursed if the item is lost or damaged. Market value coverage bases the reimbursement on the item’s value at the time of the loss.

Example:

If you have a rare coin that you and your insurer agree is worth $10,000, this is the amount you will receive if the coin is lost or stolen. If the market value of the coin increases to $15,000 over time, you would need to update your policy to reflect the new value.

Action Step: Work with a professional Appraiser

to determine the accurate value of your collection and decide whether an agreed value or market value basis is best for your coverage.

3. Worldwide Coverage

What It Is: Many Collectibles Coverage endorsements offer worldwide coverage, meaning your items are protected even when they are outside your home, such as during transportation, while on loan for exhibition, or while stored in a secondary location.

Example:

If you lend a piece of sports memorabilia to a museum for display and it is damaged during transit, your Collectibles Coverage should cover the repair or replacement costs.

Action Step: Consider the movement and storage of your collection. If your items are frequently moved or displayed outside your home, ensure your Collectibles Coverage includes worldwide protection.

4. Coverage for Transit and Storage

What It Is: This coverage includes protection for your collectibles while they are in transit or stored in a different location, such as a safety deposit box, warehouse, or second home. This is crucial for collectors who frequently move or loan their items.

Example:

If you are moving to a new home and your collection of antique toys is damaged in transit, Collectibles Coverage should reimburse you for the full value of the damaged items, depending on your policy terms.

Action Step: If you frequently move your collection or store it in different locations, verify that your endorsement includes transit and storage coverage.

5. No Deductible or Low Deductible Options

What It Is: Collectibles Coverage often offers the option of having no deductible or a very low deductible, meaning you won’t have to pay much, if anything, out of pocket in the event of a Claim.

Example:

If your policy has no deductible and a rare comic book worth $5,000 is accidentally damaged, your insurance should cover the full $5,000 cost of replacing or repairing the comic book without requiring you to pay a deductible.

Action Step: Discuss deductible options with your insurance agent and choose a level that matches your financial comfort and the value of your collection.

Specific Examples of How Collectibles Coverage Works

Scenario 1: Theft of a Coin Collection

Your rare coin collection, valued at $75,000, is stolen during a break-in. The standard homeowners policy has a sub-limit of $2,500 for valuable items like collectibles.

Outcome with Standard Coverage: Without Collectibles Coverage, your policy would only pay out $2,500, leaving you with a significant loss.

Outcome with Collectibles Coverage: With an endorsement that covers the agreed value of $75,000, your insurance should pay the full $75,000, allowing you to replace the collection or compensate for its loss.

Scenario 2: Water Damage to a Stamp Collection

A pipe bursts in your home, causing water damage to your stamp collection, which is valued at $20,000. The stamps are irreplaceable, but the damage repair costs are estimated at $10,000.

Outcome with Standard Coverage: Without an endorsement, your standard policy might only cover a portion of the damage, if at all.

Outcome with Collectibles Coverage: With the endorsement, your policy should cover the full cost of repairs or, if necessary, the full value of the collection based on the agreed or appraised value.

Scenario 3: Accidental Damage During Transit

You’re relocating, and a rare comic book is damaged while being transported to your new home. The comic book is valued at $25,000, but moving companies often have limited liability for such items.

Outcome with Standard Coverage: Standard homeowners insurance typically does not cover damage that occurs during transit, leaving you responsible for the loss.

Outcome with Collectibles Coverage: With Collectibles Coverage that includes transit protection, your policy should cover the damage, reimbursing you for the full $25,000 value of the comic book.

How to Add Collectibles Coverage to Your Policy

Inventory and Appraise Your Collection: Start by creating a detailed inventory of your collectibles and having them professionally appraised. This will help you determine their value and ensure you have adequate coverage.

Contact Your Insurance Agent: Discuss your needs with your insurance agent and ask about adding Collectibles Coverage to your homeowners policy. They can guide you through the process and help you choose the best coverage options.

Review the Endorsement Terms: Once added, carefully review the terms of the endorsement, including what risks are covered, coverage limits, and whether the policy is based on agreed or market value. Make sure the policy aligns with your needs and the value of your collection.

Consider Worldwide and Transit Coverage: If your collection is frequently moved or displayed outside your home, ensure your endorsement includes worldwide and transit coverage for full protection.

Update Your Coverage as Needed: As your collection grows or changes in value, make sure to update your coverage. Regular appraisals and policy reviews will help ensure your collection remains adequately insured.

Wrap-Up

Collectibles Coverage is an essential endorsement for homeowners with valuable collections. It provides comprehensive protection against a wide range of risks, ensuring that your investment is safeguarded. By understanding the different aspects of Collectibles Coverage and carefully considering your specific needs, you can make informed decisions to protect your collection. Regularly reviewing your policy and adjusting your coverage as needed are key steps in maintaining comprehensive protection for your valuable items.

If you have any questions or need to add this endorsement to your policy, contact your insurance agent for guidance. Properly managing your homeowners insurance with Collectibles Coverage provides peace of mind and financial security for your treasured collections.