Understanding the Aircraft Peril in Your Homeowners Insurance Policy: A Detailed Guide

Homeowners insurance policies are designed to protect your home and personal property from a wide range of risks, or perils. One of the less commonly discussed but important perils covered by many homeowners insurance policies is the aircraft peril. This peril provides coverage for damage caused to your property by aircraft or objects falling from aircraft. While it might seem unlikely, understanding this coverage is essential for ensuring that you are protected in the event of such an incident.

This detailed guide will explain what the aircraft peril is, how it works within a homeowners insurance policy, and provide specific examples to help homeowners understand when and how this coverage might apply.

What Is the Aircraft Peril?

Aircraft peril refers to a specific risk covered under most standard homeowners insurance policies. It provides protection against damage caused to your home or personal property by aircraft or by objects falling from aircraft. This peril is part of the named perils typically included in a homeowners insurance policy and is designed to cover unexpected and unusual events.

What Does the Aircraft Peril Cover?

The aircraft peril generally covers the following scenarios:

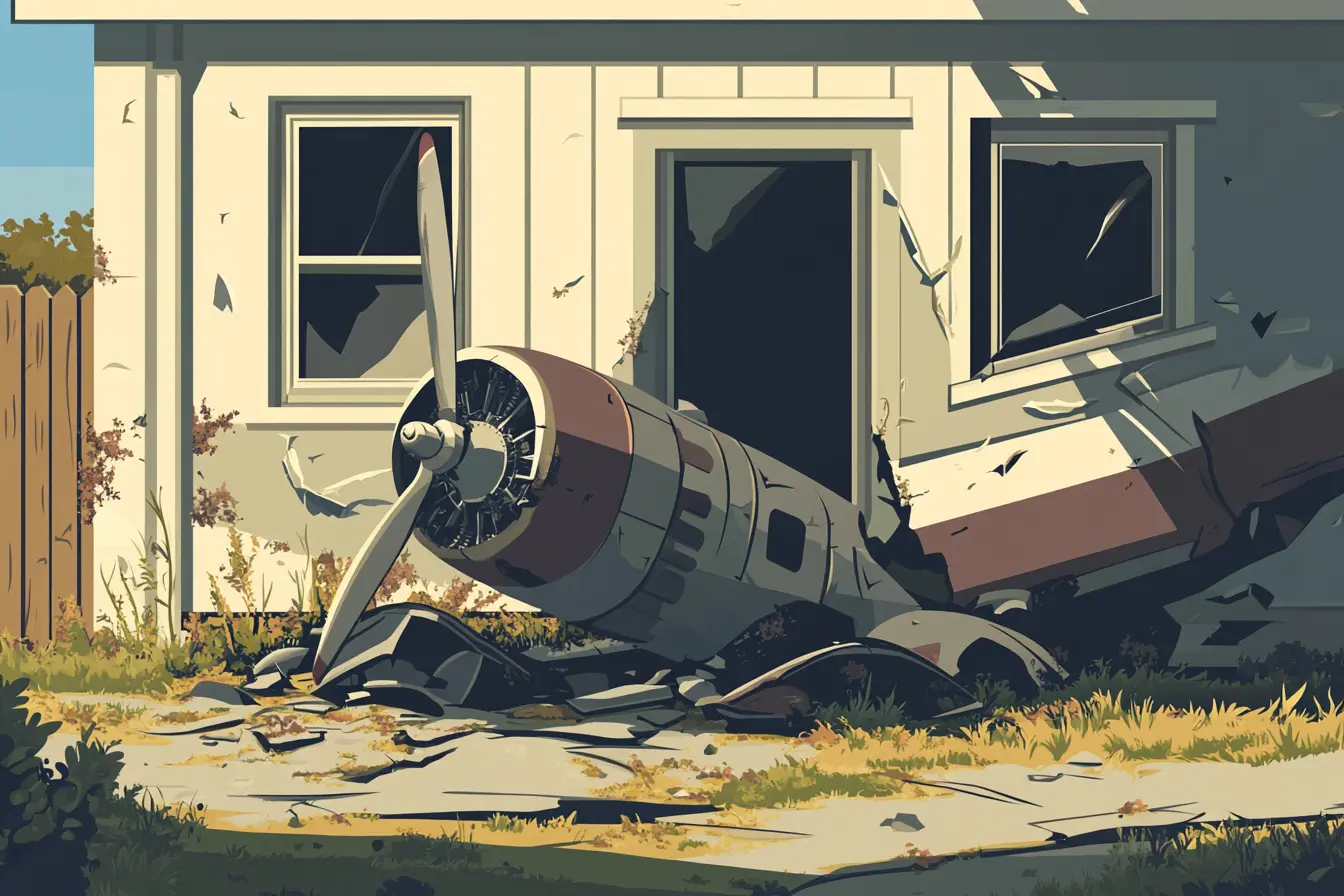

Direct Impact by an Aircraft: If an aircraft, such as a plane, helicopter, or drone, directly impacts your home or property, causing damage, this peril would cover the cost of repairs.

Falling Objects from Aircraft: If an object, such as a piece of luggage, debris, or a part of the aircraft, falls from the sky and damages your property, this peril would also cover the damage.

Damage Caused by Emergency Landings or Crashes: If an aircraft makes an emergency landing or crashes on your property, resulting in damage, the aircraft peril would apply.

What Is Not Covered?

While the aircraft peril provides important coverage, there are some limitations and exclusions to be aware of:

Wear and Tear: Damage that occurs due to wear and tear or general maintenance issues, even if exacerbated by an aircraft event, may not be covered.

Intentional Acts: If damage is caused intentionally by an aircraft or its operator, this might not be covered under the standard peril.

Damage Not Directly Related to Aircraft: If the damage is not directly caused by an aircraft or objects falling from an aircraft, it would not be covered under this peril.

Specific Examples of Aircraft Peril Coverage

1. Airplane Debris Damaging a Roof

Scenario: A homeowner lives near an airport. During a routine flight, a piece of debris, such as a metal panel, falls from an airplane and lands on the homeowner’s roof, causing significant damage.

Coverage: The aircraft peril would cover the cost of repairing the roof, as the damage was directly caused by an object falling from an aircraft.

Outcome: The homeowner files a Claim and receives compensation for the cost of roof repairs, ensuring that the home is restored to its previous condition.

2. Drone Crashing into a Window

Scenario: A homeowner’s neighbor is flying a drone, and due to a malfunction, the drone crashes into the homeowner’s window, breaking it and damaging the frame.

Coverage: The aircraft peril would apply in this situation, as the drone is considered an aircraft under most homeowners insurance policies. The policy would cover the cost of replacing the window and repairing the frame.

Outcome: The homeowner files a claim and is compensated for the repairs needed to fix the window and frame.

3. Helicopter Emergency Landing in a Backyard

Scenario: A small helicopter makes an emergency landing in a homeowner’s backyard, damaging the Fence and some landscaping in the process.

Coverage: The damage caused by the helicopter’s emergency landing would be covered under the aircraft peril. This would include the cost of repairing the fence and restoring the landscaping.

Outcome: The homeowner files a claim and receives payment to cover the cost of repairing the fence and restoring the yard.

4. Falling Luggage from a Commercial Airplane

Scenario: A piece of luggage falls from a commercial airplane during takeoff, landing in a homeowner’s garden and damaging their Shed.

Coverage: The damage to the shed caused by the falling luggage would be covered under the aircraft peril, as it directly results from an object falling from an aircraft.

Outcome: The homeowner files a claim and is reimbursed for the cost of repairing or replacing the shed.

How to Maximize Your Coverage

1. Understand Your Policy’s Coverage Limits

While the aircraft peril is typically included in standard homeowners insurance policies, it’s important to understand the specific coverage limits that apply to this peril.

Check Policy Limits: Review your policy to ensure that the limits for damage caused by aircraft are sufficient to cover potential repairs or replacements.

Understand Exclusions: Be aware of any specific exclusions related to the aircraft peril, such as intentional acts or wear and tear.

2. Document Your Property’s Condition

In the event of a claim, having documentation of your property’s condition before the damage occurred can be helpful.

Photographs: Take photos of your property, including your roof, windows, and landscaping, to document their condition.

Receipts and Invoices: Keep receipts and invoices for any recent repairs or upgrades to your property, as these can support your claim.

3. Report Damage Promptly

If your property is damaged by an aircraft or falling object, it’s important to report the damage to your insurance company as soon as possible.

Immediate Reporting: Contact your insurance provider immediately after the incident to begin the claims process.

Temporary Repairs: Make any necessary temporary repairs to prevent further damage, and keep receipts for these expenses, as they may be reimbursable.

Loti can help:

We provide easy ways to manage, organize and submit information such as photographs, documents and receipts to your insurance carrier to ease your claims process along.

Additional Considerations

1. Proximity to Airports or Flight Paths

If you live near an airport or under a common flight path, you may have a higher risk of experiencing an incident related to the aircraft peril. Understanding your risk level can help you decide whether you need additional coverage or higher policy limits.

Increased Risk Areas: Consider whether your home’s location increases the likelihood of damage from aircraft or falling objects.

Additional Coverage: Discuss with your insurance agent whether you need additional coverage based on your home’s proximity to airports or common flight paths.

2. High-Risk Times

Certain times of the year or specific events may increase the likelihood of aircraft-related incidents, such as during air shows or military training exercises.

Special Events: Be aware of any special events or periods of increased air traffic in your area and take extra precautions during these times.

Temporary Adjustments: Consider adjusting your coverage temporarily if you know there will be an increased risk due to nearby events.

Wrap-Up

The aircraft peril in homeowners insurance policies provides valuable protection against the unexpected and unusual risks of damage caused by aircraft or objects falling from aircraft. While this type of damage may seem rare, having coverage in place ensures that you are prepared for any eventuality.

By understanding what the aircraft peril covers, reviewing your policy’s limits and exclusions, and being prepared to file a claim if necessary, you can protect your home and property from this unique risk. If you have any questions about your coverage or need to explore additional insurance options, contact your insurance agent for guidance.